The Nigerian stock market is expected to sustain its bullish momentum this week on renewed interest in equities as investors actively reposition themselves for year-end opportunities.

The market ended the week on a strong bullish note last week, reflecting robust buying activity across various sectors, underpinned by improved investor sentiment and favourable market dynamics.

Analysts Optimism

Looking forward, Cowry Assets Management Limited said “the Nigerian equities market is well-positioned to sustain its bullish momentum in the coming week. The ongoing year-end rally, coupled with expectations of strong full-year corporate performance, is likely to support buying activities.

“Investors are also expected to closely monitor macroeconomic indicators, particularly the release of November 2024 inflation figures, which could shape sentiment and influence portfolio adjustments. Developments in the foreign exchange market will similarly play a critical role as market participants evaluate the impact of economic data on investment decisions.”

The chief operating officer of InvestData Consulting Limited, Ambrose Omordion said “sector rotation and portfolio rebalancing continued in the market with investors taking advantage of pullbacks and correction to buy into value.”

Last Week’s Trading Activities

The market performance last week was guided by a flurry of corporate actions, MTN Nigeria Communications (MTNN), Aradel Holdings and Nigerian Breweries. Specifically, MTNN completed its Series 13 and 14 Commercial Paper issuance, raising N72.2 billion against a target of N50 billion. Furthermore, Aradel Holdings Plc acquired a 5.14 per cent equity stake in Chappal Energies Mauritius Limited, an energy company focused on deep value and brownfield upstream opportunities in Africa. While, Nigerian Breweries secured SEC clearance for the allotment of 20.71 billion ordinary shares at N26.50 per share under its recently concluded rights issue, which achieved a 91.59 per cent subscription rate.

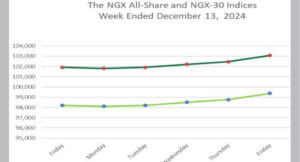

Overall, the local bourse closed the week on a positive note, as the All-Share Index advanced 1.19 per cent week-on-week to close at 99,378.06 points. Similarly, market capitalisation rose by N708 billion to close the week at N60.242 trillion.

Sectoral performance was mixed but predominantly bullish. The NGX Oil & Gas sector emerged as the star performer, posting a robust weekly gain of 7.61 per cent, driven by increased demand for energy stocks with strong fundamentals. The NGX Insurance sector followed with a weekly gain of 7.52 per cent, while NGX Consumer Goods and NGX Banking indices posted modest weekly gains of 1.01 per cent and 0.16 per cent, respectively. Conversely, the NGX Industrial Goods sector underperformed, shedding 0.60 per cent week on week.

The market breadth for the week was positive as 51 equities appreciated in price, 35 equities depreciated in price, while 67 equities remained unchanged. Golden Guinea Breweries led the gainers table by 60.00 per cent to close at N8.64, per share. Africa Prudential followed with a gain of 59.72 per cent to close at N17.25, while Tantalizers went up by 52.07 per cent to close to N1.84, per share.

On the other side, Secure Electronic Technology led the decliners table by 22.86 per cent to close at 54 kobo, per share. Austin Laz & Company followed with a loss of 14.74 per cent to close at N1.62, while Haldane McCall declined by 11.11 per cent to close at N5.20, per share.

Overall, a total turnover of 2.729 billion shares worth N49.845 billion in 43,298 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 3.893 billion shares valued at N87.749 billion that exchanged hands prior week in 43,868 deals.

The Financial Services Industry (measured by volume) led the activity chart with 1.705 billion shares valued at N18.874 billion traded in 19,203 deals; contributing 62.48 per cent and 37.87 per cent to the total equity turnover volume and value respectively. The ICT industry followed with 286.657 million shares worth N6.346 billion in 2,603 deals, while the Oil and Gas Industry traded a turnover of 209.404 million shares worth N10.827 billion in 5,803 deals.

Trading in the top equities; Coronation Insurance, E-Tranzact International, and FCMB Group (measured by volume) accounted for 865.665 million shares worth N3.629 billion in 1,149 deals, contributing 31.72 per cent and 7.28 per cent to the total equity turnover volume and value respectively.