Wema Bank has announced its unaudited results for Half Year ended 30th June 2023.

The financial institution achieved improved performance including Gross Earnings of ₦89.09bn, a y/y increase of 49% (H1 2022: ₦59.59bn). Interest Income up 53% y/y to ₦76.11bn (H1 2022: ₦49.75bn). Non-Interest Income up 32% y/y to ₦12.98bn (H1 2022: ₦9.85bn).

Profit before Tax (PBT) was ₦12.05bn a y/y increase of 97% over the ₦6.13bn reported in H1 2022. Profit after Tax (PAT) also increased y/y by 97% to ₦10.48bn (₦5.30bn in H1 2022).

The bank grew its deposit year to date by 19% as at H1 2023 to ₦1,392.85bn from ₦1,165.93bn reported in FY 2022. Loans and Advances also grew by 20% to ₦627.01bn in H1 2023 from ₦521.43bn in FY, 2022. Income statement (N’bn) H1 2023 H1 2022 (∆).

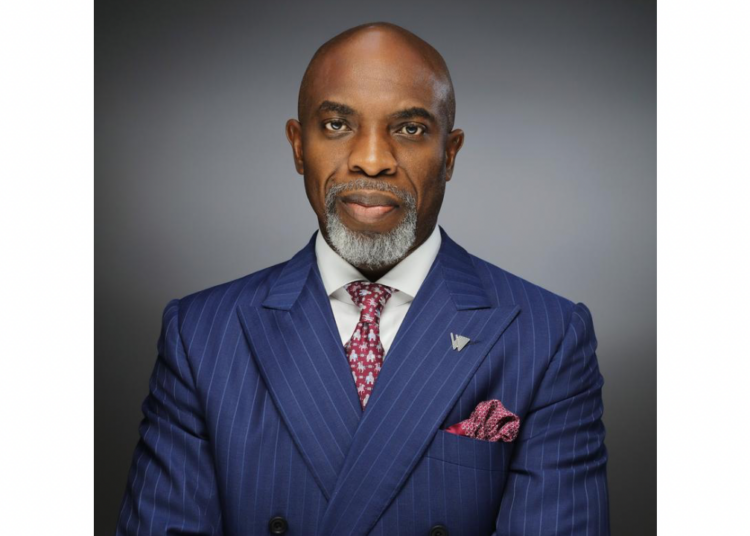

Commenting on the result, the Managing Director/Chief Executive Officer of the bank, Moruf Oseni said, “Our H1 2023 results saw significant upsides with profit before and after tax growing strongly by about 97 per cent. The management team at Wema Bank is focused on driving the execution of our current corporate strategy.

“Our embrace of technology is helping us deliver seamless best-in-class services while offering compelling value propositions to customers. Hence, we are seeing record-breaking returns across the board. Finally, we continue to see improvements in our corporate, commercial, and retail businesses as evidenced by our strong loan growth.”

Oseni said with the improved stability in the operating environment, the Banks earlier approved Rights Issuance will be commencing this 3rd quarter of 2023.

“It has been a good half-year performance for Wema Bank with gross earnings growing by 49 per cent year on year and earnings per share at 163.0 kobo.”

In addition, our cost-to-income ratio at 72.71 per cent has witnessed significant improvement from the previous period.

“We have also succeeded in making Wema Bank an integral part of the Fintech ecosystem in Nigeria with our ubiquitous fintech infrastructure support play.”