Capital market analysts predict positive trading on the stock market this week on portfolio rebalancing, and position taking in value giving and fundamentally sound stocks.

The Nigerian stock market posted an upbeat performance last week, driven by investor optimism surrounding anticipated macroeconomic developments. Also, increased expectations for favourable fiscal and monetary policies from the anticipated Consumer Price Index (CPI) data for this week and the Monetary Policy Committee (MPC) meeting the following week, alongside stronger corporate earnings from dividends paying banking stocks, fuelled bullish sentiment, pushing the NGX All-Share Index higher on a week-on-week performance.

The optimism was fueled by anticipation of quarter-end window dressing activities, continued expectation of positive corporate results from dividend paying bank stocks and major macroeconomic data.

Analysts Optimism

Analysts at Cowry Assets Management Limited said, “as Nigeria’s macro landscape continues to evolve, the bourse is poised for further activity in reaction to the changing fundamentals and technicals even as we expect continued volatility and entry opportunities for savvy investors.

“Looking into the coming week, we expect positive sentiment to rule the local bourse in the coming week on portfolio rebalancing, and position taking in value giving and fundamentally sound stocks given the relative strength of the market index trading above the T-line. Nevertheless, we continue to advise investors to focus on fundamentally sound stocks.”

On market outlook, the chief operating officer of InvestData Consulting Limited, Ambrose Omordion said, “We expect mixed sentiment to continue on profit taking and bargain hunting in the hope of an inflow of the half-year numbers from the other interim dividend paying stocks, as sector rotation continues in the market. Portfolio repositioning is however continuing, with investors taking advantage of pullbacks to buy into value.”

He noted that, “this is amid the volatility and pullbacks that add more strength to upside potential. Consequently, investors should take advantage of price correction. Also looking at the trends and events across the globe and domestically.”

Last Week’s Trading Activities

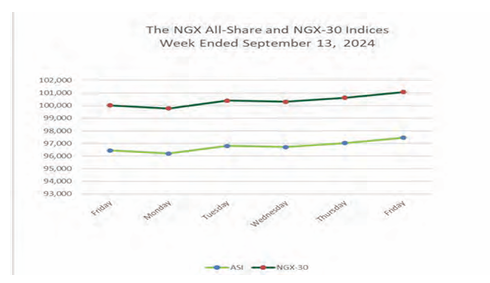

The Nigerian equities market last week closed higher, with positive market outings in three of the five trading sessions.

Thus, the All-Share Index inched upwards by 1.06 per cent week-on-week (W-o-W) to 97,456.62 points. Similarly, market capitalization of listed equities increased week on week by N608 billion to close at N56.002 trillion.

Furthermore, positive momentum across key sectors such as Banking, Consumer Goods, and Oil & Gas contributed to the market’s gains, while investors remain watchful of upcoming economic data releases and potential policy shifts.

As such, the NGX Banking index recorded a weekly gain of 5.12 per cent. The NGX Oil & Gas index posted 2.00 per cent gain, while NGX Insurance rose by 1.59 per cent W-o-W.

NGX-Consumer Goods index appreciated by 1.47 per cent and NGX Industrial Goods index up by 0.17 per cent for the week.

Market breadth for the week was positive as 52 equities appreciated in price, 31 equities depreciated in price, while 68 equities remained unchanged. Caverton Offshore Support Group led the gainers table by 42.02 per cent to close at N3.65, per share. R T Briscoe followed with a gain of 42.02 per cent to close at N3.65, while UPDC went up by 36.92 per cent to close to N1.78, per share.

On the other side, Learn Africa led the decliners table by 22.15 per cent to close at N3.62, per share.

Julis Berger Nigeria followed with a loss of 17.89 per cent to close at N140.00, while PZ Cussons Nigeria declined by 17.63 per cent to close at N15.65, per share.

Overall, a total turnover of 2.584 billion shares worth N51.205 billion in 50,615 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 2.141 billion shares valued at N51.217 billion that exchanged hands previous week in 55,603 deals.

The Financial Services Industry (measured by volume) led the activity chart with 1.707 billion shares valued at N26.989 billion traded in 19,277 deals; contributing 66.05 per cent and 52.71 per cent to the total equity turnover volume and value respectively. The Oil and Gas Industry followed with 332.829 million shares worth N11.997 billion in 9,956 deals, while the Services Industry traded with a turnover of 146.189 million shares worth N530.544 million in 3,404 deals.

Trading in the top three equities namely Jaiz Bank, Zenith Bank and Japaul Gold & Ventures Plc (measured by volume) accounted for 947.855 million shares worth N11.084 billion in 4,822 deals, contributing 36.68 per cent and 21.65 per cent to the total equity turnover volume and value respectively.

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel