Capital market analysts expect the equities market to continue its seesaw movement this week.

The Nigerian Exchange (NGX), last week, rebounded from the previous week’s decline, driven by sector rotation and portfolio rebalancing activities, reflecting optimism from third quarter (Q3) earnings releases and the undervalued nature of many stocks with strong upside potential. Market participants also digested the October inflation numbers, considering their implications for the broader market.

Analysts Optimism

On market outlook, the chief operating officer of InvestData Consulting Limited, Ambrose Omordion said, “we expect mixed sentiments to continue on bargain hunting, profit taking and low valuation ahead of Consumer Price Index (CPI) data and position taking by smart money for year-end. Also, sector rotation and portfolio rebalancing continued in the market with investors taking advantage of pullbacks and correction to buy into value.

“This is amid the volatility and pullbacks that add more strength to upside potential. Consequently, investors should take advantage of price correction. Also looking at the trends and events across the globe and domestically.”

Looking ahead, analysts at Cowry Assets Management Limited said, ‘a continued tug-of-war between bulls and bears is expected, with the bulls likely gaining an edge.’

Cowry noted that, “opportunities persist for savvy investors in undervalued stocks amid ongoing market volatility. The release of October’s Consumer Price Index (CPI) data by the National Bureau of Statistics may also influence sentiment, as inflationary pressures and naira volatility keep market players cautious. Investors are advised to prioritise fundamentally strong stocks while staying vigilant about broader economic developments.”

Last Week’s Trading Activities

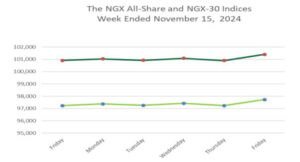

The Nigerian equities market rebounded from the previous week’s decline. The All-Share Index ended the week 0.50 per cent higher to close at 97,722.28 points. Similarly, market capitalisation gained N295 billion week-on-week (W-o-W) to close at N59.215 trillion.

Across the sectoral front, performance was largely positive. Consequently, the NGX Insurance, NGX Banking and NGX Consumer Goods indices were the toast of investors last week with gains of 2.84 per cent, 2.32 per cent and 0.60 per cent. On the contrary, the NGX Oil & Gas and NGX Industrial recorded weekly losses of 0.29 per cent and 0.20 per cent.

The market breadth for the week was negative as 39 equities appreciated in price, 46 equities depreciated in price, while 67 equities remained unchanged. John Holt led the gainers table by 60.50 per cent to close at N7.72, per share. Eunisell Interlinked followed with a gain of 46.22 per cent to close at N11.99, while Tantalizers went up by 33.93 per cent to close to 75 kobo, per share.

On the other side, DAAR Communications led the decliners table by 12.12 per cent to close at 58 kobo, per share. Oando followed with a loss of 10.44 per cent to close at N62.65, while VFD Group declined by 10.00 per cent to close at N40.50, per share.

Overall, a total turnover of 1.482 billion shares worth N38.875 billion in 44,795 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 6.468 billion shares valued at N75.745 billion that exchanged hands previous week in 48,804 deals.

The Financial Services Industry (measured by volume) led the activity chart with 1.068 billion shares valued at N19.820 billion traded in 21,001 deals; contributing 72.04 per cent and 50.98 per cent to the total equity turnover volume and value respectively.

The Oil and Gas Industry followed with 103.143 million shares worth N11.351 billion in 8,200 deals, while the Consumer Goods Industry traded a turnover of 77.198 million shares worth N2.845 billion in 4,266 deals.

Trading in the top three equities namely Access Holdings Plc, United Capital Plc and United Bank for Africa (UBA) accounted for 433.794 million shares worth N10.274 billion in 8,790 deals, contributing 29.27 per cent and 26.43 per cent to the total equity turnover volume and value respectively.