It became obvious yesterday that President Bola Ahmed Tinubu has eventually sacked Godwin Emefiele as governor of the Central Bank of Nigeria (CBN).

Also fired were all deputy governors of the apex bank.

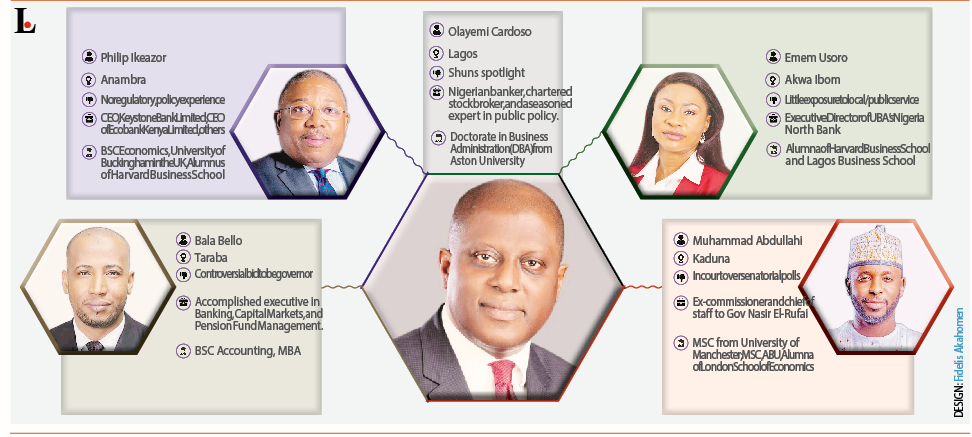

In his stead, the president nominated former commissioner for Economic Planning and Budget in Lagos State, Dr Olayemi Cardoso, to lead the apex bank for the next five years.

Cardoso is set to take over from Emefiele, who was suspended by Tinubu in June and subsequently detained by the country’s state security agency.

Emefiele was reappointed by Tinubu’s predecessor, former President Muhammadu Buhari, for a second term of five years as CBN Governor in 2019.

The president’s special adviser on Media and Publicity, Ajuri Ngelale, announced in a statement that the appointment adheres to Section 8 (1) of the Central Bank of Nigeria Act, 2007.

This section grants the president of the Federal Republic of Nigeria the authority to appoint the governor and four deputy governors for the CBN, subject to confirmation by the Senate of the Federal Republic of Nigeria.

In addition to Dr Cardoso’s nomination, Tinubu also approved the nomination of four new deputy governors of the CBN to serve for an initial term of five years. They are Mrs Emem Usoro, Mr. Muhammad Dattijo, Mr. Philip Ikeazor, and Dr. Bala M. Bello.

When Dr. Cardoso officially takes office as the CBN governor, he will be faced with a series of pressing challenges that demand swift resolution for him to succeed in this role.

Many of these challenges resemble hidden obstacles, requiring a combination of innate intelligence and divine guidance to navigate successfully.

Among the foremost concerns are issues such as exchange rates, price stability, interest rates, and economic growth, which are considered top priorities by experts.

President Bola Tinubu had previously suspended Godwin Emefiele as the CBN governor in June, instructing him to immediately transfer his duties to Folashodun Adebisi Shonubi, the deputy governor of Operations Directorate, who was to serve during the investigation and subsequent reforms.

A development economist, Dayo Falohun, said the most critical task for the new CBN governor will be restoring the proper functioning of the Investors and Exporters (I&E) window.

Nevertheless, he said, it remains imperative for Nigeria to proceed with FX reforms. ‘‘Additionally, addressing any involvement of the CBN in lending to the economy and cleaning up its balance sheet will be pivotal,’’ he added.

Also, a group of economists, DLK Associates, said that the new CBN management team should demonstrate a deep understanding of monetary economics to effectively engage in discussions about monetary policy, a dimension that was lacking during Emefiele’s tenure.

The group also added that the new CBN management must actively engage with stakeholders, as monetary policy significantly impacts various sectors of the economy.

Also, the economists expressed the desire for better collaboration between fiscal and monetary authorities and the need for a balanced approach that considers both inflation and growth objectives to avoid excessive focus on inflation at the expense of economic growth.

Experts said the primary functions and responsibilities of the Central Bank of Nigeria (CBN) encompass several critical areas which include ensuring monetary and price stability, issuing banknotes, maintaining external reserves, fostering a robust financial system, and providing economic and financial counsel to the government.

A political economist, Dr Jamiu Ahmed, said at the heart of central banking worldwide lies the mandate of monetary policy. ‘‘This involves utilizing various tools like interest rates and bank reserve requirements to uphold price stability (by managing inflation) and stimulate economic growth.

“These policy instruments grant central banks direct and indirect control over lending and borrowing, consumption, investment, employment, and inflation, among other economic factors,” he noted.

They urged the new CBN management to learn from the mistakes of the past. For instance, Ahmed said, “In 2014, when Mr. Emefiele assumed office as Governor, the inflation rate stood at approximately 8.0%. Today, it is 25.8%. Furthermore, in 2014, the USD/Naira exchange rate was less than N180.

“By the time Mr. Emefiele was suspended, it had surpassed N460. While external factors can influence the CBN’s monetary policy effectiveness, the institution’s involvement in fiscal matters through its intervention funds and development financing was concerning.’’

Analysts said strangely, despite not being explicitly listed as one of the CBN’s roles in the CBN Act (2007), development financing became the bank’s central focus in recent years, to the extent that politicians were receiving interest-free, collateral-free loans from the CBN, raising suspicions that these intervention funds may have been used for political gain.

This influx of funds into the foreign exchange market, according to them, has likely contributed to the rapid depreciation of the local currency, further complicating matters.

Appointment A Welcome Development

Reacting to the new development in CBN, Professor of capital market at Nasarawa State University, Keffi, Uche Uwaleke said the appointment was most expected.

In a statement he titled ‘welcome development,’ Uwaleke said Dr Cardoso is eminently qualified for the job.

Prof Uwaleke noted that the new governor of the apex bank must strive to align monetary policies with the agenda of the fiscal authorities.

He explained that the CBN is too sensitive an institution to allow a chief executive function in an acting capacity for a long period.

“A substantive CBN Governor sends the right signals to financial markets,” Professor Uwaleke said.

Similarly, director/CEO, Centre for the Promotion of Private Enterprise (CPPE), Dr. Muda Yusuf said, “The shakeup in the CBN did not come as a surprise. Indeed, President Bola Tinubu hinted during his inaugural speech that the CBN needed a thorough house cleaning. That is what is playing out now.”

He noted that “under the previous CBN leadership, there were serious issues around the transparency of foreign exchange management as well as the intervention funds of the CBN.

“The failure of the CBN to publish Audited Accounts for six years was also a major breach of corporate governance values and the CBN act. Cardoso is eminently qualified for the position. He has the academic, intellectual and industry credentials to head the apex bank,” he pointed out.