The Central Bank of Nigeria has in the past week issued series of circulars aimed at boosting liquidity in the foreign exchange market as well as ensuring stability of the banking industry.

According to the CBN, these measures aim to confront challenges related to forex liquidity, mitigate excessive fee speculation, and bolster transparency. Amongst the circulars issued include “Elimination of Allowable Limit of Exchange Rate Quoted by International Money Transfer Operators,” “Standardization of Reporting Requirements on Banks’ Foreign Currency Exposures.”

Asides these, the CBM governor, Dr Olayemi Cardoso whilst noting that the CBN had cleared substantial part of the verified foreign exchange backlog assured that the efforts are already in place to clear the outstanding.

He had revealed that he had met over $7 billion in backlogs owed of which around $2.4 billion could not be backed up with official claims. Cardoso who noted that the apex bank had cleared $2.3 billion of the backlog with $2.2 billion still outstanding.

He however noted that $2.4 billion remains controversial. Cardoso, maintained that CBN would not pay for foreign exchange requests that were not validly constituted, adding that the bank has written to authorized dealers to explain the disparities identified, “and sadly, quite frankly, I think much of those have not been disputed to our satisfaction.”

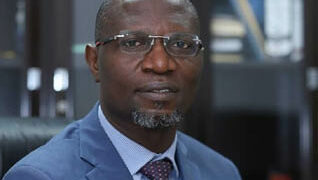

Chief Executive Centre for the Promotion of Private Enterprise(CPPE), Dr Muda Yusuf, speaking on the development said “the CBN is in a better position to determine which of the transactions are valid and which ones are not valid. If they have undertaken a forensic audit and they have come up with this figures that is what it is and this is part of the process of cleaning up the space. He also gave assurance that the totality of the backlog will soon be cleared.

“Once that is done am sure the level of confidence in the market will begin to improve because the interventions and clearing of the backlogs have also been slowing down and diminished the capacity of the CBN to intervene directly in the market and once they clear the backlog, then the capacity to intervene in the market will improve and that will help to improve and enhance liquidity in the forex market.”

Also, Head of Financial Institutions Ratings at Agusto & Co, Ayokunle Olubunmi, said it is “reassuring that they have not only started clearing the backlog but that they have gone that far.