The challenges of Nigeria’s power sector are well documented. Despite significant government investments, power generation, transmission and distribution are still sub-par, leading to inadequate supply. The unstable power supply in the country affects economic growth and development. It has stifled economic activities, including private investments and job creation.

Between February and July 2022, the national electricity grid, which is managed by the Transmission Company of Nigeria (“TCN”), recorded four total collapses and one partial collapse, most of which occurred on 20 July.

Nigeria has an unenviable history of grid collapses, which is often due to insufficient gas supply to the thermal power generation plants, combined with weakened transmission and distribution infrastructures.

When the country experienced a nationwide power outage in March 2022, President Muhammadu Buhari was reported to have apologised to Nigerians and attributed it to disruption in gas supply to some of the country’s thermal power plants.

Gas is a major feedstock for electricity generation in Nigeria. About 80% of Nigeria’s grid electricity is generated from gas-fired thermal power plants. Gas is preferred as a source of energy because of its efficiency in energy generation, relatively low per unit cost and low carbon emissions.

Nigeria, despite being a major global producer of gas and endowed with one of the largest gas reserves in the world, has struggled to deliver sufficient gas to the domestic market amid growing demand.

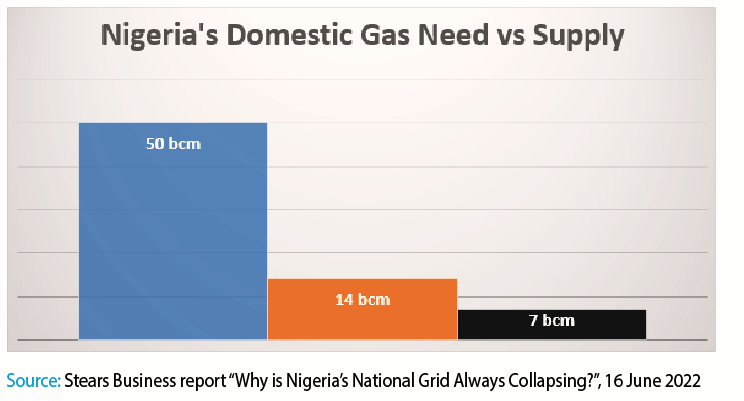

According to a recent Stears Business report (“Why is Nigeria’s National Grid Always Collapsing?”, 16 June 2022), Nigeria currently needs about 50 billion cubic metres (“bcm”) of gas, which includes 25bcm for thermal electricity generation. Currently Nigeria only produces 14 bcm, out of which 50% (7 bcm) is allocated for thermal electricity generation.

According to the Stears Business report, the volume of gas currently supplied for thermal electricity generation is significantly below the 25 bcm required.

The Nigerian gas market is hampered by several issues such as the vandalism of pipeline infrastructure, government regulated pricing for gas-to-power, unpaid gas supply invoices, an unstable foreign exchange market and low remittance within the electricity value chain, among others.

Notwithstanding these challenges, companies like Savannah Energy have continued to support the Nigerian domestic gas market. The British independent energy company focused on the delivery of Projects that Matter in Africa has, through Accugas Limited, its 80% indirectly owned subsidiary, made significant inroads particularly in the south-east and south-south parts of the country.

Since it commenced operations in Nigeria, Accugas has invested approximately US$1.6 billion in developing its gas processing and distribution infrastructure in the south-east, including over US$700million exclusively to enable the supply of gas to the Calabar thermal power station, which ranks as one of the largest thermal power plants in the country.

In addition, Accugas’ reliability as a supplier of non-associated gas, has meant that it has been rapidly adding more thermal power plants to its customer base. This year alone, Accugas has commenced gas supplies to First Independent Power Limited’s (“FIPL”) Trans Amadi and Eleme power plants in Port-Harcourt, following the execution of an addendum to its gas sales agreement with FIPL. This allowed FIPL to almost double its gas purchases to up to 65 MMscfpd (from 35 MMscfpd) to supply both its Trans Amadi and Eleme power plants, in addition to its FIPL Afam power plant under the original contract. The FIPL Trans Amadi power plant has a power generation capacity of 136 MW but, prior to the contract with Accugas, its generation capacity had been severely limited due to gas availability issues from its original supplier of associated gas. In addition, Savannah commenced gas supply to the TransAfam power plant in June this year, which has allowed for the immediate resumption of its power generation and supply to the national grid.

Accugas also commenced gas sales to the Central Horizon Gas Company Limited (“CHGC”) this year, a subsidiary of Axxela Limited and a major gas distribution company situated in the south-south of the country.

CHGC operates a 17km gas pipeline infrastructure network with a throughput capacity of 50 MMscfpd, providing natural gas to industrial and commercial customers in the Trans Amadi Industrial Area of Port Harcourt and the Greater Port Harcourt Area.

In nearby Cross River State, Accugas gas powers the Calabar power plant owned by the Niger Delta Power Holding Company (“NDPHC”), which accounted for approximately 9.48% of thermal power generation in Nigeria as at June 2022, and the Ibom Power Company (“IPC”), owned by the Akwa Ibom State Government. Savannah also supplies gas to power large industrial plants, like the Lafarge cement plant in Calabar, as well as to multiple manufacturing and industrial companies in the Port-Harcourt area via CHGC.

The quantum of Accugas’ contribution to the Nigerian economy is significant and this continues to grow. For example, Accugas is currently responsible for around 19% of Nigeria’s grid power generation, with capacity to increase this to 24%. In addition, the gas supplied by Accugas currently enables about 10% of the cement produced in the country. Overall, it is estimated that Savannah contributes approximately 0.5% to Nigeria’s GDP.

Against a backdrop of declining gas production in Nigeria, resulting in multiple grid collapses, Accugas has significantly increased its gas supply to accommodate stranded plants. This has helped to alleviate the country’s power crisis.

If Nigeria is to resolve its perennial power cuts and achieve its grid-based power generation target, then more attention needs to be paid to the constraints which bedevil gas supply in the country.

The Federal Government of Nigeria has an important role to play by way of policy – allowing pricing to be determined by the economic principles of demand and supply (“willing buyer/willing seller”), protecting pipeline infrastructure, resolving the historical issue of payments owed to gas suppliers and addressing the challenge of access to forex at the official market rate to ensure that funds can be repatriated to foreign direct investors. These will be important steps by way of policies to allow companies such as Accugas and others, who are already contributing significantly, to make further improvements to gas-to-power supply in the Nigerian market.