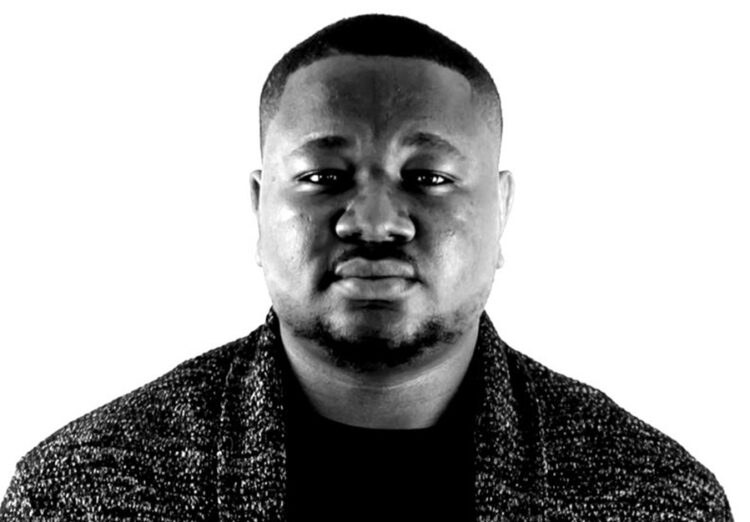

The founder of MyPayble Technologies, Roosevelt Elias, has always been passionate about product development, having developed several tools, products and businesses across multimedia to print media, and now has ventured into financial technology which is aimed at helping African micro-businesses and entrepreneurs go completely cashless.

This dream came alive about six years ago, when his mother who is a small business owner, needed a Point of Sale(POS) machine to run her business and for some reason, she couldn’t get one, either because she didn’t meet the banks requirements or perhaps it just wasn’t available as the wait times were just too long.

“So, I started thinking about developing a solution that can assist micro businesses like my mum’s. The idea started coming together in 2020 and fully clicked in 2022 in a discussion with some friends of mine who were also looking at developing a payment solution for Nigeria. So, we sat down and got working and today we have developed what we’ve now called Payble,” Elias averred.

Impacting Businesses

On how the innovation works, the founder said: “Payble is an Enterprise Resource Planning ecosystem designed for african business, capable of managing from the smallest business that you run from your bedroom to a multi-location chain stores to manage their resources from Payments to Inventory and even CRMmanage and our first product is the Payble mini card reader that works with mobile phones.

“All you need do is to download the MyPayble app from the Android Play Store or Apple’s App Store and undergo the Know Your Customer/KYB Process and your phone becomes your POS. You connect the card reader to your phone through Bluetooth, with that, you can carry out cashless transactions, seamlessly from anywhere, at any time.

“Our key difference from other solutions is that we specifically designed Payble for the smallest of businesses – Think of the ‘Mama Put’ or ‘Mayshayi’ at your junction – Imagine that you no longer needing to first look for cash before you patronize them. With this solution, Nigerians can pay, for instance, pepper bought for just N300, without additional charges incurred by having to first look for a POS agent to get the cash to complete such a simple transaction.”

To secure funds of users, Elias said: “We are partnering with tier one security company for verification of National Identity Number (NIN), Bank Verification Number (BVN) and every other Verification Touch Points as required by the Central Bank of Nigeria (CBN), while maintaining Data Privacy best practice in accordance with the Nigeria Data Protection Regulation in Nigeria.

Education and Career

Elias obtained his Bachelor of Science(Bsc) degree, Computer Science at Benson Idahosa University in 2015 and his Master’s degree, IT security at the Nottingham Trent University in 2022.

He started his career at Nextel Plus in Nigeria as Network Engineer from 2013 to 2017 and then founded Payble Technologies in October 2022. He is also the co-founder of Naira Manager in 2018 and EduAid Resources in England in 2022. He has worked at Veenpool in England as creative director; Advanced Teamworks limited as Chief technology officer and DEFT Digital as creative director.

His goal is to develop innovations that will make life more easier for the common man. According to him, “In my experience with design and working with people, I have come to know that simplicity is the new complex. I do have a complex mind for solving complex problems and making these real life issues easier for everyone else. I am a value add.”