On June 26, 2025, President Bola Ahmed Tinubu assented to four landmark laws that signal the boldest reconfiguration of Nigeria’s fiscal architecture since the return to democracy. These are not technical tweaks or bureaucratic realignments – they are constitutional in their impact. The Nigeria Revenue Service (NRS) Act, the Tax Administration (Standardization) Act, the Nigeria Tax (Consolidation) Act, and the Joint Revenue Board (JRB) Act together recast the very foundations of public finance in the federation.

These laws do not centralize power. They standardize trust. They do not take away from states. They challenge them to govern better. What they offer is both clarity and constraint: clarity about the roles and rules; constraint on informalism, discretion, and non-performance. And for Northern Nigeria, this package of reforms offers a sharp mirror. It reflects what has been neglected, and what must now be done.

The NRS Act establishes a central policy authority to define standards and coordinate compliance, without collecting a kobo of tax itself. The Tax Administration Act binds every IRS to transparent, digitized, and service-based practices. The Nigeria Tax Act simplifies and harmonizes the tax landscape, eliminating duplicative or conflicting levies. And the JRB Act turns the once-ceremonial joint board into a regulatory force capable of enforcing cross-jurisdictional audits, mediating disputes, and benchmarking performance.

This is not just administrative reform, it is institutional redesign. States are not losing autonomy. They are being required to earn it through capacity, discipline, and legitimacy.

Between Law and Leadership: Reading the Terrain

The implications of these reforms are especially stark for Northern states. The region has long relied on federal transfers, not because of a lack of economic potential, but due to the institutional weaknesses in mobilizing domestic resources. Informality dominates. Trust in taxation is thin. Political will to modernize IRS structures has been uneven at best. These reforms now disrupt that inertia.

The most immediate impact is visibility. Under the JRB framework, IRS performance will be published. Compliance metrics, audit quality, process timelines, and incentive disclosures will be accessible to the public, donors, and potential investors. States will no longer compete on political narratives. They will compete on fiscal credibility.

The second impact is operational. Every IRS must now restructure around core functions: audit, enforcement, taxpayer services, risk management, and internal control. Most IRSs in the North are still organized by tax type, an outdated structure that fragments accountability and weakens reform logic. The law now demands integration, not improvisation.

Enforcement practices must also be reengineered. Coercive field tactics, informal demand notices, and opaque assessments are no longer tolerable. The law now requires service-oriented enforcement: digital notifications, clear redress mechanisms, taxpayer education, and time-bound dispute resolution. IRSs must now act as public institutions, not political extensions.

At the political level, reforms introduce transparency where discretion once reigned. Waivers and exemptions must be gazetted. Incentives must be rationalized. Patronage and rent-seeking can no longer be hidden behind policy ambiguity. This will be deeply uncomfortable for some political actors. But it is necessary. Governance requires exposure.

These laws raise the bar for leadership. State governors and commissioners can no longer rely on anecdotal performance. They must now show measurable outcomes. IRSs are being asked not just to collect taxes but to explain their systems, justify their procedures, and make their results visible. This new accountability framework will separate the performative from the truly reform-minded.

The Opportunity Beneath the Disruption

Despite the discomfort, these laws offer Northern states a rare opportunity for strategic reinvention. For IRS leaders, the reforms provide cover to restructure agencies, defend budget allocations for technology and training, and justify independence from political micro-management. What reformers once whispered, the law now demands.

Data interoperability, once elusive, is now achievable. With TIN linked to NIN and BVN, states can build unified taxpayer databases, connect them to land records, and create digital compliance maps. This is not about surveillance. It is about building the minimum infrastructure of trust, coverage, and equity.

Digital audit trails, standardized assessment logic, and public dashboards reduce discretion and increase citizen confidence. These are not just compliance tools, they are legitimacy devices. They allow taxpayers to see government not as an extractor, but as a service actor.

Public finance will become a reputation system. States that comply will attract investor attention, donor support, and citizen engagement. Those that resist will be isolated. The rules of engagement have changed. The old path is closed.

Communication must rise to the challenge. Reform cannot be broadcast in legalese. It must be narrated – through town hall meetings, religious platforms, market associations, and youth networks. Tax must be shown to fund public goods. IRSs must explain, not just demand. Leadership must frame taxation as a shared responsibility, not a burden.

This is not merely about messaging. It is about meaning-making. Institutions must co-author a new fiscal contract – grounded in fairness, clarity, and service delivery. Without this emotional logic, technical reforms will collapse under social resistance.

More critically, the reforms enable smarter targeting of underserved populations. With accurate taxpayer profiles, governments can offer proportional compliance frameworks, especially to informal and low-income earners. Taxation need not be regressive. It can, in fact, become a lever for inclusive governance when linked to tangible returns in service access, education, and infrastructure.

States that embed tax in a development narrative – one of growth, not punishment – will build resilience, legitimacy, and buy-in. Those that enforce blindly will erode whatever little trust remains.

Reform as a Political Signal

Reforms are not just operational events. They are political signals. They tell citizens what kind of leadership governs them. They tell markets whether a state is investible. They tell the federation whether a region is serious about statehood.

Northern governors must now decide whether their fiscal posture will be strategic or survivalist. Will they empower IRS boards? Will they consolidate registries for compliance intelligence? Will they fund reform units, not just hire consultants? Reform readiness is no longer a rhetorical virtue. It is a performance demand.

The danger now is not failure. It is delay. Half-implementation will be exposed. Quiet resistance will be visible. IRSs that stall will lose relevance. Political leaders who equivocate will lose reform legitimacy.

Donor behavior is shifting. Budget support, technical assistance, and subnational investment are all being tied to reform alignment. States that do not meet benchmarks will lose access—not as punishment, but as consequence. No institution is entitled to trust.

The tax laws are a forcing function. They force clarity. They force coordination. They force institutional learning. But they also offer a ladder. Northern states can use this moment to demonstrate what progressive federalism looks like – from Kano to Gombe to Sokoto.

What the tax laws create is a new social terrain, one where citizens expect fairness, institutions must justify power, and performance cannot be hidden. This is not just a fiscal transition. It is a governance inflection point.

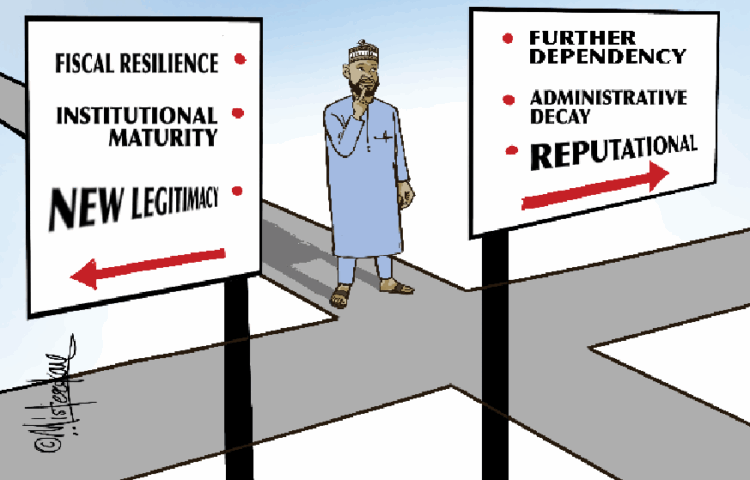

The North now stands at a crossroads. One path leads to fiscal resilience, institutional maturity, and new legitimacy. The other path leads to further dependency, administrative decay, and reputational risk.

The question is no longer whether reform is possible. It is whether it will be owned.