Project stalled at 42%, 4,834 communities lack basic mobile connectivity | Nasarawa, 7 others reduce right-of-way fees to boost access

Nigeria’s renewed push to achieve a 70 per cent broadband penetration target by the end of 2025 is under severe threat.

In 2020, the federal government set out a five-year ambitious plan to attain 70 per cent broadband penetration across the country.

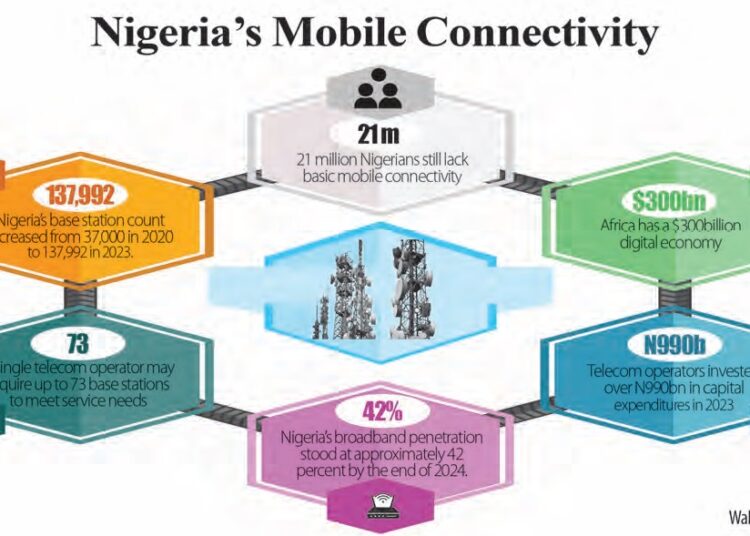

But LEADERSHIP Weekend gathered that, four years later, only 42 per cent was realised at the end of 2024.

Consequently, experts fear that if it took the government and other industry players four years to attain 42 per cent broadband inclusion, it would be difficult to cover the remaining 28 per cent in less than 11 months this year.

The experts said despite government initiatives and huge investments by telecom operators, the country still faces persistent challenges, such as inadequate infrastructure, high deployment costs, and regulatory hurdles.

These factors, they said, have continued to threaten the nation’s digital inclusion goals.

Our Correspondent gathered that the Nigerian National Broadband Plan (NNBP) 2020–2025, designed to drive broadband expansion and economic growth, is now at risk of falling short, raising concerns about Nigeria’s digital future.

Industry experts have, therefore, called for urgent steps to close the gap and prevent Nigeria from lagging in Africa’s digital economy, which is worth $300 billion.

The latest data from the Nigerian Communications Commission (NCC) showed that broadband penetration stood at approximately 42 per cent by the end of 2024, up from 38 per cent in 2020, but still far from the 70 per cent goal.

While telecom operators have expanded internet access, especially in urban areas, millions of Nigerians, primarily in rural and underserved regions, remain without reliable broadband services.

Recently, the minister of communications, innovation, and digital economy, Dr. Bosun Tijani, revealed that 21 million Nigerians in 4,834 communities still lack basic mobile connectivity.

Tijani remarked that Nigeria faces an unfortunate paradox.

“While many networks remain underutilised in some regions, others suffer from a lack of broadband infrastructure. This is largely due to limited infrastructure in unserved and underserved areas, compounded by barriers such as high costs, low digital literacy, inadequate access to devices, and erratic power supply.

“The underutilisation of existing infrastructure not only hinders Nigeria’s digital transformation but also affects investment returns for telecom operators, creating a cycle that slows broadband expansion,” he said.

The chief executive officer (CEO) of Financial Derivatives Company, Bismarck Rewane, revealed that Nigeria’s base station count rose 273 per cent from 37,000 in 2020 to 137,992 in 2023. However, he pointed out that, in high-demand areas, a single telecom operator may require up to 73 base stations to meet service needs, leading to coverage disparities between urban and rural areas.

On investment, Rewane, who spoke at the launch of the National Broadband Alliance for Nigeria (NBAN) in Lagos on Tuesday, explained that telecom operators invested over N990 billion in capital expenditures (CAPEX) in 2023, a decline from $1.41 billion in 2022, while emphasising that increased CAPEX on digital infrastructure could drive broadband adoption, improve efficiency, boost productivity, and ultimately reduce poverty by expanding economic opportunities.

“With the right investments, the telecom sector’s contribution to Nigeria’s GDP could increase from 12.1 percent in 2024 to 16.8 percent by 2028. Expanding rural broadband could also promote inclusive access to education, healthcare, and economic opportunities, while creating tech jobs and driving demand for digital skills,” Rewane added.

NBAN is built on the understanding that no single entity can achieve universal broadband access alone. It was learnt that eight states – Edo, Ogun, Kwara, Katsina, Imo, Abia, Borno, and Nasarawa – had reduced the right-of-way (RoW) fees to create a more investment-friendly broadband environment.

Available statistics show that the federal government has implemented several initiatives to accelerate broadband expansion, including the National Broadband Plan (2020–2025), which aims to achieve 70 per cent broadband penetration by 2025, provide minimum speed of 25 Mbps in urban areas and 10 Mbps in rural areas.

It plans to expand population coverage to 80 per cent by 2027 and set investment targets for broadband infrastructure, aiming for a 300-500 per cent growth by 2027.

According to a McKinsey Report, expanding internet access across the continent could add up to $300 billion to Africa’s GDP by 2025. Nigeria—one of the region’s largest economies—is expected to reap significant benefits in the agriculture, education, healthcare, and finance sectors.

One of the government’s most ambitious efforts is the deployment of 90,000 km of backbone fibre through a Special Purpose Vehicle (SPV) approved by the Federal Executive Council (FEC), which connects underserved communities that private operators deem commercially unviable.

The government also plans to streamline regulatory processes to accelerate fiber deployment, introduce incentives for private-sector investment in underserved areas, and launch public awareness campaigns to drive digital adoption.

The chief executive officer (CEO) of Nigerian Communications Satellite Limited (NIGCOMSAT), Jane Egerton-Idehen, introduced “Project 774”, a government-led initiative to expand digital connectivity across all 774 local government areas in Nigeria.

“Launched in 2023, Project 774 initially covered 51 local governments across nine states, including Zamfara, Cross River, Imo, and Borno. With a three-year roadmap, the initiative aims to accelerate rural broadband penetration, reinforcing the government’s commitment to nationwide digital inclusion,” she affirmed.