Analysts have anticipated that the Nigerian stock market will maintain its positive drive this week, underpinned by strategic positions ahead of full year 2024 dividend declarations as investors reassess valuation upside in equities with sturdy earnings performances.

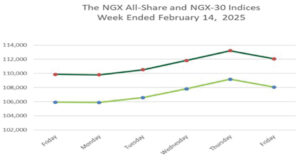

The bullish momentum in the equities market persisted for the second trading week in February. This rally saw the All-Share Index surpass the 108,000 and 109,000 psychological levels, reaching new historic highs. The strong buying interest was primarily driven by gains in Industrial, Insurance, and Energy & Commodity stocks, which propelled the ASI into positive territory.

Analysts Optimism

The chief operating officer of InvestData Consulting Limited, Ambrose Omordion said, “all eyes are on the expected full-year audited financial statements and dividend announcements which have continued to guide positioning and money flow into the market.”

He added that, the renewed buying interest in consumer and industrial goods stocks supported the markup phase that is creating new buying opportunities in few stocks ahead of their earnings reports, the January consumer price index figure and the Monetary Policy Committee meeting of the Central Bank of Nigeria scheduled for this week.”

Looking ahead, analysts at Cowry Assets Management Limited said, “we anticipate a mixed market sentiment in the coming week as investors await further corporate earnings releases and dividend declarations.

“Additionally, market participants will closely monitor the newly rebased Consumer Price Index (CPI) data and the outcome of the Monetary Policy Committee (MPC) meeting scheduled for Wednesday and Thursday. These key events will provide direction for investors as they assess the potential impact on their portfolios. We advise investors to remain vigilant, keeping an eye on stocks with strong fundamentals to make informed investment decisions.”

Last Week’s Trading Activities

The domestic bourse, last week ,closed three out of five trading sessions in the positive territory, extending the market’s positive reaction to the flurry of resilient 2024 earnings releases thus far.

The All-Share Index recorded a week-on-week (W-o-W) gain of 2.00 per cent to close at 108,053.95 points. Also, market capitalization rose by N1.83 trillion or 2.78 per cent to close the week at N67.418 trillion.

The positive outturn stemmed from renewed optimism in Dangote Cement, MTN Nigeria Communications (MTNN) and Transcorp Hotels.

Across the sectoral front, market performance was mixed. The NGX Industrial Goods index led the gainers, surging by 10.4 per cent week-on-week. NGX Insurance index followed with a weekly gain of 2.52 per cent while NGX Insurance and NGX Commodity indices gained 2.52 per cent and 0.43 per cent respectively W-o-W.

Conversely, the NGX Consumer Goods Index led the laggards, shedding 3.63 per cent. NGX Oil & Gas index followed with a weekly decline of 2.30 per cent while NGX Banking index depreciated by 0.24 per cent week-on-week.

Also, the market breadth for the week was positive as 65 equities appreciated in price, 31 equities depreciated in price, while 54 equities remained unchanged. Honeywell Flour Mill led the gainers table by 47.06 per cent to close at N14.00, per share. UPDC followed with a gain of 45.95 per cent to close at N3.78, while VFD Group went up by 30.63 per cent to close to N58.00, per share.

On the other side, DAAR Communications led the decliners table by 13.58 per cent to close at 70 kobo, per share. International Energy Insurance followed with a loss of 10.80 per cent to close at N2.23, while

BUA Foods declined by 10.00 per cent to close at N373.50, per share.

Overall, a total turnover of 2.414 billion shares worth N55.512 billion in 80,988 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 3.051 billion shares valued at N98.350 billion that exchanged hands prior week in 72,535 deals.