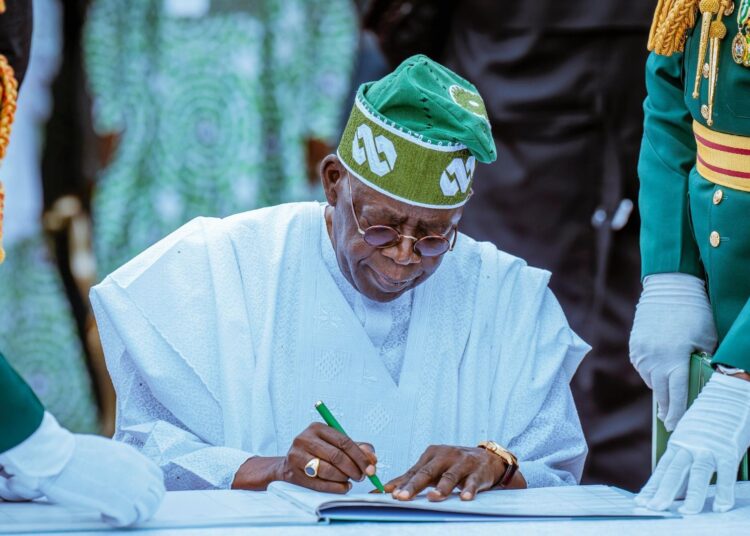

Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has disclosed that President Bola Tinubu has received the four Tax Reform Bills that were recently passed by the National Assembly, for his assent.

“It was finally delivered to Mr Presdient by the National Assembly for him to sign off on the four tax reform bills. Job well done. Congratulations,” the minister stated on Wednesday at a public lecture to mark the 50th birthday celebration of the Chairman of Presidential Tax Reform Committee, Taiwo Oyedele, in Abuja.

Edun acknoledged that it’s not just about putting up a good tax policy programme but that the implementation and perseverance.

Edun said Mr Oyedele has shown sacrifice of office in an extraordinary way by choosing to serve Nigeria in the tax reform committee over his job at PricewaterhouseCoopers. “That’s so exemplary, so worthy of emulation. You’ve done it. The reward for hard work is more work,” he stated.

The minister said the tax reform bills now ready for presidential assent will give greater fairness, clarity, ease of administration, best practice around the world and ultimately, not least of all, give more revenue for government to meet legitimate demands of the citizenry. “There is still hard work to be done in efficiently imememting the tax policies. They promised to change the fiscal landscape; they promised to virtually double the tax to GDP ratio.”

On his part, Oyedele called for lower corporate tax rates in addressing regulatory overage, and refining tariff systems to stimulate investment and economic growth.

He highlighted the need for an orderly tax system to avoid chaotic taxes that disproportionately impact the poor.

He reiterated that the tax reform measures included full income tax exemption for over 1/3 of workers, higher exemption thresholds for small businesses, and zero-rating essential consumptions.

He emphasised the importance of credible data, inclusive policies, and investing in people.

He stressed the need to refine the tariff system to reduce rates on raw materials and intermediate products to lower input costs.

“We have priority sector incentives, boosting exports and providing tax relief to prevent public transition for Nigerian businesses operating internationally. Others are changes to income class laws to attract remote work opportunities, enabling Nigerian youths to thrive in the digital economy. Introduction

“The government should focus on doing only what the private sector will not do, and collect the least amount of tasks in doing so without compromising compromising the required minimum quality standard. The government should be intentional regarding non inflationary spending priority and quality of spending.

“After all, that is the essence of the socio economic contracts the people must seek first to understand because ignorance compounds vulnerability and steals opportunities, we must think independently, ask questions, engage and, most importantly, criticize constructively with the sole aim to build not to tear apart our nation,” he stated.

According to him, he noted the need to make policies for a strong and stable Naira, such as allowing businesses to pay taxes in Naira despite having a comparative trade balance.

He lamented that the tax system in Nigeria suffers from archaic laws, complex administrative structure, low tax morale, and widespread evasion.

Speaking further, he explained the importance of prioritizing inclusion and national interest over sectional self-interest in policy-making.

He advocated for using credible data for policy decisions rather than relying solely on popular views or sentiments.