Quoted companies must strike a balance between growing shareholder value and sustaining the enterprise as a going concern. These are part of the key metrics for the assessment of competence and efficiency of management. In like manner, Nigerian listed companies are under intense pressure to grow profit and deliver shareholder value amid the inclement operating environment.

Unlike the past, when the announcement of good corporate earnings triggered high demand for a company’s shares on the Nigerian Exchange (NGX) with a share price rally, such is no longer common. “Speculators who have realised substantial capital gain ahead of the announcement of a company’s results may not bother to buy its shares on the back of the current financial performance. They will prefer to realise their capital gain ahead of the adjustment of the share price for dividend payment”, says a market watcher.

Weathering the Storm

Nigeria’s first indigenous bank, Wema Bank Plc, seems to be doing well in growing the franchise and delivering value to its shareholders. The

80-year-old bank is making a bold statement with the performance indicators and strong fundamentals that are becoming points of reference in the Nigerian financial industry. As a successful indigenous brand, it has weathered the storm and built capacity for resilience over the years, which enables it to post a superior return on investment.

Wema Bank’s audited financial reports show that its profit before tax (PBT) soared by 135 per cent to N102.51 billion in the financial year ended December 31, 2024, from N43. 59 bn posted in the corresponding period in 2023, and the dividend of 100 kobo per share, a 100 per cent increase on the 50 kobo paid in the preceding year, has made a statement: The leading money deposit bank is set to strengthen its financial muscle through innovative products and services.

The Strength in Figures

Despite the upswing and downswing on the Nigerian Exchange Limited (NGX), Wema Bank’s Market Capitalisation has increased by 225.17 per cent within one year to hit N299 billion on May 9, 2025, accounting for 0. 437 per cent of the NGX and the 30th most valued stock on the Exchange (as at Friday, May 7, 2025). It has grown its gross earnings by 91.01 per cent to N433.43 billion as at December 2024, a whopping increase of 91.01 per cent over N225.75 billion earned in 2023. Net interest income rose by 93.05 per cent to N177.06 billion; Cash and Cash equivalent, 26.65 per cent to N278.92 billion; Net assets, 87.26 per cent to N260.86 billion; and retained earnings, 182.22 per cent to N103.25 billion.

Earnings per share surged by 72.5 per cent to N4.83, with a payout ratio of 20.69 per cent and a PE Ratio of 2.22x amongst others in the review period. The strong financial performances were largely buoyed by investment in the government’s fixed-income securities and loans to customers, while Loans accounted for above 66 per cent of the Bank’s interest income. Wema Bank, like any other deposit money bank, contends with huge borrowing costs and interest expenses.

Wema Bank and Dynamics of Shareholder Value

At the basic level, corporate directors and management are supposed to maximise shareholder value for publicly quoted companies. Wema Bank’s trajectory of impressive financial performance, as reflected in growth in assets, capital appreciation, and dividend payment, demonstrates its commitment to creating shareholder value.

Its net income grew by 56 per cent to N5.200 billion in 2019, rose by 139.74 per cent to hit N86.28 billion in 2024. The Net assets surged by 341.1 per cent from N59.14 billion in 2020 to N260.86 billion in 2024. The rising asset base will enhance Wema Bank’s opportunities to expand operations, upscale market share, and boost income streams. The dividend growth stood at 22 per cent in 2019.

Although the Bank could not declare a dividend in 2020 due to the inclement operating environment and restructuring of its operations, it has continued to declare dividends since 2021. The Bank also outperformed its peers in the banking sector on NGX last year, with 60 per cent capital appreciation, emerging as the best-performing stock.

The chief executive officer, Global Management Assets Nigeria Limited, Sir Tunde Sobamowo said “the generous dividend policy, combined with its rewarding capital appreciation, exemplified Wema Bank as a good corporate citizen that has built a culture of shareholder value.”

Building a new base for competitive edge

In a strategic move to comply with the new minimum capital base as directed by the Central Bank of Nigeria (CBN), Wema Bank is currently offering Rights Issue and Private Placement to raise N200 billion through a combination of N150 billion rights issue and N50 billion private placement. The offer shall close by the end of this month. But there are strong indications that institutional investors and high net worth individuals are already on the queue for the capital raise.

Leaders of some Shareholders’ Associations are said to be mobilising their members to take the rights issue to increase their holdings and benefit from the Bank’s strong potential for high return on investment. This symbolises the bank as a metaphor for trust and shareholder value.

Wema Bank: Leading Innovation

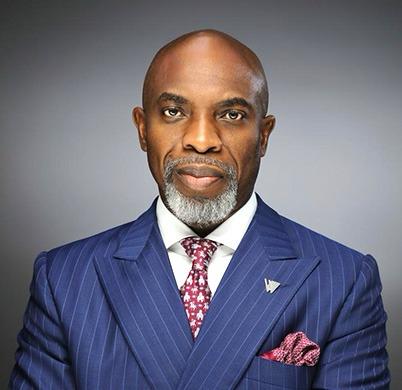

The managing director and chief executive officer of Wema Bank, Moruf Oseni, has been consistent in discussing how the bank places a premium on human capital and investment in technology to be ahead of the curve in the competitive banking ecosystem.

By driving innovation and technological advancement, Wema Bank has positioned itself as a leader in the Nigerian banking industry, contributing to the country’s economic growth and development.

“Our people are committed to the institution’s founding ethos of supporting Nigerian businesses and individuals with the most innovative banking products and services.

ALAT, our flagship digital platform, continues to lead in the adoption of digital banking services across the increasingly young Nigerian populace.

“An example of this innovation is ALAT Xplore, the first licensed bathing app for teenagers, designed to help ages 13 to 17 build their money management skills, achieve their financial goals, and become financially responsible. Despite the constrained operating environment, the bank continues to experience strong growth across all its financial indices, reflecting the quality and resilience of the workforce,” Oseni stated.