The 2025 Informal Economy Report has highlighted the continued fragile financial state of Nigeria’s small businesses sector, even though it remains the heartbeat of the nation’s economy.

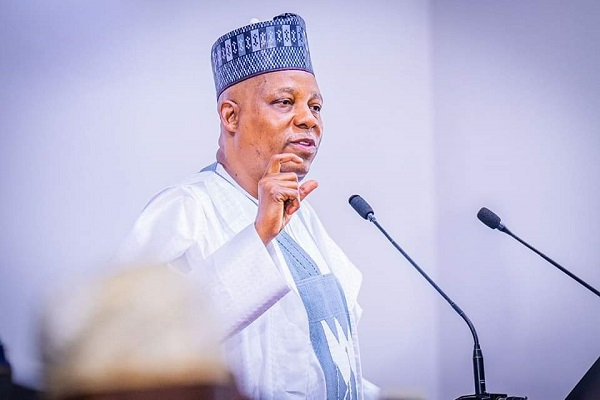

Vice President Kashim Shettima reaffirmed that Nigeria’s informal sector is the backbone of national productivity and a key driver of resilience amid global economic shocks.

Speaking during the unveiling of the 2025 Informal Economy Report in Abuja, Vice President Shettima, represented by the Minister of Industry, Trade and Investment, Dr Jumoke Oduwole, said the Tinubu administration places a high priority on the informal sector, describing it.

Shettima commended Moniepoint Microfinance Bank’s decade-long commitment to empowering small businesses across Nigeria and Africa. He lauded the fintech’s contributions to deepening financial inclusion, supporting micro, small and medium enterprises (MSMEs), and promoting entrepreneurship among youth and women.

The 2025 Informal Economy Report, jointly produced by Moniepoint, the Ministry of Industry, Trade and Investment, and the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), paints a sobering picture of the financial vulnerabilities confronting millions of small business operators.

According to the findings, 42 per cent of informal sector operators do not have enough savings to survive beyond one month without income, underscoring the fragile financial condition of small businesses nationwide. While 65 per cent of businesses recorded revenue growth in the past year, only 47 per cent reported higher profits due to rising operational costs. The report further revealed that about 38 per cent of operators earn less than N10,000 daily, even as four in ten of such businesses act as employers of labour.

It also found that women constitute a larger share of informal business owners, while youth participation continues to rise despite limited access to funding and formal banking services.

Vice President Shettima said the Tinubu administration is committed to galvanising the informal economy for greater productivity and sustainable growth.“The informal economy lies at the heart of Nigeria’s story of resilience, creativity and enterprise—from market traders to artisans, small service providers, and young digital entrepreneurs,” he said. “Small and medium enterprises are the heartbeat of Nigeria’s transformation, which is to keep driving innovation, job creation, and trade.”

He added that Nigeria’s 39 million MSMEs account for about 96 per cent of all businesses, contribute around 50 per cent to the GDP, and employ over 84 per cent of the nation’s workforce—figures that reflect the scale and importance of the sector.

Shettima also praised Moniepoint’s innovative financial solutions designed for informal operators and reiterated the government’s readiness to create an enabling environment for trade and digital innovation to thrive.

“The administration of President Bola Ahmed Tinubu is committed to creating favourable conditions for trade to thrive across Africa, and we are positioning Nigeria at the forefront of Africa’s digital transformation,” he added.

The managing director of Moniepoint Microfinance Bank, Babatunde Olofin, said the Informal Economy Report is more than a study — it is “a mirror of Nigeria’s economic reality, especially for millions who make their living outside the formal system.”

Olofin said Moniepoint’s mission is to ensure the inclusivity and sustainable growth of small businesses regardless of their background.

“Recognising that many in this sector operate without formal banking relationships, we provide accessible tools that simplify payments, collections, and help them manage their businesses,” he explained. “Beyond technology, we’ve invested in building a support system that speaks their language and meets them where they are.”

The fintech firm, he noted, has built flexible and user-friendly solutions to ensure that informal entrepreneurs are not left behind in Nigeria’s evolving digital economy.

In a goodwill message, the Special Adviser to the President on Job Creation and MSMEs, Temitola Adekunle-Johnson, hailed Moniepoint’s impact in transforming millions of small businesses through its low-cost financial services and inclusive products.

He noted that the fintech’s decade-long commitment had boosted job creation, increased access to finance, and strengthened economic participation among women and youth.

Director-General of SMEDAN, Charles Odii, disclosed that the number of micro, small and medium enterprises in Nigeria has grown to 39,654,385. He attributed much of this expansion to the resilience of small entrepreneurs and government-led formalisation efforts.

Odii explained that tax exemptions and free registration drives encouraged more small businesses to transition from informal to formal operations.

“Many small business owners had remained informal because of taxes. Previously, businesses earning N25 million and above were taxed. We have now moved that threshold to N15 million, meaning those earning below that are exempted from company income tax,” he said.

He also announced that SMEDAN, in collaboration with the Corporate Affairs Commission (CAC), has begun the free registration of 250,000 small businesses nationwide to support formalisation and access to funding.

Participants at the event—including representatives from the Ministry of Youth Development, SMEDAN, and other government agencies—agreed that the informal economy remains a crucial pillar of Nigeria’s resilience, innovation, and employment creation.

The 2025 Informal Economy Report highlights both the vulnerabilities and vast potential of Nigeria’s 39 million MSMEs. It calls for more decisive policy intervention, deeper access to finance, and sustained collaboration between government and private players to unlock the sector’s full contribution to national development.

As Vice President Shettima emphasised, the informal sector is not just a fallback for survival—it is the “heartbeat of Nigeria’s transformation” and a vital force for inclusive economic growth.