The recent court ruling reaffirming Halkin Exploration & Production as the rightful operator of Oil Mining Lease (OML) 46 is more than a legal decision; it is a defining moment for Nigeria’s oil and gas industry. It signals a maturing legal and regulatory framework—one that assures investors of due process and fair play.

For years, Nigeria’s oil sector has been weighed down by regulatory inconsistencies and contractual disputes, making investors wary. But times are changing. The Nigerian Upstream Petroleum Regulatory Commission (NUPRC), led by Engr. Gbenga Komolafe, is at the forefront of this transformation. By enforcing compliance, revoking dormant leases, and ensuring only serious investors remain in the game, the commission is reshaping how Nigeria’s vast hydrocarbon resources are managed.

Judicial Independence: A Win for Investors

The importance of an independent judiciary in attracting foreign direct investment cannot be overstated. The Halkin ruling is a strong testament to Nigeria’s commitment to upholding the sanctity of contracts. Investors—both local and international—need certainty, and this decision reassures them that the rule of law remains a pillar of the country’s business environment.

The Nigerian legal system has sometimes been accused of being slow and susceptible to political influence. However, cases like this show that the courts can be fair arbiters in business disputes, free from undue external pressures. It is a significant step in restoring confidence in Nigeria’s ability to protect investor rights and enforce business agreements with integrity. Furthermore, by ensuring contract sanctity, Nigeria is signalling to global players that its legal environment is one that can be relied upon to uphold agreements and create a fair, level playing field.

Beyond the legal affirmation, the Halkin case also highlights the effectiveness of regulatory oversight. In an industry where disputes over asset ownership can paralyse economic activities, a strong judicial and regulatory framework is indispensable. The decision to uphold Halkin’s rightful claim sets a precedent for future disputes, discouraging frivolous litigation and reinforcing contractual obligations.

Regulatory Reforms Driving Confidence

NUPRC’s role in shaping an efficient regulatory landscape cannot be ignored. One of the commission’s most impactful initiatives is the Seven Pillars of Divestment framework. This policy introduces a structured, transparent approach to asset transfers, ensuring Environmental, Social, and Governance (ESG) compliance. Global investors are increasingly looking beyond profits; they seek jurisdictions where sustainability and accountability are prioritized.

This reform ensures that only credible and financially capable investors take control of oil assets, preventing stagnation. The successful 2024 Marginal Field Bid Round, which secured over $500 million in investment commitments, is clear evidence of these policies bearing fruit. For years, marginal fields suffered from bureaucratic bottlenecks and opacity. Now, the process is widely recognized as transparent and efficient, allowing indigenous operators to thrive.

This structured approach brings much-needed stability to a sector that has long suffered from uncertainties in divestment processes. By ensuring that asset sales and acquisitions are handled with clear guidelines, NUPRC has set a new benchmark for transparency. This kind of reform signals to investors that Nigeria is no longer a market of uncertainty but one that follows clear-cut principles aimed at ensuring efficiency and sustainability.

Presidential Non-Interference Strengthens Credibility

The role of President Bola Ahmed Tinubu’s administration in strengthening regulatory autonomy deserves recognition. In the past, political interference in energy sector decisions led to policy flip-flops, discouraging long-term investments. But a shift is occurring. By allowing institutions like NUPRC to function independently, the Tinubu administration is reinforcing Nigeria’s credibility as an investment-friendly nation.

Regulatory certainty is just as critical as the presence of oil reserves. Investors need to know that policies won’t be reversed overnight and that disputes will be handled transparently. President Tinubu’s approach—prioritizing stability over short-term political gains—sends a clear message to the international business community: Nigeria is serious about attracting sustainable investment in its oil sector.

This approach marks a clear departure from the past, where executive interference often led to erratic decision-making. The Tinubu administration’s policy of allowing regulatory bodies to operate independently fosters investor confidence and creates a business climate built on predictability.

ESG and Community Engagement: The New Investment Standard

Beyond regulatory efficiency, NUPRC has also placed a strong emphasis on community engagement. The era of extractive industries neglecting host communities is coming to an end. Oil-producing regions are no longer mere spectators; they are now active stakeholders.

One of the key ways NUPRC has achieved this is by integrating ESG compliance into licensing processes. Investors are now required to demonstrate clear plans for environmental sustainability and social responsibility before securing approvals. This ensures that communities benefit directly from oil exploration and production, reducing tensions and enhancing operational stability.

The global investment climate is shifting, and Nigeria is adapting. The days when capital flowed freely into projects without scrutiny of their environmental and social impact are long gone. Investors now demand responsible governance, and by embedding ESG principles into its regulatory framework, Nigeria is aligning itself with global best practices.

This shift towards ESG compliance also represents a critical economic strategy. International energy companies and investors now prioritize ESG metrics when considering where to allocate resources. Nigeria’s willingness to incorporate these measures into its licensing framework is a proactive step towards securing future investments from global financial institutions that adhere to strict ESG policies.

Furthermore, community engagement in the oil and gas sector is no longer optional. As seen in other parts of the world, a lack of engagement often leads to operational disruptions. By integrating local communities into oil projects, ensuring corporate social responsibility commitments, and enforcing fair employment policies, Nigeria is mitigating risks that have historically hindered its oil sector.

A Future Built on Stability and Accountability

Nigeria’s oil industry is at a crossroads. While hydrocarbons remain a critical economic pillar, the global energy landscape is evolving. To remain competitive, Nigeria must continue refining its policies, ensuring transparency, and embracing innovative approaches to energy management.

The Halkin ruling and NUPRC’s regulatory overhaul mark a turning point. A legal system that upholds investor rights, a regulatory framework that prioritizes efficiency, and a government that respects institutional independence create the perfect conditions for growth. If these trends persist, Nigeria will not only retain its position as a key player in Africa’s energy sector but will also attract new waves of investment that drive long-term prosperity.

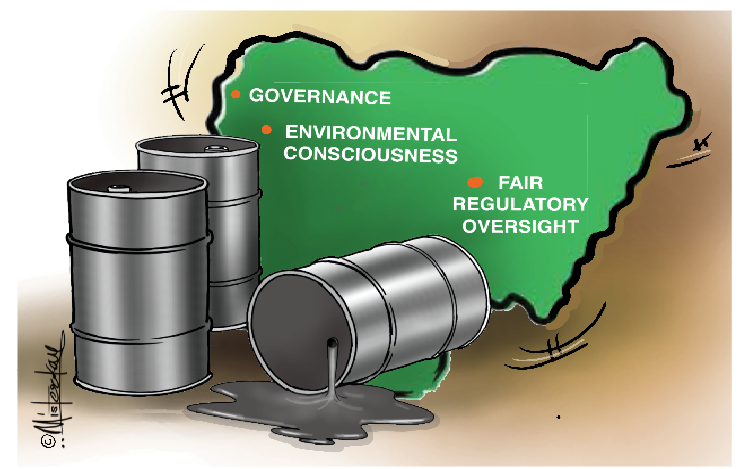

The oil industry is no longer just about extraction; it is about governance, environmental consciousness, and fair regulatory oversight. Investors today require certainty that their ventures will be secure, that regulations will be applied consistently, and that host communities will be integrated into the value chain. This is the message that Nigeria must continue to send.

Finally, in an era where global energy markets are undergoing profound transformations, Nigeria has a unique opportunity to position itself as a leader in responsible and sustainable oil production. The Tinubu administration’s policies, coupled with NUPRC’s firm regulatory hand, provide the foundation needed to ensure the country’s oil sector remains robust, resilient, and a magnet for investment. The foundation has been set—what remains is for Nigeria to keep moving forward without losing sight of the principles that have begun to restore confidence in its oil industry.