Nigerians suffering from ailments caused by their consumption of sugar-sweetened beverages (SSBs) are spending billions of naira annually on the treatment of diseases classified under non-communicable diseases (NCDs).

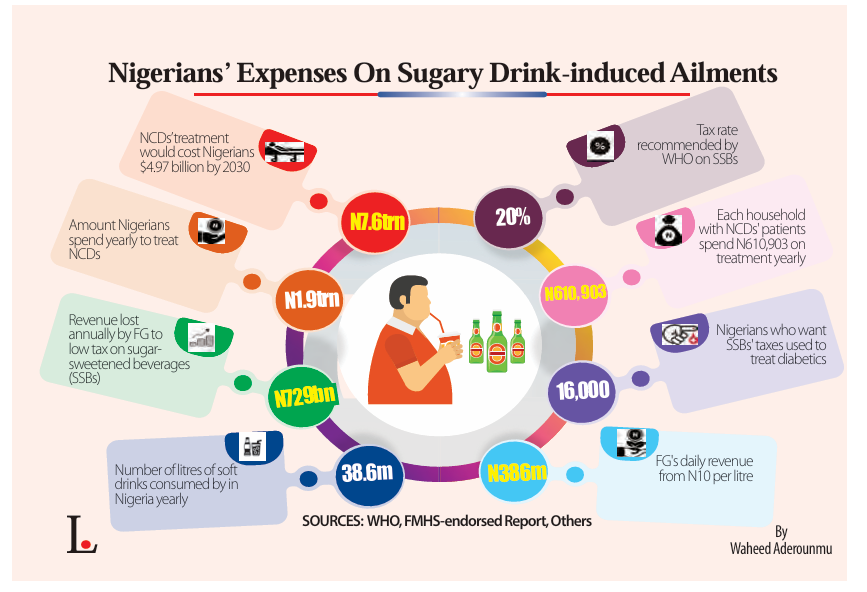

Data accessed by LEADERSHIP Sunday from federal government agencies, global bodies, and local non-governmental organizations showed that Nigerians affected by such NCDs spend N1.92 trillion ($1.26 billion) every year seeking healthcare.

The statistics estimate that Nigerians consume 38.6 million litres of soft drinks daily, making the country the fourth-highest soft drinks-consuming nation in the world.

The statistics also indicate that each household with NCDs patients spends N608,940 ($398.52) on treatment yearly.

For its part, the federal government loses N729 billion annually due to the N10 per litre tax on non-alcoholic drinks.

Based on these figures, the federal government collects N386 million each day by imposing a tax of N10 per litre on 38.6 million litres sold in the country daily.

Experts who describe the tax rate as too low have called on the government to increase the tax from N10 to N130 to curb the consumption of such products.

However, manufacturers, who are already contesting the N10 levy in court, have declared that both the current and proposed amounts could put them out of business.

Meanwhile, the federal government has hinted at its resolve to appeal the Federal High Court ruling in Abuja, which suspended the collection of the N10 sugar tax by the Nigeria Customs Service (NCS).

The Healthy Food Policy Youth Vanguard (HFPYV) has raised concerns about the escalating crisis of unhealthy diets in Nigeria, warning that it is undermining national productivity. The organization said NCDs, driven in part by poor dietary habits, are causing widespread hospitalizations and chronic disabilities, leading to substantial losses in manpower and economic output.

Beyond the health implications, NCDs impose severe financial strain on households, primarily due to out-of-pocket (OOP) healthcare expenses and productivity losses associated with hospital stays.

According to the latest National Health Accounts data, Nigerian households with NCD patients spend an average of $398.52 per year on care. Collectively, Nigerians expend an estimated $1.26 billion (N192 billion) annually to treat NCDs, pushing many families deeper into financial distress.

As part of efforts to mitigate the public health crisis linked to excessive sugar consumption, the Finance Act of 2021 introduced a levy of N10 per litre on carbonated and non-alcoholic drinks. Under the policy, a 50cl soft drink generates N5 in tax revenue for the government, with the funds intended to strengthen the healthcare system and address health conditions associated with sugar-sweetened beverage consumption.

However, a 2024 study endorsed by the Federal Ministry of Health and Social Welfare found that the current tax is grossly inadequate to curb excessive consumption. When the levy was first introduced, a bottle of soft drink cost around N150; today, prices range between N350 and N450, thereby reducing the tax’s deterrent effect. The study recommends increasing the SSB tax to N130 per litre, or at least 20 per cent of the product’s retail price, to make a meaningful impact on public health.

Beyond discouraging excessive sugar consumption, HFPYV said the report projects that a N130 per litre tax could generate approximately N729 billion in additional revenue for the federal government. If properly earmarked, these funds could strengthen Nigeria’s struggling healthcare system, particularly in areas related to diet-related diseases, which currently suffer from inadequate funding.

The overconsumption of sugary drinks is linked to rising cases of diabetes. Nearly 30 percent of all deaths in Nigeria are due to NCDs, according to the World Health Organization Country Report of 2023.

The SSB tax, introduced under the Finance Act 2021, officially came into effect in July 2022. It applies to all SSBs produced, imported, distributed, and sold in Nigeria.

According to an authoritative source in the Service, the revenue collected from the tax has steadily increased, reflecting improved compliance and enforcement measures. The source added that the service had been collecting the tax since 2022 across all its industrial commands in the country.

One purpose of the SSB tax is to generate revenue that is earmarked for the Federal Ministry of Health and Social Welfare to strengthen the health sector and enhance public health.

However, there is no indication of how the money was expended.

Stakeholders have expressed fear that the money may have been earmarked for non-health expenditures, leaving victims of SSB-induced illnesses to bear their significant treatment costs alone in a weakened health sector, contrary to the original intention of the taxes.

Last September, over 16,000 Nigerians from Lagos, Abuja, Kano, Kaduna, and Enugu signed a petition urging the federal government to allocate the revenue from SSB taxes to subsidize diabetes treatment for vulnerable citizens. The petition was part of a broader campaign spearheaded by the National Action on Sugar Reduction Coalition (NASR) to utilize pro-health fiscal policies, like the SSB tax, to combat the increasing prevalence of NCDs in Nigeria.

Experts Call for Higher Tax Rate To Curb Consumption

Whatever the amount collected by NCS, stakeholders believe the current SSB tax rate is too low to drive serious behavioural change among consumers. They referenced the WHO recommendation that countries should raise retail prices of SSBs by at least 20 per cent to reduce consumption and improve public health as part of a comprehensive approach to preventing obesity and diet-related NCDs.

In Nigeria, the current rate of N10 per litre translates to less than five percent of the cost of most beverages. Experts argue that this failure to appropriately tax SSBs is not only affecting lives but also costing the country an additional N729 billion yearly in revenue, which would accrue to its coffers and the health sector if the tax is increased from N10 to at least N130, or 20 percent of the retail price.

An economist, Austine Iraoya, told LEADERSHIP Weekend that NCDs’ treatment would cost Nigerians $4.97 billion by 2030, up from $2.37 billion in 2019.

Iraoya, formerly a researcher at the Centre for the Study of the Economies of Africa (CSEA), explained the economic rationale for the SSB tax on “market failure” and consumers’ lack of full awareness of the harmful effects of SSBs, adding that demand for sugary drinks could be lower if consumers had better information.

“Market failure in the sense that science has shown that SSBs have a negative impact on our health, as they can lead to obesity and diabetes, among other NCDs. It is not easy to treat these health conditions. For instance, the total economic costs of treating obesity in Nigeria amounted to $2.37 billion in 2019, and it is projected to reach $4.97 billion in 2030. Why should we continue to consume something that has negative impacts on our health? That is the reason the government introduced the SSB Tax, to curtail its consumption,” Iraoya explained.

On the SSB tax impact on consumption, he said in the United States, the consumption of taxed SSBs decreased significantly by 42 per cent, and Saudi Arabia recorded a 58 per cent reduction in consumption of taxed SSBs.

On the evidence of the impact on health outcomes, Iraoya disclosed that in the Philippines, it averted 5,913 deaths related to diabetes, 10,339 deaths from ischemic heart disease, and 7,950 deaths from stroke over 20 years. In South Africa, it reduced obesity prevalence by more than three per cent in men and more than two per cent in women.

Commenting on the evidence of the impact on revenue, the economist stated that Indonesia raised $920 million in revenue in the first year and $27.3 billion over 25 years; the Philippines raises $813 million in revenue per year, and South Africa raises $450 million in SSB tax revenue annually.

Unlike the Philippines, South Africa, and other countries, Iraoya lamented that the marginal price increases (N10 per litre) may not be sufficient to alter the excessive consumption patterns of SSBs in Nigeria, adding that the WHO recommends at least a 20 per cent price increase for a significant reduction in consumption.

He urged the federal government to benchmark the levy on the quantity of sugar in each litre of drink.

A study on how the consumption of SSBs could lead to NCDs, titled “Drink soda, gain weight: Sugary beverages very clearly tied to obesity,” reviewed 85 studies from the past decade that looked at sugary beverages and weight gain among adults and children.

The study, which tracks people’s health outcomes for long periods, showed that each serving-per-day increase in sugary drinks was associated with an almost one-pound increase in body weight among adults.

The glucose spike from sugar increases blood glucose levels, triggering a glycemic response that, over time, could cause insulin resistance and diabetes, the study revealed, adding that fructose in added sugar impacts the liver and increases a person’s risk of fatty liver and metabolic disease. “Fructose also elevates uric acid levels, which is another driver toward insulin resistance and other diseases. Spikes in insulin can, in turn, affect your appetite and encourage overeating, which leads to excess insulin in the blood.”

“On the other hand, being overweight or obese increases a person’s risk for several health problems, including diabetes, heart disease, and cancers. One of the reasons for these negative health outcomes is the makeup of added sugar,” the study stated.

Corroborating the study’s findings, a public health specialist at the University College Hospital, Ibadan, Dr. Francis Fagbule, told LEADERSHIP Sunday that sugar-sweetened beverages contribute significantly to health issues such as obesity and diabetes.

“These drinks offer no nutritional value, yet they are widely consumed, leading to an increase in lifestyle-related diseases,” he said.

Fagbule added that taxation remains one of the most effective tools for reducing the consumption of unhealthy products, as seen in countries like South Africa and the Philippines, where similar taxes have led to a decline in sugar intake.

“Because of the high calories consumed in SSBs, it leads to excessive weight gain. SSBs’ liquid sugar is easily absorbed into the body, and those sugars alter the body’s metabolism, affecting insulin, cholesterol, and metabolites that cause high blood pressure and inflammation. These are linked to the increasing rates of obesity and diabetes in the country,” Fagbule stated.

He disclosed that several studies have shown a tremendous increase in NCDs. “For example, a national study has shown that less than one million Nigerians were diagnosed with type 2 diabetes in 1990, but in 2022, we are talking about six million adult Nigerians living with the condition.”

“We can prevent NCDs like diabetes by reducing the intake of junk foods and artificial sugar consumption. It is important that steps are taken to address these public health challenges, and one of the ways to prevent this burden is through the taxation of SSBs,” he stated.

He applauded the federal government for enforcing the 30 per cent and valorem plus N84 per pack of tobacco, the N40/litre tax on beer, and the N50/litre tax on spirits while advocating an increase to N130/litre on SSB products.

“Though this demonstrates a holistic approach to addressing the common risk factors of NCDs, there is a need to increase the tax on SSB from N10/litre to N130/litre and then subsequently increase it to meet the WHO’s recommendation of a 20 per cent tax on SSBs. This will lead to better economic gain for individuals and the country, and the fund should be devoted to strengthening the health system,” he averred.

Manufacturers Kick, Fear Closure of Businesses

But beverage manufacturers have raised concerns about the tax’s impact on their businesses, arguing that it increases production costs and could lead to job losses. They have also passed the extra cost onto consumers, making sugar-sweetened beverages more expensive for lower-income groups.

The manufacturers have taken the fight to court to stop the SSB tax.

On February 3, 2025, the Federal High Court in Abuja suspended the collection of the SSB tax “pending when the provisions of section 13 of the Customs, Excise Tariff, ETC. (Consolidation) Act (CETA), Cap C49 LFN are complied with.”

The Nigeria Employers’ Consultative Association (NECA) filed the suit in 2022 to challenge the tax, arguing that it was unjustified and an undue financial burden on companies. The court, however, ruled that the government’s circular authorizing the tax was invalid because it exceeded the legal powers of the Ministry of Finance.

Responding to LEADERSHIP Sunday’s inquiry, the SSB companies argued that the industry was already overburdened by taxes, contributing 40-50 per cent of its gross profit as tax to the government.

The companies argued that the continued pressure of macroeconomic challenges poses a significant threat to industry operations. Hence, they requested a moratorium until 2026 before implementing the tax.

“The industry already contributes 40 percent-45 per cent of its gross profit as tax to the government. The industry currently pays multiple taxes, including the SSB Tax of N10 per litre introduced in 2022. Increasing taxes despite the country’s macroeconomic challenges is detrimental and could result in a sharp decline in its contribution to GDP, loss of jobs, and total tax payable to the government.”

“Also, the continued pressure of macroeconomic headwinds poses a significant threat to industry operations. Without a stabilisation period to facilitate recovery, these challenges are likely to translate into direct and indirect job losses within the sector. Compounded by tax increases, our estimation suggests a loss of livelihood could directly and indirectly impact a staggering 6.6 million Nigerians.”

FG To Appeal Court Suspension Of Tax

Meanwhile, the federal government has said it would appeal the Federal High Court’s order to the NCS to stop collecting the N10 per litre tax on SSBs.

A source at the Federal Ministry of Finance, Budget, and Economic Planning in Abuja disclosed this to our correspondent.

The source was, however, silent on whether the NCS was still collecting the tax despite the court order.

In his ruling, Justice Obiora Egwuatu barred the NCS from collecting the excise duty, adding that it would be in force until the provisions of Section 13 of the Customs, Excise Tariff, etc. (Consolidation) Act, Cap C49 LFN, are fully complied with.

The decision was delivered on January 30 in Suit No: FHC/ABJ/CS/2004/2022, filed on October 28, 2022, by NECA, NBC, and SBC against the Nigeria Customs Service Board (NCSB) and the Minister of Finance, Budget, and Economic Planning.

The court also declared that the 2022 Fiscal Policy Measures and Tariff Amendments issued by the Minister of Finance on March 1, 2022, were null and void.

Egwuatu ruled that the failure to follow due legal procedures renders actions or services legally ineffective. He declared that any service or policy not executed in accordance with the law remains invalid.

However, Shade Oyelade, an Abuja-based legal practitioner who reviewed the judgment, told LEADERSHIP Weekend that, contrary to some media reports, the court did not abolish the SSB tax.

“Rather, it recognized the SSB tax as an obviously economic and environmental policy that the federal government introduced for the growth of the nation and the safety of its citizens,” Oyelade said.

She explained that the court “upheld the current N10 per litre tax rate as contained in the CETA, affirming its validity under the law, but restrained Customs from collecting the tax pending compliance by the Ministry of Finance.”

“It also held that the circular entitled ‘Approval for the Implementation of 2022 Fiscal Policy Measures and Tariff Amendments,’ dated March 1, 2022, issued by the Minister of Finance, Budget, and National Planning was invalid and beyond its powers. But that only affected the circular, not the tax.”

“Furthermore, the court held that Customs was not entitled to demand transport and feeding allowances from NECA members. This suggests that the SSB tax paid by sugary drinks manufacturers is so low that it cannot even cover the transport and feeding allowances of the Customs officials who have to travel from their base to the manufacturers’ companies to administer the tax. It makes a fairly good case for an increase in the SSB tax as advocated by the National Sugar-Sweetened Beverages Coalition.”