In Nigeria’s foreign currency sector, turmoil brews. Once-powerful players in the foreign exchange market now evade authorities, their erstwhile dominance shattered.

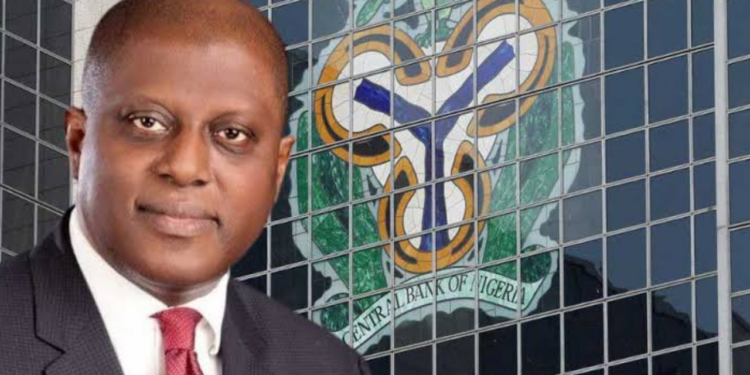

Resolve of both the Central Bank of Nigeria to begin forex sales to Bureau De Change (BDC) vendors after over three years break, and the crackdown on illegal traders in the foreign exchange market by operatives of the Economic and Financial Crimes Commission (EFCC) combined to pave the desired way for rates’ convergence as the Naira begins a persistent appreciation against the dollar.

The illegal Bureau De Change vendors, once ubiquitous in the vibrant heart of Wuse Zone 4, now flee. Their erstwhile bustling enclave, once synonymous with frenetic trading, lies deserted. Government and CBN joint intervention has purged the area of structures that throttled the naira’s value, transforming it into a desolate expanse.

The metamorphosis of Zone 4 from a teeming hub into a desolate landscape marks a decisive victory for the government. The demolition of structures and removal of individuals engaged in illicit currency dealings signal a turning tide in the battle against economic malpractice.

For street hawkers, once peddlers of speculation, the crackdown heralds despair. “It’s a perilous time,” laments Abubakar Bello, a vendor, highlighting the omnipresent threat of arrest. The shadow of law enforcement looms large, prompting traders to conduct business clandestinely, far from Zone 4’s abandoned streets.

“Oga, it’s not easy for us again o. Police and EFCC are parading Zone 4 every time and if they see me and you standing along this street they would just jump down and arrest us. Holding dollar at all is a big evidence against us. They will just handcuff both of us and take us to their office,” says one of the street traders of hard currencies said in a chart with this reporter in Abuja. “If you have dollar to sell, send me your address I will come to meet you wherever you are,” he stated.

Like Bello, most of the street traders now carry out currency transactions away from Zone 4 for fear of harassment or arrest by Police and EFCC operatives.

In February 2024, EFCC operatives raided some Bureau De Change operators’ outlets in Abuja, arresting over 50 suspected currency speculators. Policing of the areas has been a daily routine since then. The authorities have also demolished structures used for currency racketeering in the area. The City Management Team of the Federal Capital Territory Administration (FCTA) demolished the illegal shanties and structures of the BDCs. The aim was to force the BDC operators to operate in designated and licensed areas.

Director, Department of Development Control in FCTA, Mukhtar Galadima said the area was characterised by all kinds of illegal activities, constituting a security threat to residents in the area. “Our concern is to ensure the safety and security of residents in the area, and nothing to do with the alleged clampdown on BDC operators,” he stated.

The clearance and regular policing of the area against the currency racketeers has restored decency to the area. It is now easy for motorists to drive through the usually dirty and crowded area. The once ghetto-like Wuse Zone 4 has worn the look of a city centre, paving the way for the naira to gain some value against the dollar and other foreign currencies.

The central bank on 1st March, revoked the licenses of 4,173 Bureaux De Change operators for failure to observe at least one of the regulatory provisions for licensed BDCs. In specific terms, the affected companies failed to comply with the required payment of all necessary fees, including licence renewal, within the stipulated period in line with the guidelines; rendition of returns in line with the guidelines; and compliance with guidelines, directives and circulars of the CBN, particularly Anti-Money Laundering (AML), Countering the Financing of Terrorism (CFT) and Counter-Proliferation Financing (CPF) regulations.

That sanitization threw up strange names not even known to many people, including executives of the forex traders. The long list of the affected BDCs include, 10-20 Times BDC LTD, 1717 BDC LTD, 19TH BDFC LTD, 1HR BDC LTD, 1ST Money Exchange BDC LTD, 2017 BDC LTD, 2019 BDC LTD, 2022 BDC LTD, 205 Innovative BDC LTD (formally Tuge BDC LTD) and 360 Exchange BDC LTD. The list also includes: A. A. Funtua BDC LTD, A. Maikore BDC LTD, A.A Currency BDC LTD, A.A SILLA BDC, A.A. Dangongola BDC LTD, A.A. Funtua BDC LTD, A.A. Lukoro BDC LTD, A.A. Silla BDC LTD, A.B.S BDC LTD, A.B.Y BDC LTD and A.G. Tsoho DOGO BDC LTD.

Others are: ZITTS & Lords BDC LTD, Z-Leo LinK Global BDC LTD, ZLF BDC LTD, ZOBA BDC LTD, Zobic BDC LTD, Zoeelux BDC LTD, Zolo BDC LTD, Zomante BDC LTD,

Zonal Global BDC LTD, Zuli-Macaulay BDC LTD, Zulli BDC LTD, Zulu BDC LTD, Zuma Rock Global BDC LTD, Zumunci BDC LTD, Zungerru BDC LTD and Zupen Forex BDC LTD.

President of the Association of Bureau De Change Operators of Nigeria (ABCON) Mr. Aminu Gwadabe said because it was difficult to separate the licenced from the unlicenced traders made it rather unfortunate to sanitise the forex market in Nigeria, a situation he said he said has led to stigmatisation and criminalisation of the sector due to a lack of understanding even with the security agencies.

“What is happening is not targeted at licensed Bureau De Change but the operator of FX street trading. We are against any street trading and support any actions that will remove street trading. It affects me also. I have an office but my clients cannot come to my office because of the menace of street traders,” Gwadabe told reporters in a telephone conversation.

Gwadabe, however, laments the collateral damage inflicted on licenced BDCs, advocating for a nuanced approach to tackling illicit trading.

To beef up the market’s supply side and give buffers to the Naira, the CBN began forex allocation to the licenced BDCs earlier this month with $10,000 allocation at a rate of N1,251/$1.

According to the circular, the BDCs are mandated to sell the allocated dollars to eligible customers at a rate not exceeding 1.5 percent above the purchase price, indicating that BDCs are expected to sell at a maximum of N1,269/$1. “We write to inform you of the sale of $10,000 to each BDC at the rate of N1,251/$1. The BDCs are to sell to eligible end users at a spread of NOT MORE THAN 1.5 per cent above the purchase price,” the apex bank said in a circular to the BDCs.

That announcement marks the resumption of dollar sales to BDC operators after a prolonged ban imposed by the central bank in 2021. The ban was lifted earlier this year following the revocation of licenses of over 4,173 BDC operators in February.

The narrative of Zone 4’s decline and subsequent revival echoes the broader struggle to regulate Nigeria’s forex market. Gwadabe’s plea for clarity and cooperation underscores the need for a comprehensive strategy to combat economic malfeasance.

As the dust settles in Zone 4, the city’s pulse quickens anew, signaling a fresh chapter in the ongoing battle for financial integrity.

A currency trader, Mr Joseph Aadebayo who described the Zone 4 market as hitherto an all-comers affair, applauds the federal government’s resolve to ride the market of currency speculators in a quest to restore confidence in the market. “I support the efforts of the government to sanitise the place,” he said in a chat with this reporter.

Most of the Mallams, agent hawkers of the various currencies are said to have started returning to farms where they believe they would be more productive following the hostility of the security agents against non-licenced traders. “Some of them were even trading with as low as 200 dollars and they had large families to feed. I think it will make them more productive,” he said while decrying the chaos that once prevailed in the area.

He however believes that the FX challenges in Nigeria is more induced by Nigeria’s problem of lack of productive activities to earn dollars or other foreign currencies, stating that the “government should look into that and reduce corruption.”

Economic experts say to sustain the current achievements in the foreign exchange market, authorities must prioritize ongoing vigilance and enforcement. The argument is that a continued monitoring of licensed Bureaux De Change operators is crucial to prevent a resurgence of illicit activities. “Regular audits and inspections should ensure compliance with anti-money laundering and counter-terrorism financing regulations, bolstering the sector’s integrity,” Professor of economics Hassan Oaikhenan said. The advice is that collaboration between regulatory bodies and law enforcement agencies must persist to swiftly address any emerging threats or malpractices.

Apart from that, the experts called for fostering a conducive environment for legitimate forex trading is imperative. This involves streamlining bureaucratic processes for obtaining licenses and conducting business within regulatory frameworks. Simplified procedures would encourage more operators to enter the formal market, reducing the influence of unlicensed traders.

Moreover, initiatives to enhance financial literacy and promote responsible trading practices among both operators and consumers can bolster market transparency and stability. “By fostering trust and confidence in the forex market, authorities can sustain the momentum of positive reforms and support the long-term growth of Nigeria’s economy,” he stated.