Nigeria Education Loan Fund (NELFUND) has said the students loan Scheme application will first be opened for students in federal tertiary institutions.

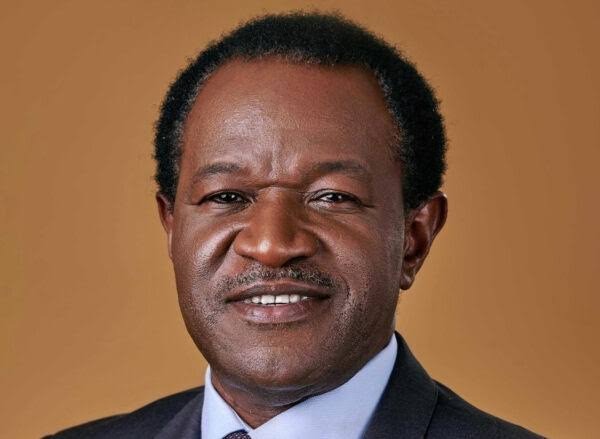

NELFUND’s managing director/chief executive officer, Akintinde Sawyerr, stated this yesterday during a pre-application sensitisation press conference in Abuja.

Sawyer, however, said only students whose institutions have uploaded their data on its dashboard would be eligible to apply.

He said the first phase of the application for the portal of students loan programme would be officially opened May 24, 2024 for students in federal institutions like universities, polytechnic, colleges of education and technical colleges, whose institutions have completed and uploaded their students data.

“This students loan scheme is available to students who are in government institutions at the tertiary level.

“We are going to start with federal institutions because it is a programme that we have to roll out in phases. It will eventually, be rolled out to state owned institutions,” he said.

On documents that would be required, Sawyer said applicants will require the following documents to complete application; “Joint Admission and Matriculation Board (JAMB) letter, National Identification Number (NIN), Bank Verification Number (BVN).”

Applicants are also to complete the application including personal details, academic information and details of financial need and submit application after reviewing it.

Speaking on the repayments, he said the loanees, regardless of where they get a job whether they are working with the government or with somebody else, must pay back the loans after two years.

“The student loan scheme will pay 100 percent of the fee for the loanees at the institution. There is also track of providing stipends to the loanees.

“We only pay a session at a time because people drop out of institutions, they change institutions, change their mind about the course they want to do,” Sawyer said.

On bad loans, he said the fund is trying to ensure that it has absolute information about the applicants as much as possible and be sure that they are bona fide Nigerian citizens and are of good standing.

“We also have various ways of working with security agencies to ensure that the people who are applying to these loans are not people who may want to defraud,” he said.