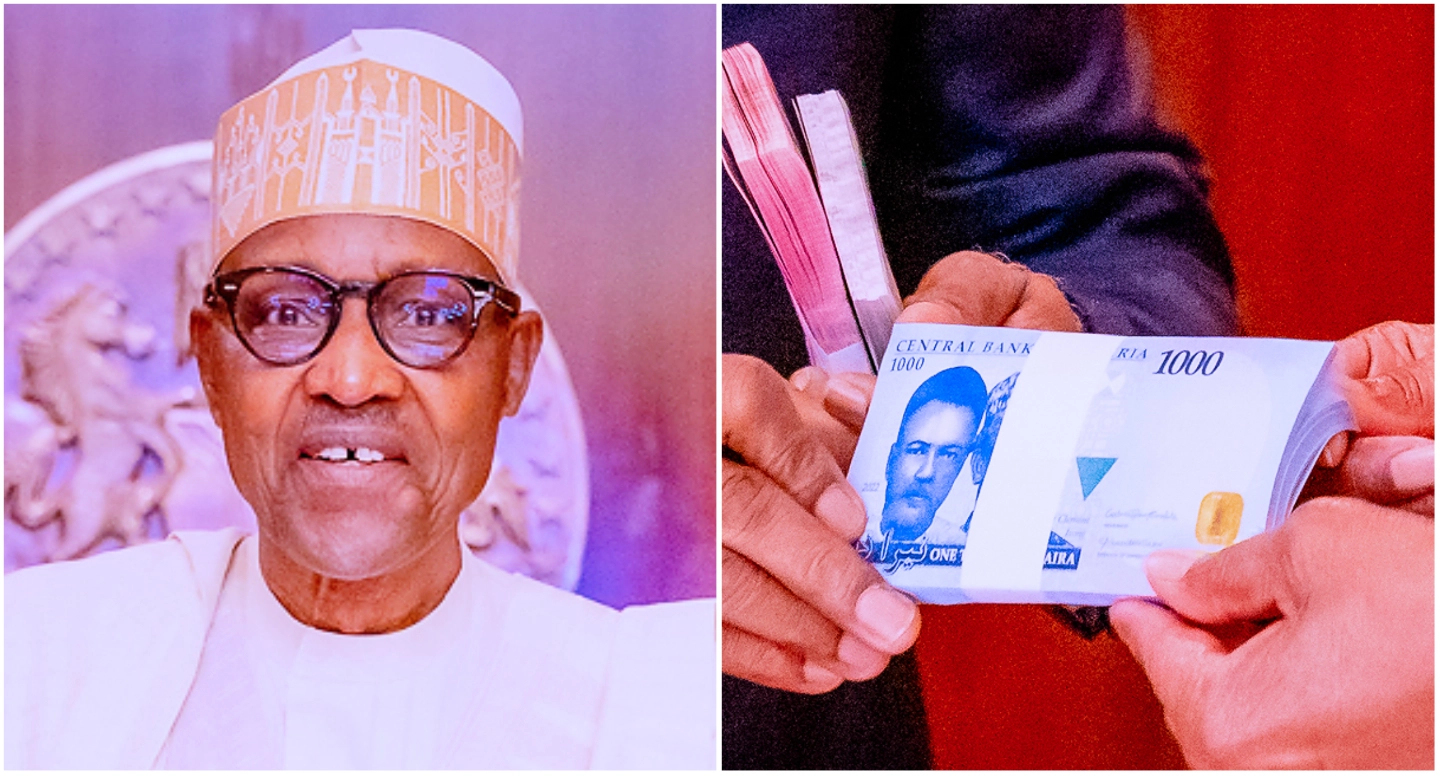

President Muhammadu Buhari has approved the Central Bank of Nigeria’s (CBN) request for the extension of the deadline for swapping of old Naira notes with the redesigned ones.

The new deadline has now been shifted from January 31, 2023, to February 10, 2023.

Also, a seven-day grace period, beginning on February 10 to February 17, 2023, has also been approved to enable Nigerians to deposit their old notes at the CBN after the February deadline when the old currency would have lost its Legal Tender status.

This followed the President’s meeting with the apex bank’s governor, Godwin Emefiele, in his country home of Daura, Katsina State on Sunday.

Emefiele briefed correspondents after the meeting, revealing that 75 per cent of the N2.7 trillion held outside the banking system has been recovered.

He said: “We are happy that so far, the exercise has achieved a success rate of over 75 percent of the N2.7trillion held outside the banking system. Nigerians in the rural areas, villages, the aged and vulnerable have had the opportunity to swap their old notes; leveraging the Agent Naira Swap initiative as well as the CBN Senior staff nationwide sensitization team exercise.

“Aside from those holding illicit/stolen Naira in their homes for speculative purposes, we do aim to give all Nigerians that have Naira legitimately earned and trapped, the opportunity to deposit

their legitimately trapped monies at the CBN for exchange.

“Based on the foregoing, we have sought and obtained Mr President’s approval for the following:

“10-day extension of the deadline fromJanuary 31, 2023, to February 10, 2023; to legitimately held by Nigerians and achieve

more success in cash swap in our rural communities after which all old notes outside the CBN losses their Legal tender Status.

“Our CBN staff currently on mass mobilization and monitoring together with officials of the EFCC and ICPC will work together to achieve these objectives.

“A 7-day grace period, beginning on February 10 to February 17,2023, in

compliance with Sections 20(3) and 22 of the CBN Act allowing Nigerians to deposit their old notes at the CBN after the February deadline when the old currency would have lost its Legal Tender status.

“We therefore appeal to all Nigerians to work with the Central Bank of Nigeria to ensure a hitch free the implementation of this very important process for program.”

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel