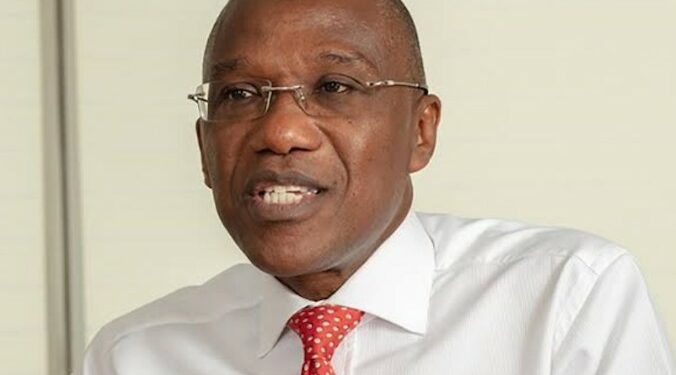

On Thursday, President Bola Ahmed Tinubu appointed a new Managing Director signifying the end of Ahmed Lawan Kuru’s tenure as the Managing Director/Chief Executive Officer of the Asset Management Corporation of Nigeria (AMCON).

Presidential spokesman, Ajuri Ngelale, in a statement on Thursday named Mr Gbenga Alade as new MD/CEO of AMCON.

In a reaction, economic policy expert and former commissioner of finance in Benue State Dr Justine Amase said AMCON under Kuru achieved significant milestones.

Kuru was first appointed in 2015 for a first tenure of five years and was in December 2020, reappointed by former President Muhammadu Buhari, for a second term that ought to end in 2025.

LEADERSHIP Weekend’s overview of the corporation’s activities, covering enforcement, asset management and funding model emphasised the fact that even though the terrain has been difficult for it to operate, AMCON has achieved significant results, especially in the last eight years.

AMCON was created as a bad bank with various challenges beyond its control, the corporation became a profit-making organisation aside from delivering on the recovery mandate for which it was created by the federal government ab initio. As of December 2023, AMCON had recovered over N1.8trillion from obligors.

AMCON, a loss minimization entity, made a profit of N23.97 billion in 2020, which increased to N34.65 billion in 2021. In the year 2022, the corporation made N58.59 billion profit.

The loss captured in the Management Account as of 30th September 2023 was because interest accrual on the CBN loan note had been charged as an expense to its Profit and Loss Account, according to official data. The corresponding credit, the receipts for external recoveries, which is estimated to about N359 billion was yet to be recognised and captured in the corporation’s balance as at that time.

This is usually recorded in the last month of the financial year, December, before closing the books. Consequently, the corporation was projected to close with over N70 billion in profits by December 2023 once the receipts from the sinking fund is reflected in its Profit or Loss Account accordingly.

AMCON purchased 12,743 NPLs or EBAs worth N3.797 trillion from 22 Eligible Financial Institutions (EFIs) for a purchase price of N1.8 trillion. The purchases are covered by various collaterals.

The corporation also injected a total sum of N2.2 trillion to 10 banks – Bridged and Owned Banks (intervened banks) – bringing Net Book Value (NAV) to Zero. AMCON capitalized three EFIs and provided financial accommodation to five.

That N2.2trillion was not backed by any collateral, which made recovery extremely difficult. AMCON capitalized three EFIs and provided financial accommodation to five others.

Dr Amase also said since AMCON was created to clean up the banking sector, it is expected that the incoming managing director upholds transparency and accountability in whatever he’s going to do in respect of the outstanding transactions that are still not resolved.

“There will be need for him to bring in experts to make significant impute about the best way he can go about resolving some of the outstanding issues because AMCON has a limited time bound. He doesn’t have all the time. He needs collaboration with experts that know how most of those issues are resolved,” the economic consultant stated.

There are those who also say that the new man at the helms of affairs needs to quickly bring in experts who should guide him because he’s going to have so much on his hand. The present administration of President Bola Tinubu brags about determination to ensuring that there is transparency and accountability in whatever it does.

That is why many economic experts agree that Alade should focus on making transactions and their processes very transparent and accountable. “He needs to position himself to effectively address some of those outstanding issues and resolve them in good time.”

The incoming MD would be faced with major challenges in a resolve to achieve set targets. As Nigeria struggles with a huge debt burden, so is AMCON struggling with very recalcitrant obligors who have mastered the act of clinging to the technicalities, rather than settling their established obligations.

AMCON had raised the alarm about some recalcitrant obligors who have found new tricks of colluding with a third party who would present himself as the owner of the traced assets and file for the Order of Court to be set aside. “We urge Your Lordships to kindly be wary of these characters.”

About 350 obligors on its watch list account for N3.957 trillion, which is above 84 percent of the total outstanding amount the new team lead would have to retrieve from the recalcitrant debtors. Its debt is in the Central Bank of Nigeria (CBN) balance sheet, a development experts classified as a threat to the economy.

The new boss would be faced with the task of not only pursuing but ensuring AMCON wins the many cases pending with the various divisions of the Courts.

“These matters are very vital to the success of the corporation and particularly as we know that if we are unable to resolve them, it becomes a burden on our country’s debt profile and taxpayer’s money,” a director in AMCON’s Abuja head office said in a chat with our eporter on Friday. The staff who refused to be named said Mr Alade would have to probably lobby the Judges for quick dispensation of justice.

Another staff of AMCON in the legal department said “We are still strongly battling with our debt recovery activities. It is very difficult, particularly given our peculiar situation.”

Economic experts expect the new MD of AMCON to brace up for difficult job, especially in the current times when more businesses are threatened by local and external headwinds.

“Mr Alade and his team should prepare for the worst bearing in mind the current downturn and its grievous impact on businesses and the balance sheet of most banks by way of non-performing loans,” says Professor Hassan Oaikhenan.

Like Oaikhenan, many experts say the CBN and AMCON would have to step up their supervisory role to prevent an overcrowded list of NPLs. “Any addition to the current level of NPLs would be disastrous for both the financial sector and the economy,” he stated.

The non-performing loans ratio reportedly declined from 4.5 percent in March to 4.4 percent in 2023. But that was before the floating of the naira and removal of subsidy on gasoline that has triggered nationwide hardship and pushed up the cost of doing business, with a dwindling purchasing power of the citizenry and unprecedented stagflation currently put at 29.9 percent.