Analysts anticipate mixed performance on the Nigerian equities market this week amidst portfolio rebalancing. The equities market closed last week on a bearish note as investors continued to adopt a cautious stance amid an earnings season that has so far delivered little in the way of surprises.

Despite ongoing dividend announcements and corporate disclosures, investor appetite remained subdued, suggesting that market participants are more focused on macroeconomic signals than company-level news. The 90-day pause on US tariffs offered some relief globally, but it failed to spark a meaningful rally on Customs Street. Instead, profit-taking and portfolio rebalancing dominated trading as investors rotated out of high-flyers and re-entered defensive counters.

Analysts Optimism

Looking ahead to the new week, Cowry Assets Management Limited said the “short-term outlook for the market remains cautious. All eyes are now on the March CPI data and the Q1 2025 macroeconomic report, which are expected to offer more clarity on the direction of the economy and set the tone for risk sentiment. The market is currently sitting in oversold territory, which may provide a technical basis for a short-term rebound, it said.

The research firm, however, said sustained recovery will likely depend on improvements in economic indicators, policy clarity, and fresh triggers from corporate earnings, saying, “until then, we expect continued sector rotation, with investors favouring value names and defensive plays with strong fundamentals and resilient earnings power.

“For savvy investors, this dip could be a buying opportunity, particularly in counters with robust dividend yields, solid balance sheets, and positive technical setups.”

The chief operating officer of InvestData Consulting Limited, Ambrose Omordion noted that “we expect mixed sentiment and rebound to continue as players digest the global outlook and earnings reports in the midst of bargain hunting, profit taking and portfolio reshuffling, as few more earnings are expected to hit the market with dividend announcement.

“Also, sector rotation and portfolio rebalancing continued in the market with investors taking advantage of price correction to buy into value.”

Last Week’s Trading Activities

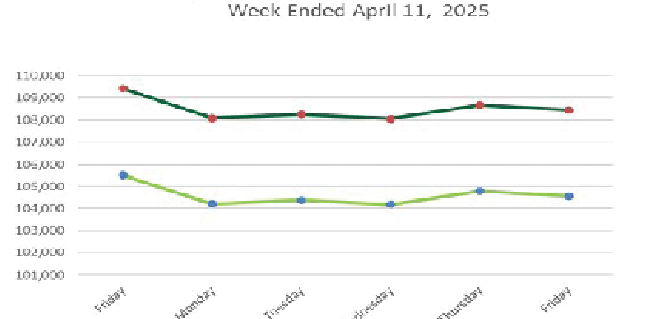

The local equities market closed last week on a bearish note, as the All-Share Index (ASI) declined by 0.90 per cent week-on-week (WoW) to close at 104,563.34 points. Also, the market capitalisation reflected the bearish mood, dipped by N441 billion to close the week at N65.707 trillion.

Across the board, sectoral performance was largely negative, reflecting risk-off sentiment. The NGX Insurance index led the losses, down 4.57 per cent W-o-W. The NGX Banking index followed closely, losing 2.20 per cent, while the NGX Consumer Goods and NGX Oil & Gas indices shed 0.61 per cent and 0.50 per cent respectively for the week.

Also, the NGX Industrial Goods and NGX Commodity indices posted a weekly decline of 0.26 per cent and 0.10 per cent respectively.

The market breadth for the week was negative as 27 equities appreciated in price, 56 equities depreciated in price, while 64 equities remained unchanged. VFD Group led the gainers table by 53.86 per cent to close at N87.70, per share. Union Dicon Salt followed with a gain of 31.03 per cent to close at N7.60, while Abbey Mortgage Bank went up by 29.60 per cent to close to N6.13, per share.

On the other side, Royal Exchange led the decliners table by 20.79 per cent to close at 80 kobo, per share. Cornerstone Insurance followed with a loss of 15.15 per cent to close at N2.80, while Sovereign Trust Insurance declined by 15.00 per cent to close at 85 kobo, per share.

Overall, a total turnover of 2.094 billion shares worth N52.967 billion in 64,612 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 1.183 billion shares valued at N28.868 billion that exchanged hands previous week in 42,397 deals.

The Financial Services (measured by volume) led the activity chart with 1.539 billion shares valued at N36.353 billion traded in 36,013 deals; contributing 73.49 per cent and 68.63 per cent to the total equity turnover volume and value respectively.

The Agriculture industry followed with 98.884 million shares worth N 1.344 billion in 2,772 deals, while the Services Industry traded a turnover of 93.000 million shares worth N522.147 million in 3,012 deals.

Trading in the top equities; Access Holdings, Guaranty Trust Holding Company (GTCO) and Zenith Bank accounted for 629.327 million shares worth N25.820 billion in 12,742 deals, contributing 30.06 per cent and 48.75 per cent to the total equity turnover volume and value respectively.