The African Refiners and Distributors Association (ARDA) and top international financial experts are considering options that will unlock sustainable funding for the downstream petroleum industry on the continent as tightening global financial conditions pose challenges for oil and gas projects.

The Association along with the global stakeholders, who gathered at its third annual virtual workshop on Sustainable Financing recently are aggressively pushing for billions of dollars of investment to fund existing, critical multi-billion-dollar refinery, storage & distribution and liquefied petroleum gas (LPG) projects across Africa.

ARDA stated that given that the downstream segment of the oil & gas value chain contributes 33% of oil and gas emissions, urgent attempts to effectively decarbonise African Downstream sector operations via carbon abatement projects, while also incorporating Environment, Social and Governance (ESG) factors will serve to attract much-needed sustainable financing to develop the sector.

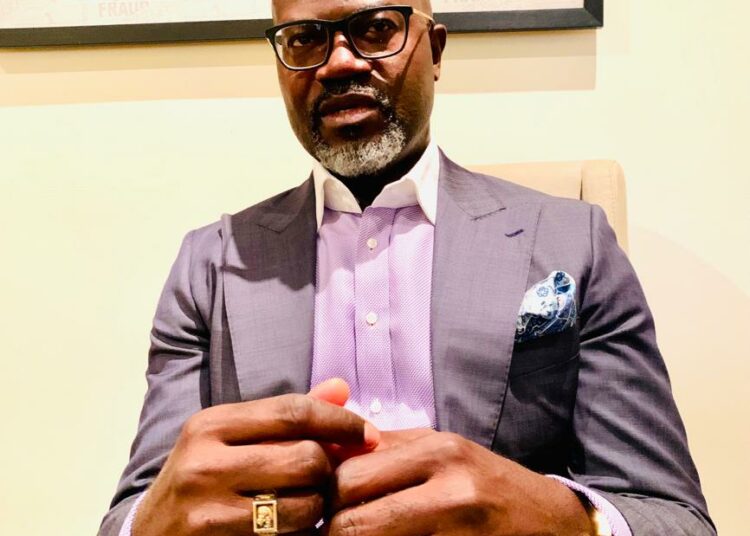

The Executive Secretary of ARDA, Anibor Kragha, speaking during the yearly workshop insisted that carbon mitigation strategies remain key for securing financing to execute long-term strategies to boost refining, value-added petrochemicals, efficient storage & distribution and LPG for Clean Cooking strategies across Africa.

Admitting that refineries play a central role in global emissions as emitters of CO2 and suppliers of fossil fuels, Kragha also stated that regulations would increasingly affect profitability of refining companies in selected regions, and that top performers in refining sector can mitigate downside risks through internal-abatement efforts and new value creation opportunities.

Disclosing that ARDA and the SIR Refinery in Cote d’Ivoire, alongside Advisian and Vitol, had already kicked-off the first-ever Refinery Carbon Abatement Project in Africa, Kragha, a former NNPC COO Refining & Petrochemicals and ExxonMobil Nigeria Treasurer said the future of refining and the downstream sector is based on lower environmental footprint and higher capital efficiency.

He said: “An inclusive, equitable energy transition roadmap must be deployed that captures priorities, challenges and perspectives of Africa’s low-emitting countries…the roadmap must not prioritize near-term emissions reductions (with relatively little climate benefits) over support for economic development and energy transformation.”

Kragha also disclosed that, to ensure that Africa’s Downstream Energy Transition Plan is matched with a Finance Plan, ARDA is working with key stakeholders on two Funds. The first Fund will cover refinery upgrades for cleaner, low-sulphur fuels and carbon emissions reductions, strategic storage & distribution investments and petrochemical projects for value addition and carbon footprint reduction.

The second Fund, being developed in conjunction with the UN-backed Global LPG Partnership, will be a dedicated Africa LPG Sector Development Fund to deploy financing for rapid scale up of clean cooking with LPG across the continent via national LPG sector ecosystems.

Senior Investment Professional in charge of Transportation and Logistics at Africa Finance Corporation, Bowale Odumade, shared a Case Study of the Uganda Fuel Transportation and Storage Projects that focused on addressing unsatisfactory road transportation of fuel from Kenya to Uganda and attendant issues including high costs, congestion of roads and high CO2 emissions. This transformational low-emissions fuels storage & distribution project will deploy world class infrastructure assets – barges, tank farm, jetty, etc. – to deliver a 50% reduction in transportation cost and time and reduce green-house gas (GHG) emissions by an estimated 90% and is in line with AFC’s mission to sustainably address Africa’s infrastructure challenges.

Ms. Odumade also noted that are key considerations for accessing financing for African Downstream projects include addressing regulatory and market, supply, financial and structuring, currency risk, sponsor strength, phased development as well as developmental impact and sustainability issues.

Speaking on “Accessing Sustainable Financing for African Downstream Projects”, Latham & Watkins Project Development & Finance Practice, jointly represented by John-Patrick Sweny (Partner) and Chidi Onyeche (Associate) noted that while project financing for the oil & gas sector is in a state of transition due to ESG impacts, financing sources remain committed to a low carbon future but concessional finance should be scaled up to strengthen Africa resilience to climate change and help speed the green energy transition. For example, while Africa needs $190 billion per year until 2050 for carbon mitigation and thereafter, another $50 billion per year by 2050 for adaptation, sub-Saharan Africa received just $15.7 billion in concessional climate finance in 2020.

According to the experts, divestments of oil and gas assets by international energy companies may accelerate shift to alternate sources of capital, primarily traders and other speculative private capital.

“Private sector participation will need to grow, particularly in the power sector, but will require viable and successful projects and innovative financing programs,” Sweny and Onyeche said. Noting that issuance of ESG bonds by African entities increased substantially from $3 billion in 2018 to $5.1 billion in 2021, they said a pipeline of credible, climate-related, “bankable” projects is key to unlocking private investment.

In a presentation titled “Generating Carbon Credits from Downstream Projects – Way Forward”, Executive Director & Chief Investment Officer, Nigeria Sovereign Investment Authority (NSIA), Kolawole Owodunni, said that NSIA is actively participating in the developing carbon credit markets in collaboration with the Nigerian National Council on Climate Change (NCCC) to develop a carbon tax framework for Nigeria and the African Carbon Markets Initiative (ACMI) which was launched at the COP 27 summit in Egypt last year to develop African voluntary carbon markets and drive increase in production of African carbon credits. A key initiative is NSIA and Vitol’s collaboration to create the innovative Carbon Vista Fund (with an initial commitment of $50M) to invest in a diversified portfolio of assets in Nigeria with the potential to generate carbon credits that can be exported internationally.

He said Carbon Vista will invest in a range of high integrity, socially impactful, carbon avoidance and removals projects, adding that the platform has been set up to attract capital from institutional investors that desire access to the voluntary carbon market. The Carbon Vista Fund will deploy funds across clean cooking & water purification, agriculture, forestry, manufacturing and renewables over the next few years. NSIA is also anchoring establishment of a renewable energy fund that will develop, co-invest and operate projects along the renewable energy vertical in Nigeria.

Oil and Refining Analyst at Vitol, Maryro Mendez said Africa has a huge potential to use Voluntary Carbon Markets to access climate funding, stressing however that while growing, African Carbon market activity is still well short of its potential of 2400 MtCo2e per year by 2030.

Mendez also shared the hands-on approach that ARDA, SIR Refinery and Vitol are taking towards implementation of carbon abatement projects in the refinery in Abidjan. Specifically, the ARDA-SIR-Advisian-Vitol team has identified projects to generate CO2 savings at the refinery and determined their business case related to energy savings and/or carbon credits. The project is now at the investment decision stage and financing considerations, project implementation & monitoring are being evaluated. Finally, she stated that decarbonisation requires collaboration and investment, and a number of options exist for the downstream industry to achieve a lower carbon footprint.