The National Pension Commission (PenCom) and the Independent Corrupt Practices and Other Related Offences Commission (ICPC) have entered into a strategic partnership to strengthen compliance and accountability in Nigeria’s pension system.

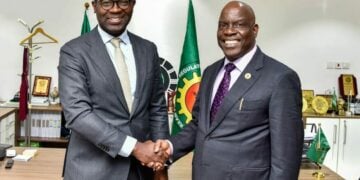

The collaboration, sealed through a Memorandum of Understanding (MoU) in Abuja, seeks to enhance enforcement mechanisms against defaulting employers and safeguard workers’ retirement savings.

PenCom’s director general, Ms Omolola Oloworaran, described the agreement as a milestone in rebuilding public confidence in the contributory pension scheme. She noted that the partnership embodies a shared institutional and moral responsibility to ensure transparency and integrity in managing pension assets.

“This collaboration is not just about signing a document; it reflects our collective resolve to protect the trust reposed in us by millions of Nigerian workers,” she said. “Every deduction made from a worker’s salary must be properly remitted and accounted for. Anything short of that is a breach of trust.”

Oloworaran acknowledged that despite improvements in pension administration, issues such as unapplied contributions under the Integrated Personnel and Payroll Information System (IPPIS) and unremitted deductions by some employers remain persistent. She emphasised that such lapses threaten the financial security of retirees and would no longer be tolerated.

According to her, the MoU provides for joint operations between PenCom and ICPC, including information sharing, coordinated investigations, recovery of unremitted pension funds, and prosecution of defaulters. “With ICPC’s enforcement powers and PenCom’s regulatory authority, we can ensure full compliance across the public and private sectors,” she said.

The ICPC chairman, Dr Musa Adamu Aliyu, represented by the Commission’s Secretary, commended PenCom’s initiative and pledged the agency’s full commitment to the cause. He observed that pension defaults, particularly in the private sector, had persisted due to weak enforcement and a profit-driven disregard for employee welfare.

“In this part of the world, compliance in the private sector is often ignored because employers prioritise profit over workers’ rights,” he stated. “Through this partnership, we will ensure that every worker’s contribution is protected, no matter how small.”

Aliyu explained that the ICPC’s approach would continue to balance education with enforcement — ensuring that employers understand their obligations before applying sanctions where necessary. “We have focused on enlightenment, but when that fails, the law must take its course,” he warned.

Both agencies expressed optimism that the partnership would usher in Nigeria’s new era of pension accountability. They agreed that the combined weight of regulatory oversight and anti-corruption enforcement would deter non-compliance and reinforce trust in the pension system.

Oloworaran said, “This marks the beginning of a stronger, cleaner, and more transparent pension system — one that truly protects the future of every Nigerian worker.”