In the recent visit to Nigeria, Bill Gates remarked that the country’s tax collection rate is too low. It’s a familiar refrain from the technocratic elite, for whom GDP figures, fiscal deficits, and taxation policies are abstract numbers on a spreadsheet. But for those of us on the ground, living in a country where the per capita income barely scrapes $2,200, it’s not so simple. Let us first consider the undeniable truth: Nigeria is a low middle income country, not because of a dearth of taxes, but because of an impoverished economic framework that has left the vast majority of its citizens without purchasing power.

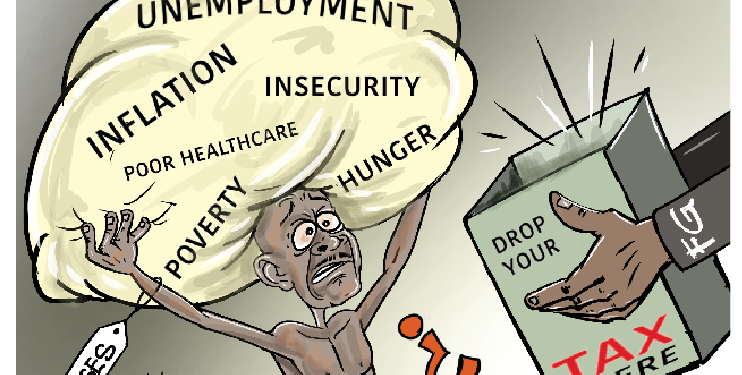

Where, pray tell, do these so-called experts expect to find this miraculous revenue? From the pockets of people whose wallets are already empty? Who exactly should be paying more taxes in a country where nearly half of the population lives below the poverty line?

The Moral Question: Taxing the Poor

When we discuss taxation, we must ask ourselves a fundamental ethical question: Is it moral to tax people who have so little? In Nigeria’s case, taxing an already impoverished population is not merely ineffective—it is, quite frankly, immoral. As Amartya Sen famously posits in The Idea of Justice, justice must concern itself not just with the distribution of resources, but with fairness in terms of human capabilities and opportunities. Sen highlights that true justice is rooted in equity, not just equality.

How does this apply to Nigeria’s taxation system? The overwhelming majority of Nigerians do not have the capabilities to contribute more to the economy, let alone pay taxes. Their access to basic needs—healthcare, education, electricity, and water—is either non-existent or unreliable. They are already crippled by an economy that does not provide them with the means to live decently, let alone to prosper. When you tax such people, what you are effectively doing is increasing their hardship rather than contributing to any real notion of justice.

What Mr Gates and those who think like him overlook is that Nigeria’s problem is not that of ineffective tax collection, but an economy that is fundamentally broken. You cannot expect significant tax revenues from a population that is already drowning in financial quicksand. Majority of the people are in debt; they are living on deficits. And yet, the ruling class and their foreign admirers are still fixated on extracting more from a system that barely has anything left to give.

The Economics of Poverty and the Fallacy of Taxation

Let’s take a step back and think about Nigeria’s economic reality. Here we have a population of around 200+ million people, with a GDP of under $300 billion. To make it starker, that’s less than $2,200 per person annually. When economists from affluent nations start talking about “effective taxation” in such a context, one has to question whether they have any grasp of reality—or if their expertise has completely detached them from the lived experiences of the people they claim to help.

In countries with more advanced economies, taxes function as a fiscal policy tool to correct market failures, address income inequalities, and fund essential public services. That is what I was taught in my public finance classes. Taxation, in its ideal form, is not merely about revenue collection; it is a method of achieving fairness in an economy riddled with distortions. But here’s the thing: before you can tax, you must have something to tax. How does one tax people who are, quite literally, surviving on nothing? How do you justify taxing a society where most individuals spend their earnings not just on themselves, but also on their extended families because social services are either unavailable, unaffordable, or inaccessible?

Even John Maynard Keynes—hardly a radical opponent of government intervention—warned about the dangers of inflation, calling it “the most subtle and destructive tax of all.” Inflation, Keynes argued, erodes the purchasing power of people without them even realizing it, making it a form of taxation that strikes hardest at the poor. Nigeria’s inflation rate has skyrocketed, and it has had a devastating impact on people’s livelihoods. Prices have surged, yet incomes have not kept pace. The poor are taxed through their inability to afford the most basic necessities of life.

This leads us to an unsettling conclusion: Nigerians are already being taxed, just not in the way Bill Gates imagines. Their tax comes in the form of inflated prices, poor infrastructure, non-existent social services, and a corrupt elite siphoning off public funds. What more can you take from people who are already paying this hidden, but crushing, inflation tax every day?

The Misguided Obsession with Government Revenue

Like Mr Gates, there’s a dangerous trend among our policymakers to focus almost exclusively on government revenue as the key to solving Nigeria’s problems. The idea is that if only the government could collect more taxes, it would be able to fund public services, infrastructure, and create jobs. But this obsession misses the bigger picture. How can you talk about government revenue when the people have no revenue of their own?

Our economy is in a dire state. The private sector, which is supposed to be the engine of growth, is stifled by corruption, bureaucratic inefficiencies, and a hostile business environment. Nigeria has one of the highest unemployment rates in the world. The manufacturing sector is in tatters, and local businesses are struggling to survive. What we need is not more taxes, but more income-generating opportunities. We need a government that understands that it must first empower its citizens before it can expect them to contribute to the state’s coffers.

The Nigerian government, by failing to create a conducive environment for businesses to thrive and for people to earn a decent living, is effectively choking off its own source of revenue. If the economy were to grow, if businesses could expand, and if people had jobs that paid decent wages, tax revenues would naturally increase.

The Path Forward: An Economy that Works for the People

If we are serious about fixing Nigeria, we must stop talking about taxation as if it were a silver bullet. What Nigeria needs is not more effective tax collection, but a comprehensive plan to grow the economy in a way that benefits the many, not just the few. We need to build an economy that guarantees at least $4,000 per capita before we can even begin to talk about raising taxes.

Economic growth should be our primary concern. We must focus on improving our industrial base, encouraging local entrepreneurship, and creating a regulatory framework that allows businesses to thrive. We need to attract investment not through tax breaks for multinationals, but by fostering an environment of political and economic stability. Most importantly, we need to address the extreme inequality that has left a vast number of Nigerians in a state of perpetual poverty.

Until we do this, any talk about taxation is not just premature—it is an affront to the suffering masses who can barely make ends meet. Nigeria’s future will not be built on the backs of the poor, but on a thriving middle class that has the income, purchasing power, and capacity to contribute meaningfully to the nation’s development.