The government has been charged to work towards addressing the food, manufacturing and energy deficit in the country to create opportunities for growth as inflation is expected to further rise to around 35 per cent for December while the value of the naira is expected to depreciate mildly in the course of the year.

Speaking at the First Bank of Nigeria 2025 Economic Outlook for Nigeria themed ‘Nigeria 2025: Path to Economic Rebound & Recovery,’ managing director at Financial Derivatives Company Limited, Bismark Rewane noted that, while prices will continue to rise, it will not be as much as it has been in the past.

Noting that inflation, which had been rising ‘in leaps and bounds, is now slowing down,’ Rewane said, “we are projecting that the figure that will come out will be at 35.4 per cent in December while food inflation is expected to remain flat.

“The fact that things have been difficult does not mean that is how it will continue to be. Also, the fact that we are closer to equilibrium means change that is going to come will not be as large and as painful as before. 2025 is going to be less hard, less painful, and less difficult than 2024.”

On his own part, chief executive of BA Adedipe Associates Limited, Dr Biodun Adedipe, noted that Nigeria has over the years struggled with food, manufacturing and energy deficit which according to him has continued to hinder growth.

Noting that, inflation is expected to moderate to around 27 per cent by the end of this year, he said, the value of the naira is expected to hover between N1500 and N1600 to the dollar. Tagging 2025 as the year of recovery, he said, benchmark interest rate is expected to also drop moderately as the Monetary Policy Committee would be wary of lowering MPR too fast so as not to reverse foreign portfolio investments which had trickled in to take advantage of the high interest rates.

“The economy is going to grow and that will create some pressures on its own and with the naira still at N1574 to the dollar, that will bring some inflationary pressures as well on the other side of the equation in terms of imports and such things that we consume or use in manufacturing.

“So, all well and good in our own expectation 2025, for the Nigerian economy, is a year of recovery. Now, 2024 has struggled to be a year of resilience. We see 2025 as a year of recovery where opportunities are diverse.” Adedipe stated.

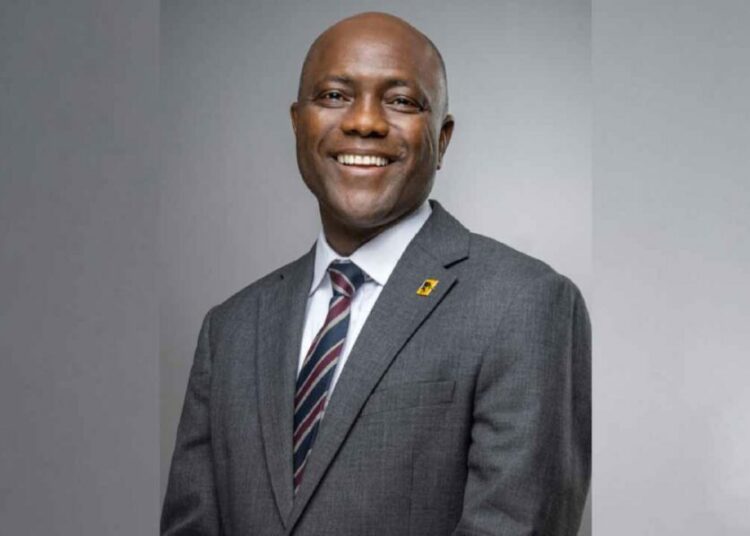

On his part, the chief executive of First Bank of Nigeria, Olusegun Alebiosu, expressed firm belief that ‘2025 is pregnant with potentials for discerning business individuals, as he said, the bank is committed to helping its customers grow their businesses.

He pointed out that, due to the impacts of some of the ‘painful but necessary’ reforms that the government had pursued, inflationary pressures had been hard on businesses and households as interest rate was hiked to 27.5 per cent to curb rising prices.

“The combination of these actions has resulted in significantly higher cost of living/operations and funding for households and corporations. Nevertheless, the Nigerian Gross Domestic Products (GDP) grew steadily on a quarter-on-quarter basis in 2024, growing the most by 3.46 per cent in Q3. Similarly, signs have begun to emerge that the reforms pursued by the Government are starting to yield the desired results.

“In addition, early signs such as the stability that characterized the foreign exchange market on the back of the introduction of the electronic foreign exchange matching system in December 2024; the emergence of competition on the supply side of our nation’s downstream sector that is leading to falling prices inpremium motor spirit (PMS) and the coming back on stream of the Port Harcourt & Warri refineries are indicative that there is, indeed, light at the end of the tunnel for us as a country.

“As a thorough-bred Nigerian myself, the sheer timing of the emergence of these developments has strengthened my optimism about the Nigerian economy, especially coming into the new year 2025. Also, the Government’s proposed N49.7 trillion 2025 budget is expected to provide sufficient economic stimulus in view of the lower likelihood for poor budget implementation due to improving Government’s revenue position. Therefore, the projected GDP growth rate of 3.68 per cent for 2025 is a very likely outcome,” he stressed.