As fully remote and hybrid workplaces become more prevalent, traditional office perks such as catering and beer kegs have lost some of their allure in terms of attracting and retaining employees. Additionally, with inflation on the rise, employee satisfaction is increasingly linked to their salary. It’s no longer sufficient to pay wages promptly and correctly. Providing employees with greater control over their finances has become a critical aspect of the overall employee experience.

Payroll, an integral part of the weekly or monthly employee experience, takes precedence over other milestones in the employee experience. It is crucial for employees to have confidence in the accuracy of their compensation for hours worked, the current status of their leave, and the accessibility and immediacy of their money.

The shortcomings of the payroll experience are not limited to the employee side. HR and finance administrators also face challenges due to outdated technologies. Those responsible for salary disbursement and accessing payroll data for business planning, cost control, and identifying talent requirements require a more streamlined, user-friendly experience that resembles consumer technologies.

There is a noticeable shift from payroll bureaus to software due to the increasing consumerization of payments that is spilling over into the relationship between businesses and employees. Employees now desire the flexibility to receive their wages anytime, from anywhere, and through various payment methods, and payroll technology has emerged to address this need. This marks the first time in decades that such a shift has occurred.

The increase in the demand for payroll technology in Africa

In Africa, fintech innovation has reached unprecedented levels, driven by the growing dependence of consumers on mobile financial services, the emergence of novel digital finance solutions by startups, and the gradual investments made by venture capital investors in entrepreneurs operating within this sector.

According to a report by market insights firm Briter Bridges, fintech companies in Africa secured almost $3 billion in funding last year, representing two-thirds of the total investment garnered by startups in the region. This figure is more than twice the $1.35 billion raised by fintechs in 2020 and three times the amount secured in 2019.

As the fintech industry continues to flourish, African entrepreneurs are venturing into new territories within the sector, including payroll and corporate benefits management. In this particular sub-segment, several startups have emerged, each with comparable yet unique business models, aiming to penetrate the human resources management (HRM) market in the region that has traditionally relied on non-digital backend procedures. These startups include Earnipay, Bento, Workpay, Zuberi, Floatpays, and SeamlessHR.

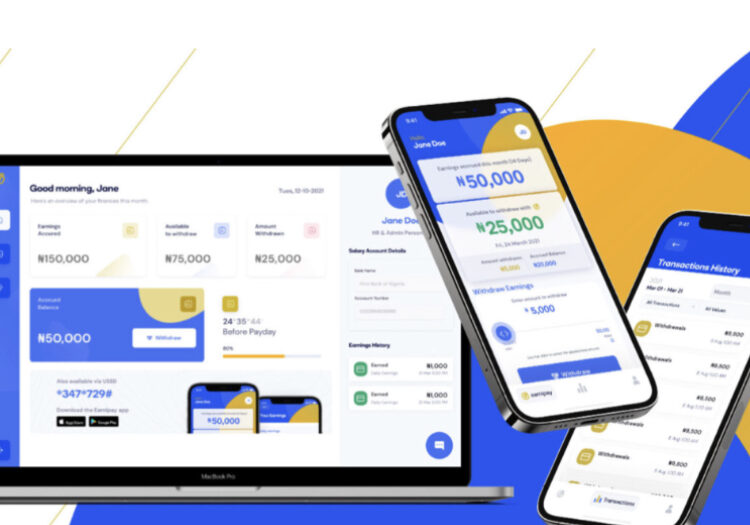

Conventional payroll payment procedures often necessitate at least three days to complete. However, with the advent of new payment methods promoted by tech startups, this timeline can be trimmed down to mere minutes. By utilizing web portals or mobile self-service applications, businesses can efficiently monitor working hours, handle payroll in accordance with local regulations, and promptly remunerate their workforce.

Going from Payroll towards Employee Benefits

In Africa, the payroll fintech sphere is fostering expansive ecosystems, with startups offering more than just paycheckprocessing and related services. These companies are also providing a range of supplementary benefits, such as salary advances, loans, pension plans, healthcare coverage, and insurance policies, to name a few.

A rapidly growing sector within the payroll fintech landscape is earned wage access (EWA) platforms. Fintech companies operating in this particular subcategory, such as Nigeria’s Earnipay and Ghana’s Zuberi Pay, collaborate with employers and financial institutions to provide employees with convenient and adaptable access to their earned wages.

When salaried workers require fast cash between pay cycles, they have traditionally turned to payday lenders, bank loans, or salary advances. However, these options frequently entail excessive interest rates, and salary advances, in particular, can result in indebtedness for the employee.

This is where startups such as Earnipay and Zuberi which are mobile platforms that provide on-demand employee benefits, offering salary streaming features that enables workers to obtain a portion of their earnings on a daily basis upon completing their work. This means that instead of having to wait until the end of the month, employees can withdraw their salary as and when needed.

The blurred lines between employee payroll tech and consumer fintech

Fintech has a pervasive presence in the lives of consumers, who utilize its services for mobile payments, online banking, and money transfers to acquaintances. As fintech consumers, employees anticipate their payroll and wages to be transmitted accurately and in accordance with their preferences.

It’s worth emphasizing that the prompt delivery of salaries according to employee preferences has greater significance than merely catering to their personal whims. The ability to receive wages regardless of one’s location provides greater financial agility, which significantly impacts overall financial health. This can translate into the ability to invest at will, hasten the attainment of financial targets, pay bills promptly, and assist family and friends in times of need, among other things. As a result, payroll technology firms have entered the fintech arena, revolutionizing the way in which wages are disbursed and received.

In general, businesses provide payroll to their employees once or twice a month. However, as consumers, employees require the flexibility to access their money whenever necessary to pay bills, handle emergencies, and purchase goods and services. Without this flexibility, employees can experience financial stress, which can negatively impact their engagement and productivity levels.

However, altering payment dates can be a challenging task for companies without disrupting existing processes. As a solution, payroll technology and fintech intersect, offering new ways to pay employees. Forward-thinking employers can utilize payroll technology to provide earned wage access (EWA) or on-demand pay through a downloadable mobile application, driven by a desire to reduce stress and enhance employee experience. Innovative technology enables employees to check their work hours and PTO data, and withdraw earned pay as needed, giving them greater financial control.

According to recent research conducted by EY, 80% of workers would avail themselves of earned wage access (EWA) and on-demand pay, which is not limited to those with lower salaries. Some respondents cited that this approach would help them manage their cash flow and the timing of their bill payments, leading to reduced reliance on credit cards or payday loans.

To attract and retain top talent in today’s competitive job market, employers need to leverage all available technology to enhance the employee experience. Payroll tech has taken note of this and is following the lead of fintech by recognizing that employees are also consumers and offering financial wellbeing tools to provide greater access to earned wages. By allowing employees to manage their finances on their terms, this type of visibility and flexibility improves financial wellbeing and positively impacts employee engagement and retention, and can even attract new talent.

The use of payroll tech has an added advantage of providing accessible and dynamic payroll data. This data includes past earnings, hours worked, benefits, expenses, taxes, savings plans, and anticipated future earnings. This complete payroll record can be compared to the data visualizations already found in bank apps to provide enriched data for meaningful and actionable insights for both the organisation and the employee. This means that payroll data can now serve as a powerful business intelligence tool for companies, while also providing employees with data for financial and life planning in new and unexpected ways.

Payroll Tech is essential to a developing financial ecosystem

As workforces around the world become more tech-savvy, employees anticipate an employee experience that mirrors their customer experience. Fintech solutions must respond by catering to empowered employees with technology that guarantees interoperability, personalization, and confidentiality. This necessitates payroll technology to follow suit by embracing fintech and catering to employee expectations of seamless, prompt, and autonomous payment methods. It is essential to realize that fintech and payroll technology are interdependent, and it is myopic to overlook a future in which the two become intertwined.

About Contributor:

Kelechi Anyikude is a growth strategist, Growth Marketing Manager at Earnipay and a regular tech and business contributor at various other publications.

Connect with Kelechi about tech marketing and opportunities in scaling startups on Twitter(@kelechiafc) and LinkedIn (Kelechi Anyikude)

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel