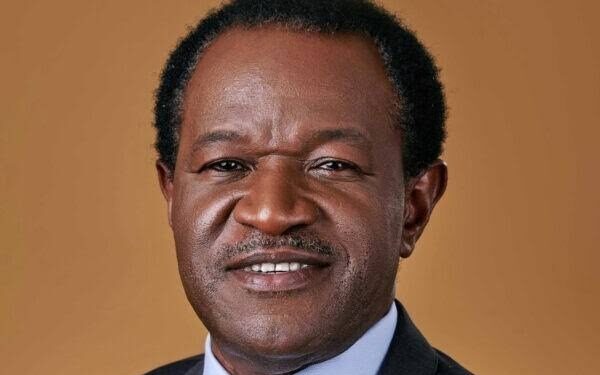

The managing director of the Nigerian Education Loan Fund (NELFUND), Mr. Akintunde Sawyerr, has restated the Fund’s commitment to providing inclusive access to loans for all students who gained admission through the Joint Admissions and Matriculation Board (JAMB).

Sawyerr gave the assurance in Abuja yesterday at the Stakeholders Engagement Session/Technical Workshop on the Fund’s System Automation and Loan Application Processes.

His clarification follows concerns from technical institutions’ stakeholders, particularly those in two-phase diploma programmes, over their inability to access the loan within the timelines of their students’ academic programmes.

While acknowledging initial challenges, he emphasised the Fund’s commitment to close the gaps and ensure that technical students access the loan as and when due.

“For too long, many technical students have faced steep financial barriers. Some drop out. Others never apply. This is the gap we’re here to close.

“When you launch a project of this magnitude, you do all the preparation you can, then launch it into the marketplace to see the level of engagement and issues, and then refine it.

“This isn’t just about teething problems. It’s about ensuring that the system evolves with feedback, technology, and user needs,” Sawyerr said.

The workshop, which brought together representatives from polytechnics, monotechnics, and technical institutes, focused on automating NELFUND’s loan application and processing systems.

The NELFUND boss hailed technical institutions as “the engine rooms of innovation and expertise,” calling the workshop pivotal in bridging educational financing gaps.

He stressed that the mission of NELFUND goes beyond disbursement; it is about enabling equitable opportunity.

“We want access without stress, transparency and trust, and purposeful partnerships,” he told participants.

He also commended the National Board for Technical Education, NBTE, for its role in regulating the sector and called for continued collaboration in integrating institutional systems with NELFUND’s processes.

“At the heart of all this is a student, a young Nigerian with dreams, ambitious, and the courage to pursue them. Everything we do must serve that student,” he said.

“It’s a loan, not a giveaway. Students must make informed decisions about when and why to take it. It’s not just about getting a loan, it’s about investing in a path that propels your future.”

On the latest data, on a student’s application for a loan, he said NELFUND has recorded approximately 570,000 registrations, with over 515,000 applicants completing the process.

He added that daily applications now average around 1,800, stating that the application speed won’t compromise standards.

“We aim to process loans as fast as they are safe for the Fund. We are managing government and stakeholder funds and must conduct thorough due diligence,” he said.