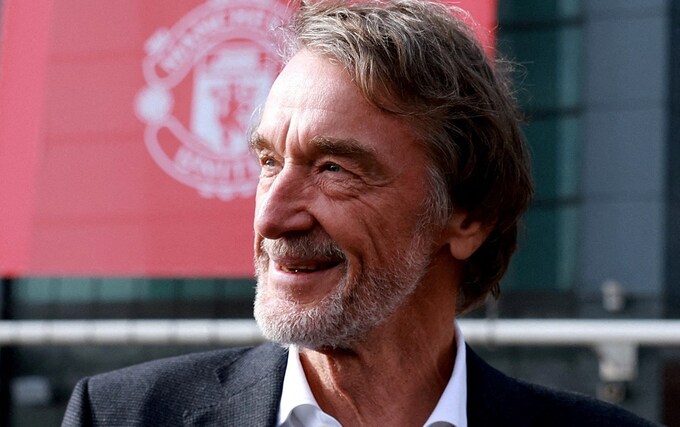

Sir Jim Ratcliffe has received Premier League directors and owners’ test approval for his 25 per cent purchase of Manchester United.

A deal will be completed within days as the Football Association signs off a final agreement after Ratcliffe extended his purchase offer until the end of this week.

United’s Class A shares rose more than six per cent to $21 (£16.57) in post-market trading after the tender offer deadline was extended to Friday from Tuesday.

Club filings to the US Securities and Exchange Commission (SEC) overnight confirmed the league has privately approved the deal.

A Premier League statement confirming the decision is only expected once Ratcliffe completes, however, which is likely next week.

Filings confirmed there was no doubt as far as United’s shareholding set-up is concerned that the Ratcliffe deal will be done. By February 9, around 36.7 per cent of the outstanding Class A Shares had been “been validly tendered (and not validly withdrawn) pursuant to the Offer,” the documents confirm.

Premier League approval for the deal is confirmed in the filing’s offer terms.

“Premier League Approval” has “already been obtained”, the document confirms, but the Football Association Approval is still awaited.

Ratcliffe, 71, has agreed to gain complete control of football operations as part of his deal for a minority shareholding but the Glazers have since agreed that Ineos should have a broader influence encompassing key decisions across the business.

Telegraph Sport detailed last week how plans include eventually creating a “Wembley of the North” under an ambitious 90,000-seater redevelopment of Old Trafford.

The Ratcliffe deal is now all-but-done after an extraordinary saga which saw the Glazers first start exploring a sale in Nov 2022.

A bump in share values overnight erased losses from earlier in the trading day on Monday amid speculation over whether the offer would be extended. In December, Ratcliffe agreed to buy the stake by allowing investors to swap about one-quarter of their Class A stock holdings for $33 per share, well above the current market price.

As of the close of Friday, 19.4 million shares had been validly tendered, according to the regulatory filing – which means Ratcliffe has already passed the threshold to complete his deal.

United’s American owners are set for a cash windfall of around £715 million from the sale of B shares to Ratcliffe. That eye-watering sum adds to earnings of around £465 million through past sales of A shares and around £150 million in dividend payments.

However, it was announced in previous regulatory filing that there will be no dividends paid for at least three years under Ratcliffe’s deal with the Glazers.

United were acquired by the Glazers for around £790 million in a hostile takeover in 2005, since when around £1 billion has been sucked out of the club in debt repayment, interest and management fees to service the leveraged buyout.

In addition to purchasing the Glazer shares, Ratcliffe – through his Isle of Man investment vehicle Trawlers Ltd – is buying up to 25 per cent of Class A shares at the same $33 per share price so as to minimise any risk of legal action from other minority shareholders such as Eminence Capital, Lindsell Train and Ariel Investments.

The deal values United’s equity at around $5.4 billion and gives the club an overall enterprise value of $6.3 billion, almost £5 billion.

Ratcliffe has also pledged an additional $300 million (£237 million) to invest in Old Trafford and infrastructure needs. The Oldham-born billionaire will have first refusal for a period of 12 months if the Glazers opted to sell more B shares in the future.

Equally, “drag-along” rights included in the deal mean Ratcliffe would be obliged to sell his shares subject to him receiving a $33 per share cash offer from the Glazers should they decide on a full sale 18 months from now.

A drag-along right is a provision or clause in an agreement that enables a majority shareholder to force a minority shareholder to join in the sale of the company.