A technical assistant on broadcast media to the executive chairman of the Federal Inland Revenue Service, Arabinrin Aderonke Atoyebi, has said that the tax reform bills undergoing legislative proceedings will transform businesses in Nigeria and better livelihoods if implemented effectively, it will ensure that the benefits of democracy reach everyone, not just a select few.

The public hearing on President Bola Tinubu’s tax reform bills has seen key stakeholders voicing diverse opinions.

But Atoyebi shared insights into the proceedings, highlighting critical debates, concerns, and the potential impact of the reforms on businesses and the economy.

The hearing sparked intense discussions among lawmakers, tax professionals, industry leaders, and religious organisations.

While the proposed reforms aim to create a fairer and more efficient tax system, opposition from various quarters threatens to derail the initiative.

President Tinubu introduced the Tax Reform Bills in October 2024 to simplify tax collection, curb evasion, and boost government revenue without overburdening citizens.

The bills, the Nigeria Tax Administration Bill, the Nigeria Revenue Service Bill, the Joint Tax Board Bill, and the Nigeria Tax Bill, seek to close loopholes and ensure large corporations pay their fair share.

Dr. Zacch Adedeji, chairman of the Federal Inland Revenue Service (FIRS), has been a key advocate for greater transparency and efficiency in tax administration.

“For many years, Nigeria’s tax structure was inefficient, with leakages, multiple taxes, and an overreliance on oil revenue,” Atoyebi noted.

Religious organisations, including the Supreme Council for Shariah in Nigeria and the Committee of FCT Imams Initiative, objected to the proposed inheritance tax, arguing it infringes on religious rights.

“Inheritance tax is not a new idea; it exists globally to promote economic fairness. Nigeria is not under religious rule—our laws balance secular and customary principles,” Atoyebi countered, suggesting modifications rather than outright rejection.

Labour unions, including the Trade Union Congress (TUC), raised concerns over the proposed increase in Value-Added Tax (VAT) from 7.5% to 15% by 2030, warning it could worsen the cost-of-living crisis.

While acknowledging these concerns, Atoyebi argued, “A gradual increase, with exemptions for essential goods, can ease the impact,” citing global examples where VAT funds public services.

The Nigeria Customs Service also expressed concerns that the reforms might interfere with its operational duties.

However, Atoyebi dismissed these fears, stating, “This is not about power struggles; it’s about improving things. The reforms will enhance collaboration among government agencies and address long-standing revenue collection problems.”

Despite the fierce opposition, supporters insist the reforms are necessary.

“Fighting change will only slow progress,” Atoyebi warned, urging lawmakers to refine the bills rather than discard them.

“Those against it should ask themselves: Do we want a Nigeria where the rich avoid taxes while ordinary people struggle? Do we want to keep losing revenue due to loopholes? Or do we want a fair system where everyone contributes to national growth?”

With the Senate and House of Representatives now reviewing the bills, the next phase will determine whether Nigeria embraces this critical tax reform or succumbs to resistance.

“This reform will strengthen the economy, create a fairer tax system, and improve livelihoods. If implemented effectively, it will ensure that the benefits of democracy reach everyone, not just a select few,” Atoyebi concluded.

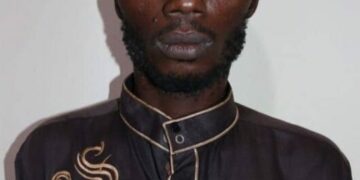

Arabinrin Aderonke Atoyebi an technical assistant on broadcast media to the executive chairman of the Federal Inland Revenue Service