Nigeria stands at the cusp of a significant fiscal transformation, one that promises to reshape the lives of millions, particularly those at the bottom of the socio-economic ladder. The proposal by the Presidential Fiscal Policy and Tax Reforms Committee to reform the Value-Added Tax (VAT) system is not just a technical adjustment of tax rates—it is a social contract aimed at redressing imbalances, empowering the most vulnerable, and ensuring that the structure of the economy supports inclusion, fairness, and social justice. As both an economist and a gender and equity advocate, it is essential to dissect this proposal, examine its likely impact on poor Nigerians, and assess its broader implications for equity and gender justice.

At the heart of the proposed VAT reform is the reduction of VAT to zero percent on essential goods and services—namely, food, healthcare, education, and key services such as rent and transportation. At first glance, this is a welcome reprieve for Nigeria’s poor, who are disproportionately burdened by the VAT system in its current form. As data from the National Bureau of Statistics (NBS) reveals, poor households spend the majority of their income on these essentials. By eliminating VAT on these categories, the reform promises to ease financial pressure on those least able to bear it, allowing more households to meet their basic needs without the added tax burden.

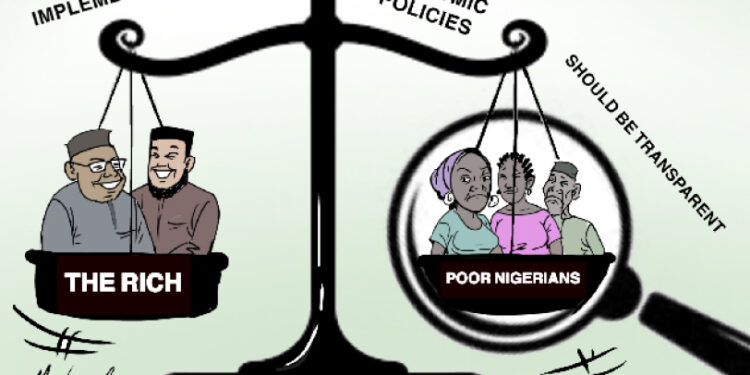

This shift acknowledges the regressive nature of VAT, which, by its design, imposes a heavier burden on the poor than on the rich. A tax uniformly applied to all consumption, regardless of income, necessarily takes a larger percentage of a poor person’s earnings than from the wealthy. The reform proposal seeks to counteract this, aligning with the principles of progressive taxation, where the tax burden increases with an individual’s ability to pay.

Immediate Impact on Poor Nigerians

For poor Nigerians, the immediate effects could be profound. With zero VAT on food, healthcare, and education, families can redirect scarce resources toward improving their quality of life. They may be able to purchase more nutritious food, access better healthcare, or afford educational materials for their children. In a country where millions live on less than $2 a day, these savings could reduce the cost of living for millions, potentially lifting many out of extreme poverty. The ripple effect could also stimulate local economies, as households with more disposable income are likely to spend on local goods and services, thus fostering community-level economic growth.

However, this VAT reduction on essentials comes with a caveat—an increase in the VAT rate on non-essential goods. This is designed to offset revenue loss from exempting essentials. While this may seem fiscally prudent, it raises important questions about the broader impact on poor Nigerians. The line between what is considered “essential” and “non-essential” is not always clear. Items that seem non-essential from a policy standpoint—like cleaning products or personal care items—could be seen as necessities by poor families striving to maintain a basic standard of living.

Thus, while the VAT reduction on essentials is likely to provide relief, the increased rate on other goods may impose a new burden on households, particularly women.

Gendered Impacts of the VAT Reform

From a gender perspective, the proposed reforms need careful scrutiny. Women, especially in low-income households, are typically the primary caretakers, managing household expenditures, food, healthcare, and education. They are often the ones who stretch limited resources to cover daily needs. The VAT exemption on essentials will undoubtedly ease some of their burdens, but higher VAT on other goods may still affect their purchasing power, potentially leading to difficult trade-offs in household spending.

Women make up a significant portion of Nigeria’s informal sector, including small businesses. The proposal to exempt over 97% of SMEs from charging VAT is a positive step for women entrepreneurs. By eliminating VAT for small businesses, the reform reduces administrative burdens and helps these businesses remain competitive, which is particularly important as the informal sector provides substantial employment for women.

However, to ensure that women entrepreneurs reap the full benefits of this exemption, the government must implement a clear and accessible process for determining which businesses qualify as small. Ensuring that this process is straightforward and free from bureaucratic hurdles will be essential in making sure that the reform supports women fairly and effectively.

Revenue Sharing and Regional Inequalities

Beyond the direct impact on consumers and businesses, the reform also addresses a longstanding issue in Nigeria’s tax system—the contentious sharing of VAT revenue among states. Currently, 85% of VAT revenue is allocated to state governments, with poorer states often receiving smaller shares than wealthier ones. This imbalance perpetuates regional inequalities and limits poorer states’ ability to invest in public services. The proposal’s aim to make VAT revenue-sharing more equitable could help address this disparity, ensuring that poorer states receive a fairer share of revenue and enabling them to invest more in education, healthcare, and infrastructure. Such improvements could significantly enhance the quality of life for their citizens, particularly those living in poverty.

From a social justice perspective, this reform could be a crucial step toward addressing the structural inequalities that have long plagued Nigeria. By easing the VAT burden on the poorest citizens and reforming revenue distribution to better support underserved regions, the proposal aligns with the principles of distributive justice. This realignment could foster greater regional cohesion and economic stability, creating a more balanced development trajectory across the country.

Moreover, a fairer distribution of VAT revenue could help build trust between citizens and their governments. When state governments have more resources, they can improve local services, address infrastructure needs, and invest in community development. This, in turn, may lead to more effective governance and a stronger social contract, where citizens see tangible benefits from their tax contributions, fostering a more inclusive and equitable society.

Potential Pitfalls and Implementation Challenges

The proposed VAT reforms come with notable risks and challenges that need careful management. A primary concern is ensuring that businesses pass the VAT savings onto consumers. In Nigeria, where informal markets are prevalent, there’s a risk that businesses may not fully reflect these savings in lower prices. Effective oversight and robust engagement with civil society are crucial to ensure that consumers see the intended benefits of the reform.

Additionally, the broader macroeconomic context poses challenges. The reform seeks to moderate inflation by reducing VAT on business costs, but inflation in Nigeria is influenced by various factors, including foreign exchange volatility and supply chain disruptions. Even with VAT reductions on essentials, inflationary pressures in other areas, such as energy, could erode the reform’s gains. This is particularly concerning for Nigeria’s poor, whose already limited incomes make them highly vulnerable to economic shocks.

Therefore, while the VAT reform represents a step towards a more equitable tax system, its success hinges on transparent and inclusive implementation. Policymakers must ensure that VAT savings are passed on to consumers, inflationary impacts are managed, and the most vulnerable populations are supported through broader economic policies. The reform could offer significant benefits, especially for Nigeria’s poor and women, but it must be integrated into a comprehensive approach to economic governance to achieve lasting social justice and equity.