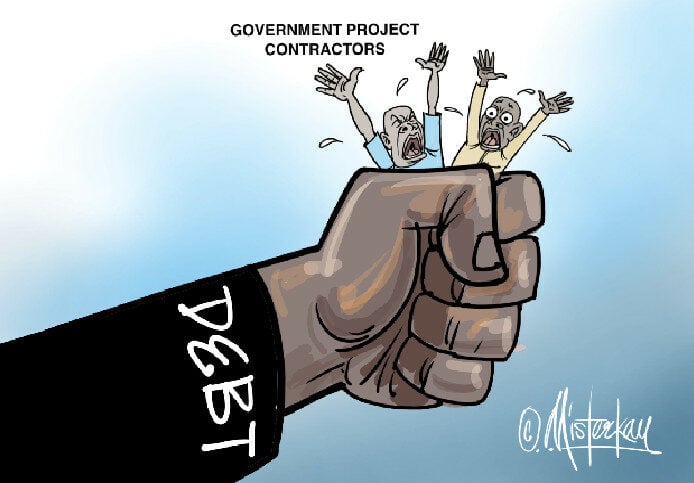

One apt way of explaining the situation of indigenous contractors in Nigeria, specifically those handling federal government projects, is that they have been strangled by debt and are gasping for breath.

And to imagine that this is happening under a government that claimed to be championing the efforts to encourage the purchase of locally made goods and services through its much-touted Buy Nigeria initiative smacks of hypocrisy.

The recent protest by the All-Indigenous Contractors Association of Nigeria (AICAN) has once again emphasised the urgent need for the government to honour its contractual obligations. According to AICAN, the federal government is indebted to its members by N4 trillion for completed and verified projects.

AICAN’s president, Jackson Nwosu, dismissed the government’s claims that payments for 2024 capital projects had been disbursed, insisting that only about one per cent of indigenous contractors had received funds.

Broader Implications

The non-payment, however, goes beyond the contractors alone. When the government fails to meet its payment commitments, whether to contractors or workers, the consequences ripple through the broader economy, affecting millions of Nigerians.

Denying contractors their payment after project completion and verification sends a disturbing signal: the government cannot be trusted in business. Such a perception, reinforced by long delays, discourages investors and undermines confidence.

Essentially, the government’s delay in payment is a significant disincentive to businessmen, particularly those who commit considerable resources to national projects. More worryingly, it depicts a government whose actions can cripple indigenous contractors and stall the nation’s economy.

Most contractors rely on bank loans and other sources of financing, often at exorbitant interest rates, to deliver these projects. With delayed payments, these loans accumulate interest, significantly eroding potential profits and, in many cases, forcing contractors out of business. Some contractors may have even died waiting for payments, while others have gone bankrupt. Companies have closed down, workers have been sacked, and families have been left stranded.

In an economy already plagued by high unemployment, which has an attendant impact on crime and social unrest, the government’s deliberate act of owing contractors only compounds the crisis.

It is also difficult to understand why the government, the biggest spender in the economy, owes contractors for this long, knowing full well that paying them will have a multiplier impact on the economy. This is even more bewildering given the administration’s claim that it exceeded its revenue target, generating over N20 trillion from January to August.

Failing to pay contractors despite improved revenue generation sends a wrong signal to those wishing to do business with the government. This clearly shows that the government does not prioritise them. Otherwise, why deny them payment when the revenue base has expanded remarkably? No individual, organisation or nation enjoys dealing with a government that fails to honour its obligations.

Revenue or spending problem?

Increasingly, the managers of Nigeria’s economy appear to be telling the world that the nation’s problem lies not in revenue but in reckless spending. How else can one explain a situation where contractors remain unpaid, Nigerian embassies abroad cannot settle rents and salaries, and ministries, departments, and agencies are starved of funds for capital expenditure, despite the government boasting robust revenue inflows? The only logical conclusion is that Nigeria has a spending problem, not a revenue one.

However, the plight of indigenous contractors is only one in a long list of grievances by Nigerians. Police retirees have protested over unpaid entitlements, soldiers who voluntarily disengaged from service have raised their voices, and several other groups have repeatedly lamented non-payment or delayed payment of their dues.

Rising debt burden

At a deeper level, the protest by indigenous contractors speaks to the country’s rising debt crisis. The Nigerian government’s appetite for borrowing remains insatiable, with little transparency regarding how previous loans were spent. The country’s domestic and foreign debt has now risen to nearly N150 trillion, a staggering and frightening figure.

Nigeria’s debt-to-GDP ratio currently stands at 52%, far above the 40% statutory ceiling set by the Debt Management Office. The opaque management of public finances makes this situation even more worrisome.

The government frequently justifies its borrowings by citing the need to address infrastructure, budget deficits, and financing social security. More recently, the government has argued that loans are needed to cushion the harsh impact of fuel subsidy removal, which has widened the country’s poverty net.

While the government can borrow to finance infrastructure like roads and power, which will, in turn, boost the economy, the borrowing needs to be transparent, with processes, terms, and conditions of the loans clearly defined.

But why can’t the government explore alternative sources of funding infrastructure, like the public-private partnership approach, contractor financing, or even a tax waiver? It is clear: the government doesn’t always need to turn to external borrowing sources for unchecked loans, which have increasingly raised fears that current leaders are mortgaging the nation’s future.

There is no contesting the fact that Nigeria’s reckless borrowing, devoid of accountability, risks undermining its credibility at home and abroad. Most Nigerians believe, and rightly so, that there is no justification for the over N40 trillion borrowing under the Bola Ahmed Tinubu administration.

The real question is: How does large-scale borrowing impact national priorities? Is Nigeria’s debt burden not already threatening the welfare of present and future generations, seeing that high inflation, rising unemployment, and mounting debts represent a double whammy to the economy and the citizenry?

Although debt can be a tool for financing infrastructure, driving growth, and supporting sustainable development when correctly managed, Nigeria’s reckless borrowing without accountability entrenches dependency and perpetuates debt cycles.

What must concern an average Nigerian is that the country is trapped in a web of unsustainable debts, with little tangible outcome. This lack of transparency in loan utilisation remains one of Nigeria’s many tragedies.