With the first trading week of 2024 closing positive, Nigerian equities are expected to extend the performance in the second week as investors take position, OLUSHOLA BELLO writes.

Analysts said the Nigerian stock market is expected to continue its positive performance as investors seek bargain hunting opportunities.

In the inaugural trading week of the year, the Nigerian Stock Exchange (NGX), demonstrated a robust commencement, marked by bullish sentiments and a formidable winning streak. The resurgence, driven by positive market breadth, was further fueled by a fervent interest across stocks spanning diverse price ranges.

Emanating from what appears to be the January effect, this upward trajectory signifies a substantial demand for Nigerian stocks, setting the stage for the imminent reporting and dividend earning season.

Consequently, the opening week not only witnessed remarkable market highs but also surpassed historical benchmarks, culminating in an unmistakably bullish trajectory as the financial year kicked off on a notably positive note.

Analysts Optimism

Afrinvest Limited said, ‘this week, we anticipate an extended positive performance on the bourse, buoyed by strong investor sentiment.’

Analysts at Cordros Securities Limited noted that, “in the near term, we believe positioning for 2023 full year earnings releases and accompanying dividends declarations will continue to support buying activities on the local bourse even as institutional investors continue to search for clues on the direction of yields in the FI market.

“However, we advise investors to seek trading opportunities in only fundamentally justified stocks as the weak macro environment remains a significant headwind for corporate earnings.”

Looking ahead into the new trading week, Cowry Assets Management Limited opined that, the market is poised for mixed sentiment, potentially influenced by profit-taking activities within the local market.

“As the NGX-ASI approaches the psychological threshold of 80,000 plus, market participants are expected to position themselves strategically and taking considerable advantage of the price corrections.

“The looming monetary policy committee meeting in January and the impending earnings and reporting season are anticipated to be pivotal factors shaping market dynamics in the near term. Amidst all these, we maintain our advice to investors on taking positions in stocks with sound fundamentals and whose earnings yield and earnings per share support higher payout ratio, while taking advantage of the price corrections in the market.” Cowry said.

Last Week’s Trading Activities

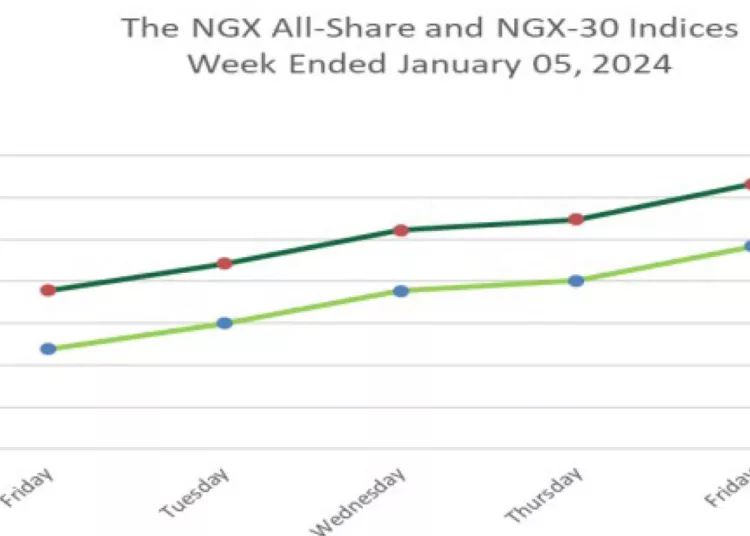

The local stock market celebrated a bullish start to the first trading week of 2024, with gains recorded on all trading sessions this week.

The market was opened for four trading days as the federal government declared Monday January 01, 2024 as Public Holidays to commemorate New Year celebration.

Accordingly, the All-Share Index gained dipped by 6.54 per cent week-on-week (W-o-W) to close at 79,664.66 points. Likewise, market capitalisation rose by N2.680 trillion to close the week at N43.594 trillion.

Across various sectors, the bullish trend manifested prominently, with the financial services sector, in particular, witnessing significant advancements. The NGX Banking and NGX Insurance indices led gainers, exhibiting increases of 10.29 per cent and 14.08 per cent, respectively. The NGX Consumer Goods, NGX Industrial Goods, and NGX Oil & Gas indices also recorded appreciations of 4.40 per cent, 3.58 per cent, and 3.00 per cent, respectively.

The market breadth for the week was positive as 88 equities appreciated in price, 17 equities depreciated in price, while 50 equities remained unchanged. Transnational Corporation led the gainers table by 46.19 per cent to close at N12.66, per share. Ikeja Hotel followed with a gain of 46.17 per cent to close at N8.77, while Unity Bank went up by 45.06 per cent to close to N2.35, per share.

On the other side, C&I Leasing led the decliners table by 39.64 per cent to close at N3.38, per share. SCOA Nigeria followed with a loss of 17.68 per cent to close at N1.63, while Champion Breweries declined by 11.81 per cent to close at N3.66, per share.

Overall, a total turnover of 3.320 billion shares worth N41.755 billion in 46,994 deals was traded last week by investors on the floor of the Exchange.

The Financial Services Industry (measured by volume) led the activity chart with 2.399 billion shares valued at N26.054 billion traded in 22,833 deals; contributing 72.25 per cent and 62.40 per cent to the total equity turnover volume and value respectively.

The Conglomerates Industry followed with 213.139 million shares worth N2.434 billion in 2,284 deals, while the Oil and Gas Industry traded a turnover of 163.313 million shares worth N2.054 billion in 3,443 deals.