It’s a famous story in Christendom. Palestine, a vassal territory under the Roman Emperor Caesar, was obliged to pay tributes and taxes to Rome. A radical teacher in the territory, Jesus, taught things that the teachers of the law and local administrators in Palestine were uncomfortable with.

After setting traps for him but missing, they pitted him against Caesar by asking him a question that could have gotten him in trouble and possibly gotten rid of him for good.

“Is it lawful to pay taxes?” the Pharisees asked him.

“Give unto Caesar what is Caesar’s and unto God what is God’s,” he replied.

Caesar’s dilemma

The problem is that the world’s Caesars have never been satisfied with what is theirs without resistance or, sometimes, a nasty fight.

Take England, for example. In the 13th century, the barons revolted against King John over arbitrary taxation. When the King would not budge, they renounced their allegiance, forcing him to back down and sign a charter (the Magna Carta) which limited his powers.

It was the same in the US about four centuries later, leading to the famous “No taxation without representation” that paved the way for American independence. The Germans had theirs earlier, and the French, who loved nothing more than a rebellion, also waged violent wars against their kings for excessive taxation.

It’s not a foreign thing. Our tax rebellions have been championed not by men who often start the trouble but by women who bear the brunt. The British colonialists, for example, will not forget the Aba Women’s Riots of 1929 in a hurry.

Money not a problem

Yet, much as the world’s Caesars may be despised or resisted, running a country without taxation is not an option. Nigeria almost succeeded in doing so. I am not using the worn-out statistic about the low tax-to-GDP ratio to make the point. As long as there was oil money to spend, the problem—as General Yakubu Gowon said in the 1970s—was not the money but how to spend it. Tax was a non-issue.

The elite lived mainly on rent. Businesses recruited smart consultants to manipulate their numbers, and a small percentage of the public sector population who paid anything at all paid a token. Oil money was not the problem, but how to spend it.

We woke up one morning to find that while our population was growing rapidly and the infrastructure was decaying, what was left from declining oil sales, after accounting for corruption, theft, and our appetite for foreign products and services, was barely enough to fix the broken system.

The day after

The states went haywire, and Caesars everywhere launched one of the most egregious campaigns to finance themselves in an epidemic of internally generated revenue. Thus, the era of agencies staffed with some of the most ruthless staff members was born, mandated to raise revenues from the living, the dying, and the dead by hook or by crook.

It’s not funny. There was a proliferation of levies and taxes, some collected on the Walking Dead. In a September 2024 report, BusinessDay said a study by the Stakeholder Democratic Network showed that businesses in Rivers State identified 75 taxes and levies. Anambra, Lagos, and Edo are also in this brutal tax-and-levy bracket.

In addition to taxes and levies paid by companies to states and local governments, the Federal Inland Revenue Service (FIRS) collects income tax, stamp duties, capital gains tax, personal income tax, withholding tax, industrial training fund tax, VAT, and education tax for the Federal Government.

If you are wondering how bad it is, PwC cited 57 percent of multiple tax and levies incidents, revealing a significant lack of coordination between the states and the Federal Government. As it might have been said in old Palestine, it was a case of more Caesars than taxpayers. The system is broken and overdue for reform.

Anatomy of the bill

That’s why the current interest in the Tax Reform Bill 2024 is good. If the good times were still here, the government would not bother, and few Nigerians would care. But we now care more because the times are hard and mainly because, in recent years, governments have promised to use taxes and levies to improve infrastructure but have done nothing, if not worse.

According to the government, the Tax Reform Bill promises significant changes in tax relief to small businesses (with exemptions for those earning below N25 million), expansion of VAT exemptions on essential goods, and harmonisation of consumption taxes to simplify the tax system. The bill also aims to increase transparency and compliance, reduce the corporate tax rate from 30 to 25 percent, adjust the PAYE band, focus on technology, and centralise VAT collection.

Governors and the political class directly oppose the reform, especially in the North. In addition to the derivation-based VAT model and potential increased tax burden, this objection concerns regional disparity.

The governors are concerned that the reform may not energise people and enable investment. Manufacturers also have these concerns, including the potential inflationary impact of an incremental hike in the VAT rate from the current 7.5 percent to 15 percent in six years. They worry that it does not address the economic realities of the different regions, may worsen existing inequalities, and may not benefit local economies.

The heart of the matter

I have a slightly different concern. Centralising VAT and tax collection despite genuine concerns about a poor federal structure is ill-advised. How can a government pursuing an agenda for a state police emasculate the states?

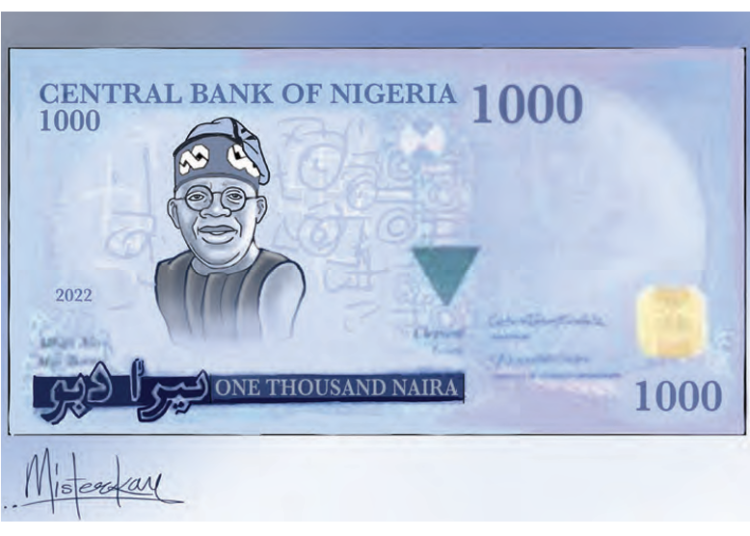

How can President Bola Ahmed Tinubu, whose government as Lagos governor achieved some of the most far-reaching fiscal restructuring by ligation, be the enabler of central tax collection, which Rivers State litigated against, and Lagos State even joined?

How can a government that went to the Supreme Court to promote fiscal independence for local governments, promote a centralised system that collects revenues that should go to the states? Except if the intention is to treat the states like Rome did ancient Palestine—a conquered territory, by the way—a reform that creates a Caesar in Abuja does not make sense.

VAT is commonly used in Europe and is the prevalent system in many parts of the world. However, it’s a far cry from what has been implemented in Nigeria. For example, a critical element of VAT in Europe and elsewhere is VAT refund. That is not on the cards in Nigeria and never was.

I wonder if it confers more advantages than the consumption or sales tax, for example, the predominant US system. If the goals are simplicity in the collection, lower compliance costs, instant revenue generation, transaction transparency, and lower risk of evasion, sales tax ticks all the boxes.

Still a federalist?

This centralised plan should be particularly troubling for Tinubu, an acclaimed exponent of true federalism. I understand the point about simplicity, transparency, and the benefits of technology. I also appreciate the nonsensical irony of states that ban certain items wanting to share VAT revenue from the same items.

The government has responded to many of these concerns and said the bill is a work in progress. It promises that a fairer, harmonised, and transparent system will block leakages and create a larger pool by making the wealthy and big businesses pay more. However, it remains to be seen how a central collection and distribution system, which often has significant administrative costs and complexities, will deliver these benefits.

Under the reform’s proposed centralised collection system, Abuja may become more affluent, giving Tinubu’s government more money to spend, hopefully on good causes. But nothing stops his successor from using the same larger pool of funds for bad causes, including those that would undermine his legacy.

In Ancient Rome, lack and scarcity didn’t ruin the empire. It was complacency and abundance.