The current trend of corrections and pullbacks on the Nigerian equities market are expected to continue on the back of portfolio rebalancing, and sector rotation by investors and fund managers.

The corrections and pullbacks are part of stock market dynamics that follows bull rally as a reflection of changes in market fundamentals, amid the higher interest rate and yields in alternative investment windows in the face of mixed economic data and ongoing reform policies of the government.

The domestic equities saw another pullback which reflects the current market dynamics and changes in fundamentals in the face of high interest rate environment, mixed macroeconomic data and yields in the alternative investment windows as market players continue to analyse the potential impact of these variables on investment decisions.

Analysts Optimism

Looking ahead to the new week, analysts at Cowry Assets Management Limited said, “the current trend of corrections and pullbacks are expected to continue on the back of portfolio rebalancing, and sector rotation by investors and fund managers. We think investors will closely monitor expected earnings numbers, published macroeconomic data and government policy direction for furth er guidance. Meanwhile, we continue to advise investors on taking positions in stocks with sound fundamentals.”

The chief operating officer of InvestData Consulting Limited, Ambrose Omordion said, “we expect mixed and bearish sentiment continued in the face of plan bank recapitalisation as more corporate earnings inflow with dividend announcements, while taking advantage of pullbacks to position and rebalancing portfolio.

“This is amid the volatility and pullbacks that add more strength to upside potential. As such, investors should take advantage of price correction. Also looking at the trends and events across the globe and domestically.”

Last Week’s Trading Activities

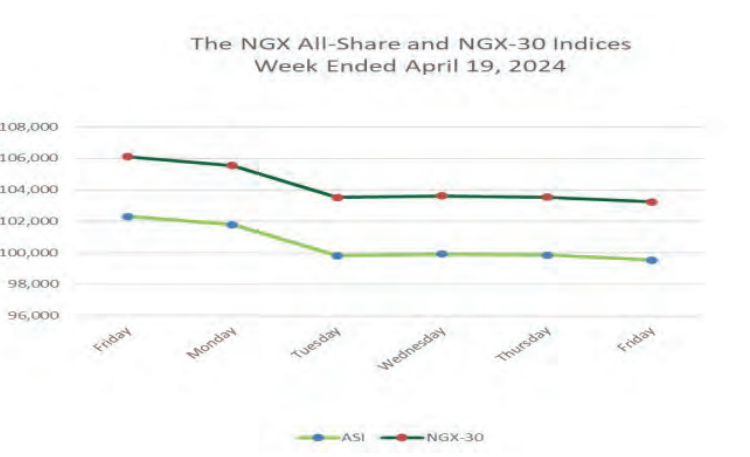

The local stock market, last week, primarily demonstrated a bearish trend as the All-Share Index closed below the 100, 000 psychological mark at resulting from the downbeat in market sentiments which came from sell-offs across the SWOOT (stocks worth over one trillion) sectors and the continued dumping of banking stocks by investors in the wake of the recapitalisation drive by the Central Bank of Nigeria (CBN) and the digestion of recently published macroeconomic data.

The All-Share Index rose by 2.71 per cent week-on-week (W-o-W) to close at 99,539.75 points. Similarly, market capitalisation gained N1.6 trillion W-o-W to close at N56.296 trillion.

On the sectoral performance, it was another week of market-wide bearish performance as the NGX-Banking index led the losses by 11.46 per cent week on week. Trailing on the losers table were the NGX-Insurance index (2.80 per cent), NGX-Industrial Goods index (2.71 per cent), and NGX-Consumer Goods index (0.96 per cent). Meanwhile, the NGX Oil & Gas index stayed muted from previous week’s close.

The market breadth for the week was negative as 13 equities appreciated in price, 62 equities depreciated in price, while 79 equities remained unchanged. Morison Industries led the gainers table by 45.31 per cent to close at N3.72, per share. Guinness Nigeria followed with a gain of 10.00 per cent to close at N55.00, while Academy Press up by 9.77 per cent to close to N1.91, per share.

On the other side, Guaranty Trust Holding Company (GTCO) led the decliners table by 19.08 per cent to close at N33.50, per share. Unity Bank followed with a loss of 19.00 per cent to close at N1.62, while Livestock Feeds declined by 18.99 per cent to close at N1.45, per share.

Overall, a total turnover of 1.597 billion shares worth N32.313 billion in 44,915 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 1.132 billion shares valued at N28.650 that exchanged hands prior week in 21,921 deals.

The Financial Services Industry (measured by volume) led the activity chart with 1.148 billion shares valued at N22.422 billion traded in 26,192 deals; contributing 71.87 per cent and 69.39 per cent to the total equity turnover volume and value respectively. The Conglomerates Industry followed with 117.629 million shares worth N1.579 billion in 2,501 deals, while the Oil and Gas Industry pulled a turnover of 92.498 million shares worth N810.985 million in 2,621 deals.

Trading in the top three equities; Access Holdings, United Bank for Africa (UBA) and Zenith Bank (measured by volume) accounted for 570.027 billion shares worth N14.078 billion in 12,079 deals, contributing 35.69 per cent and 43.57 per cent to the total equity turnover volume and value respectively.