The presidency has granted a three-month period for Nigerian vessel owners to settle their outstanding tax bill, which has accumulated over the past 10 years. This outstanding bill, amounting to millions of dollars, has caused some ship owners to avoid the nation’s port.

Multiple businesses received demands from the Federal Inland Revenue Service (FIRS) for the period spanning 2010 to 2019. These demands range from $400,000 to $1.1 million per vessel, resulting in a total sum reaching tens of millions of dollars.

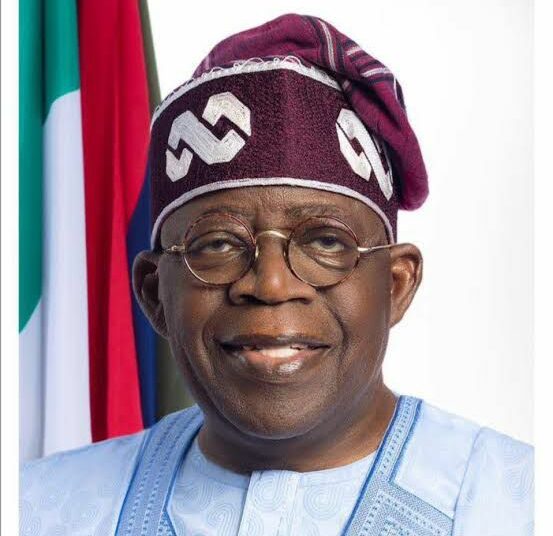

Zaccheaus Adedeji, the special adviser to the president on revenue, revealed this information to State House correspondents after a meeting with the group chief executive officer of NNPCL Mele Kyari, and NMDPRA CEO, Engr Farouk Ahmed among other ship owners.

Adedeji stated that the issue has been resolved, and the vessel owners have been given a three-month timeframe to settle the tax and balance their accounts within six weeks.

“We have made a commitment to resolve this issue swiftly to ensure it does not impede the flow of products in and outside the country. Nigeria will not tolerate any blackmail from defaulters who do not comply with our laws. We have laws that must be respected and obeyed,” Adedeji emphasized.

He further explained that no defaulting ship or vessel will be detained or arrested, as this has caused panic. Instead, a demand notice has been sent to them, and it has been agreed to establish a technical committee to resolve the issues.

The stakeholders, including oil and gas regulators, NNPC, FIRS and representatives from the Presidency, namely the Special Adviser on Revenue and the Special Adviser on Energy, participated in an interactive session to address the matter.

The technical committee will consist of regulators such as NUPRC, NMDRA, NNPC, FIRS, and the Presidency, represented by the Office of Chief of Staff, special adviser on energy, and special adviser revenue. The secretariat for the committee is located at the Federal Inland Revenue

Adedeji confirmed that the technical committee will address concerns, reconcile the back taxes, and establish a process to ensure compliance in the future. A three-month period has been granted for the parties involved to reach a conclusion.

Additionally, a grace period of six months will be provided during which no laws will be enforced to allow for reconciliation. This means that no vessel or ship will be detained or delayed. The intention is for them to reconcile with the technical committee within this six-month break.

The federal government affirms that Nigeria is open for business and maintains a business-friendly environment. They emphasize that while the country is open, no one should take advantage of it. The law must be respected.

The executive director of the Oil Producers Trade Section, Bunmi Toyobo the Lagos Chamber of Commerce and Industry (LCCI), expressed gratitude to the Special Advisers on Revenue and Energy for their attentive and receptive approach.

Toyobo highlighted that collectively, their members, along with NNPCL, account for approximately 90% of Nigeria’s oil production and generate 50 to 60% of government revenue. They also contribute about 70% to the GDP.

Toyobo further explained that the initial concern was that non-resident vessel owners, particularly non-Nigerian ship owners, were unwilling to come to Nigeria due to potential enforcement of Nigerian tax laws.

The commitment to address this issue demonstrates the government’s dedication to fostering a favorable business environment while ensuring compliance with tax regulations.