The Tertiary Education Trust Fund (TETFund), National Agency for Science and Engineering Infrastructure (NASENI) and National Information Technology Development Agency (NITDA) will all cease to exist if the four Tax Reform Bills currently being considered by the National Assembly were passed into laws.

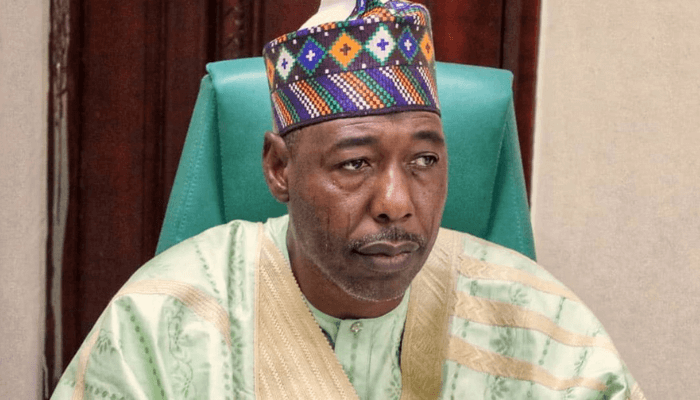

This was disclosed by Borno State governor, Prof. Babagana Umara Zulum, while speaking on Channels TV’s programme, ‘Sunday Politics’, which was monitored by our Correspondent on Sunday night.

LEADERSHIP reports that the contentious Bills are the Joint Revenue Board of Nigeria (Establishment) Bill, 2024 -SB.583; The Nigeria Revenue Service (Establishment) BILL, 2024- SB.584; The Nigeria Tax Administration Bill, 2024-SB.585; and the Nigeria Tax Bill, 2024 – SB.586.

Zulum, who said neither himself nor any Northern governor was against President Bola Tinubu over the Executive Bills, however, noted that they were only craving for dialogue and adequate consultation about the proposed legislations in order not to be short-changed.

“This is a democratic setting, we need more time. People have told the President that governors are against him, we didn’t say anything like that. We know the powers of the President, I am a system man, I respect him, if the President want to use his powers to pass the Bills, he may have his way but it has consequences for the people,” Zulum stated.

The governor expressed reservations about some of the provisions of the Bills, which include the status and nomenclature of the current Federal Inland Revenue Service (FIRS) upon passage of the Bills into law, to assume the power of being the only tax collection agency in Nigeria, questioning whether the agency has the structures in place to execute such mandate.

“Another provision of the Tax Bill is that by 2029 TETFund will be scrapped because companies will cease to support TETFund according to the law…NASENI will be scrapped in 2029…NITDA will be scrapped…These are some of our concerns,” the Borno State governor explained.

Zulum also explained that if the Bills scaled through and become laws, 34 States of the Federation would be shortchanged as only Lagos and Rivers States would be the main beneficiaries.

“Let them give us facts and figures, let them convince us,” Zulum stated, warning that there would be consequences for Nigerians if President Tinubu go ahead to get the Bills passed into law at all cost.

It will be recalled that President Tinubu had in October forwarded the four executive Bills to the National Assembly for passage into laws. On November 28, the Tax Reform Bills passed the second reading stage in the Senate, while the House of Representatives has fixed Tuesday for debate on the proposed legislations.