Nigeria and other countries in Africa are feeling the heat of the slew of tariffs imposed by the United States (US) President Donald Trump, which have sparked global shocks and outrage with concomitant retaliation from affected countries.

Nigeria was slammed with 14 per cent of tariff for goods going from the country to the US market, one of the least levies imposed by the US on any African country. It could be said that Nigeria’s non- oil trade with the US is about 10 per cent while its trade in oil and gas constitutes about 90 percent cent of the trade with the US.

President Trump did not impose tariffs on oil and gas therefore Nigeria may feel relatively safe but it may face a fundamental crisis as the tariffs have led to the global fluctuations in the prices of crude oil, which as of Friday sold at 64 dollar per barrel.

The Trump tariffs have sparked a crisis in the energy sector as Brent crude oil, which is usually used as a global benchmark of oil prices, fell to $58.84 at one point, a 6.34 per cent drop. The price per barrel continues to fluctuate between Wednesday and Friday and has also risen slightly above $60 at points before falling back down.

The situation is not likely to abate soon as Nigeria has pegged its 2025 budget benchmark at 75 dollar per barrel but now that the prices are hovering between 55 and 64 dollar per barrel, the country is already facing a crisis in its budget implementation and may have to review its budget to avert further crisis.

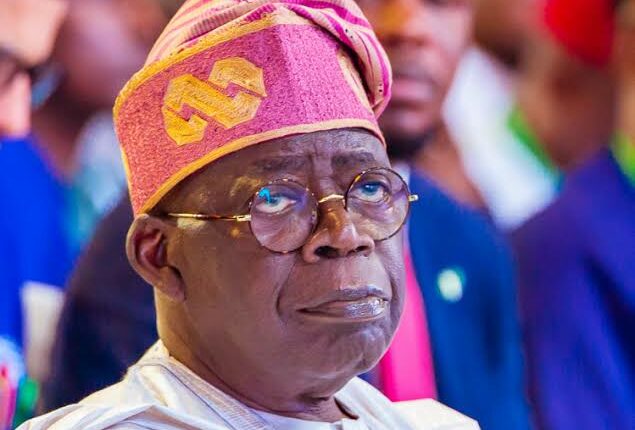

President Bola Ahmed Tinubu signed the N54. 99 trillion 2025 Appropriation Bill into law with much enthusiasm but of the amount, the Federal Government will generate revenue of N41.81 trillion, leaving a deficit of N13.08 trillion. The budget was based on another ambitious target to ramp up crude oil production to 2.06 million barrels per day and exchange rate of N1, 400 to $1.

Nigeria’s 2025 budget, officially titled “Budget of Restoration: Securing Peace, Rebuilding Prosperity,” represents a significant increase from the 2024 budget and is the largest budget in Nigeria’s history.

The expectations notwithstanding the grim reality is that fluctuations in the international market might disrupt the flow of this budget and it requires serious tinkering for it to meet the demands of hapless Nigerians already suffering from massive poverty, unemployment, high cost of living amid dwindling economic fortunes of the country.

Speaking on the aftermath of this development, renowned energy analyst, Muda Yusuf, warned that the global inflationary crisis will affect Nigeria and other African countries in ways that may be difficult to handle because of the nature of their economies, which are often weak in the face of such global developments.

He advised the government to revisit the budget to make it attune to the current global economic realities especially as US and China have intensified their trade wars levying each other with heavy taxes.

Concerns over the US-China trade dispute have continued to weigh on demand expectations. China announced it has increased its tariffs on US imports to 125 percent, warning that the rate was high enough to effectively dampen US access to the Chinese market.

This comes after the White House clarified on Friday that it was actually imposing tariffs totalling 145 percent on China, combining the previously announced 125-percent rate with a 20-percent import tax levied for fentanyl smuggling.

Although Trump announced a 90-day pause on the implementation of new tariffs, Americans have remained uncertain about his tariff policies, which have triggered protests in many US cities in the last couple of days.

China is, however, refusing to back down after being hit with the new tariff from Trump, even as Beijing has already filed a complaint to the World Trade Organization saying the US is violating international trade laws.

Lending his voice to the global discourse, public intellectual Dr. Katch Ononuju, said although Nigeria faces significant challenge in the oil and gas sector due to the backlash, the country has the potential to wriggle out of the quagmire with proper planning and efficient implementation which has become urgent to forestall any crisis.

In the midst of this global turmoil, President of the African Development Bank Group, Dr. Akinwumi Adesina, advised African countries including Nigeria not to engage in a tariff war with the United States, urging African nations to prioritise strategic trade and investment partnerships instead.

Adesina stated this while delivering the 14th convocation lecture of the National Open University of Nigeria (NOUN) with the theme; “Advancing Africa’s Positioning Within Global Development And Geopolitical Dynamics.”

He warned that the new U.S. tariffs could send shockwaves through African economies, weakening local currencies, increasing inflation and raising debt servicing costs stressing that Africa’s trade with the U.S. is minimal and engaging in a trade war is risky.

“This will send other shockwaves right through African economies. Local currencies will weaken on the back of reduced foreign exchange earnings. Inflation will increase as the cost of imported goods rises and currencies devalue against the U.S. dollar.

“The cost of servicing debt as a share of global revenue will rise as expected revenues decline.

These global tariffs will also have significant indirect effects on Africa, as its exports to developed countries such as China and others in Europe and Asia will buy goods from Africa.

“This will be expected to reduce the amount of official development assistance that will come to us from those economies. Of course, today we have the Africa Growth and Opportunity Act. It’s a duty-free access of Africa to the rest of the world.”

According to the Director of the Center for China Studies, an Abuja-based think tank, Charles Onunaiju, Nigeria can learn from China to absorb the pressure coming from this global crisis. China, he said, has envisaged this latest development and is well-prepared ahead to tackle the backlash focusing on domestic consumption, value addition and the effective implementation of policies to ensure it trades with itself even more than it does with the international community.

This was achieved through disciplined investment, better resource management, and improved governance. “Nigeria can embrace this method to recalibrate domestic trade as well as look for more opportunities in other areas especially the Chinese market, other parts of Asia and the rest of the world,” he noted.