Analysts on the Nigerian stock market are expecting a continuous cautious trading sentiment this week.

They noted that cautious trading continues at this critical support levels of the market ahead of Q3 corporate earnings in the midst of low valuation and liquidity in the market.

They said despite the lingering high interest rates atmosphere, rising inflation and slowing industrial output as a result of policy changes and uncertainty around the globe, there are sectors, industries and individual stocks that are still seeing positive activities from traders and investors.

Analysts Optimism

Analysts at Cordros Securities Limited said: “considering the outcome of the MPC meeting, we believe the CRR hike would drag the banks’ profitability, as downward pressure on net interest margins (NIM) would inhibit earnings growth and may further limit investors’ interest in banking stocks.

“Overall, we expect the local bourse to maintain cautious trading sentiments as electioneering activities kick off in full gear. However, we advise investors to take positions in only fundamentally justified stocks as the fragility of the macroeconomic environment remains a significant headwind for corporate earnings.”

The chief operating officer of InvestData Consulting Limited, Mr Ambrose Omordion said: “we expect a mixed sentiment to continue on bargain hunting as reactions to rate hike last, in the midst of quarter-end window dressing by fund managers.

“This is just as banking stocks are gaining attention, despite profit taking that makes the sector more attractive for income investors, while portfolio rebalancing continues on bargain hunting in the midst of the worsening sovereign risks.”

He also noted that the flow of funds into the fixed income segment on the rate hike by the CBN, as sector rotation persists.

Going into the new week, Cowry Assets Management Limited expected “the market to sustain its current trend as investors adopt cautious trading styles at this critical support levels amidst low valuation and liquidity in the market.

“However, we continue to advise investors to trade on companies’ stocks with sound fundamentals and a positive outlook amid the macro-dynamics which remains a headwind.”

Last Week’s Trading Activities

Momentum in the domestic equities market last week closed quietly amid market reactions to the latest interest rate hike and Treasury Bills auction rates which jumped across board and leaving investors with a chance for portfolio realignment.

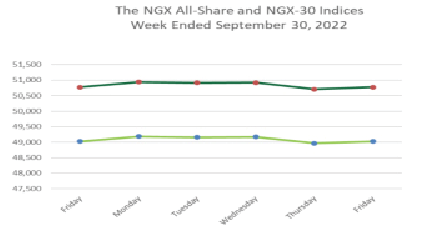

The NGX All-Share Index (ASI) ended the week flattish with a decline of 0.01 per cent to close at 49,024.16 points. While, the market capitalisation up by N8 billion to close the week at N26.451 trillion.

Across sectors, the Industrial Goods index recorded weekly gain of 3.01 per cent, while Oil & Gas index up by 0.20 per cent week-on-week (W-o-W). On the other side the Consumer Goods index declined by 3.4 per cent, Insurance index down by 3.2 per cent, and Banking index shed 0.9 per cent W-o-W.

The market breadth for the week was negative as 25 equities appreciated in price, 33 equities depreciated in price, while 98 equities remained unchanged. Multiverse Mining & Exploration led the gainers table by 30.85 per cent to close at N3.69, per share. Nigerian Exchange Group followed with a gain of 17.65 per cent to close at N20.00, while Jaiz Bank went up by 15.38 per cent to close to 90 kobo, per share.

On the other side, Neimeth International Pharmaceuticals led the decliners table by 10.26 per cent to close at N1.40, per share. Nestle Nigeria followed with a loss of 10.00 per cent to close at N1,215.00, while Africa Prudential declined by 9.91 per cent to close at N5.00, per share.