Gross earnings of Wema Bank soared by 91.51 per cent, from N225.75 billion in 2023 to N432.34 billion in 2024 even as its Profit Before Tax surged by 135.16 per cent to N102.51 billion, up from N43.59 billion in 2023,

Its Profit After Tax, however, jumped 140.13 per cent to N86.29 billion, compared to N35.93 billion recorded the previous year while Total Assets rose by 60.04 per cent to N3.59 trillion, and Total Deposits expanded by 35.65 per cent to N2.52 trillion.

At the bank’s 2024 annual general meeting (AGM) held virtually in Lagos on Thursday, shareholders unanimously commended the board and management, expressing renewed confidence in the bank’s future trajectory. The meeting marked another milestone for Wema Bank, and pioneer of Africa’s first fully digital bank, ALAT, as it disclosed unprecedented growth across key performance indicators.

The Bank also reported a 49.94 per cent increase in Loans to Customers, closing the year at N1.2 trillion, while earnings per share stood at 483.2 kobo. Wema’s Non-Performing Loan (NPL) ratio declined to 3.86 per cent, signalling improved credit quality and risk management.

Shareholders, including Matthew Akinlade, described the financial performance as very outstanding, while Dr. Olatunde Okelana hailed it as historical. Bisi Bakare, national coordinator of the Pragmatic Shareholders Association of Nigeria, applauded the bank’s gender inclusion—highlighting the 38 per cent female representation on the Board—and praised its robust succession planning and full board attendance rate.

Wema Bank’s chairman, Dr. Oluwayemisi Olorunshola, thanked stakeholders for their enduring support, stating that the bank’s consistent upward trajectory is a testament to strategic leadership and stakeholder collaboration. She reaffirmed the commitment of the Board and Management to sustaining long-term value creation.

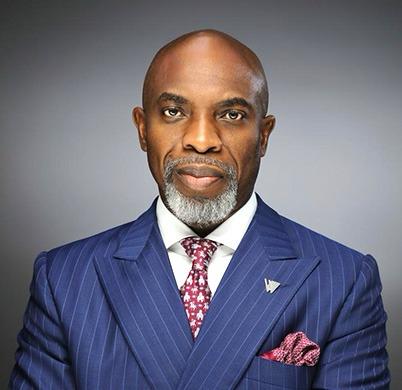

In his address, managing director/CEO, Moruf Oseni outlined Wema Bank’s strategic roadmap for sustaining growth, citing continued investment in cutting-edge technology, operational efficiency, innovation, and customer-centric services. He disclosed that the N150 billion Rights Issue closed on May 21, 2025, while plans are underway to raise an additional N50 billion through private placement in June.

“With qualifying capital expected to exceed N267 billion, we are positioning Wema Bank for greater resilience, scale, and relevance in the evolving financial services industry,” Oseni said. At 80, Wema Bank is stronger than ever, and the momentum we’ve built is only the beginning of what’s to come, he stressed.