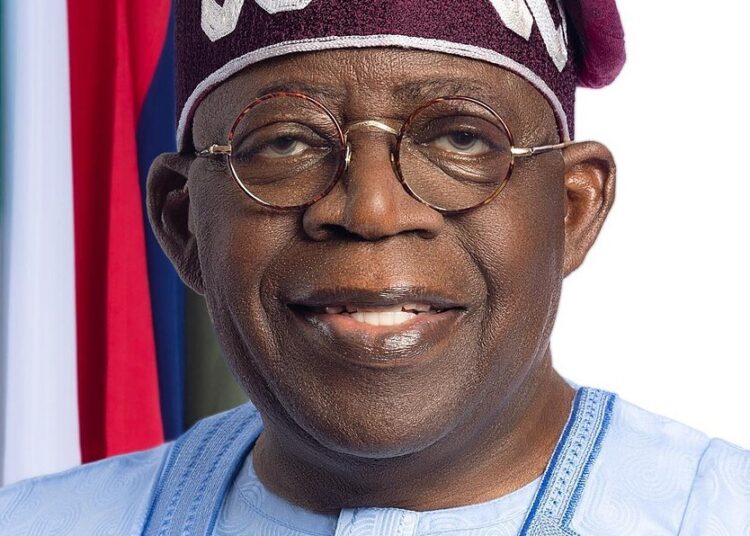

President Bola Tinubu has called for a strategic review of pension fund asset policies to allow investment in Nigeria’s oil and gas sector, urging a rethinking to unlock the vast economic potential of the industry.

President Tinubu, who commissioned the $400 million Green Energy International Limited (GEIL) crude oil export terminal in Otakikpo, Rivers State, on Wednesday, emphasised the immense returns that could be realised from such investments.

The Otakikpo terminal is Nigeria’s first indigenous crude oil export terminal and the first new terminal constructed in the country five decades after the previous ones.

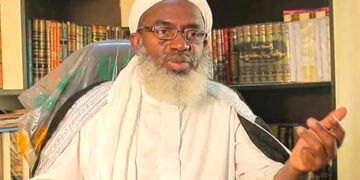

Represented by the Minister of State for Petroleum Resources (Oil), Senator Heineken Lokpobiri, the President said that the federal government was already engaging with Ogoni people to resolve all outstanding issues so that crude production can commence.

He added that the Otakikpo terminal will evacuate the crude oil produced from their land.

“We need to tinker with our pension laws so that pension funds can also be invested in oil and gas,” he stated.

He emphasised the immense returns that could be realised from such investments, citing an example from Senegal where an $8 billion investment is projected to yield $40 billion over 25 years.

“Imagine a situation where you invest $8 billion in Senegal, and the return is $40 billion. Even if you invest $8 billion in pension funds, it won’t give you more than maybe twice that amount. But this is 300 per cent or more,” he said.

The President highlighted the critical role of indigenous companies in transforming the sector. “I believe that we need to encourage indigenous players like Green Energy that have pioneered this move,” he said, praising Green Energy for investing over $400 million into building the new terminal.

He also criticised some marginal field license holders who, instead of investing in the sector, misused funds for private jets, asserting, “If you don’t have the capacity to do it, you’d better go and look for something else to do instead of wasting your time in oil and gas.”

He described the oil and gas sector as a solution to Nigeria’s economic challenges, pledging government collaboration with stakeholders.

“Federal government will collaborate with stakeholders, with state government, with local government, with community leaders to ensure that we unlock the huge deficits we have in this part of the world,” he said.

In the energy transition debate, the minister dismissed calls to abandon oil and gas, stressing the continued global reliance on hydrocarbons. “Oil and gas will never go away,” he declared.

Referring to the International Energy Agency’s new projections, he explained, “The world will need to spend about $540 billion per annum to avoid an energy crisis in the next 25 years. And this investment is proposed to be made in the upstream sector, the same oil and gas sector.”

He added that oil and gas are expected to constitute more than 50 per cent of the global energy mix for at least the next 50 years.

The president underscored the importance of local collaboration, especially with communities in the Niger Delta, to unlock resources. “I want the people of River State and the people of the Niger Delta to collaborate with operators and create an enabling environment to bring this resource to the market,” he urged, warning that buried resources create no value.

“If these resources are buried in the ground, there’s no value created.”Regarding finance for the sector, the Minister cited the creation of the African Energy Bank, which aims to mobilise local capital for energy investments.

“We have discovered that the biggest challenge we have in Africa is access to finance. And that is why we’ve come up with African Energy Bank, which is ready to go,” he said, adding that Nigeria has met all its obligations for the bank’s launch.

Also speaking, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) chief executive officer, Engr. Gbenga Komolafe, said the terminal was expanding Nigeria’s crude export infrastructure at a critical time and demonstrates the capacity of Nigerian operators to deliver world-class projects once thought possible only for international major players.

He further noted that the Otakikpo terminal is significant to the present national crude oil production, about 1.8 million barrels, because the efficiency of evacuation and export is critical.

Komolafe also said that by creating an alternative export hub in Rivers State, the Otakikpo terminal reduces over-reliance on existing terminals, many of which are operating at near capacity and are exposed to security and pipeline challenges.

He said the industry’s indigenous operators have evolved to the stage of accounting for 30 per cent of the national production.