One of the most popular lines in the Nigerian music sensation, highlife singer and songwriter Flavour’s 2023 single “Big Baller” is “How much is money?” A rhetorical question that in our context mostly speaks to having more than enough and being unperturbed by the cost of luxury as long as one can afford it. It has also become a refrain that many privileged few uses across the country but for most Nigerians, money and what it can afford is simply beyond their reach.

Money is a medium of exchange that is widely accepted in transactions involving goods, services, or settling debts. It serves as a unit of account, a store of value, and a standard of deferred payment. Money can take various forms, including coins, banknotes, or digital currencies, and it facilitates economic activities by providing a standardised way for people to trade and measure value. The functions of money make it a crucial component of modern economies, enabling efficient and flexible transactions.

The value of money is subjective and depends on various factors, including the currency in question and its purchasing power. Different currencies have different exchange rates, and the purchasing power of money can vary based on economic conditions, inflation rates, and other factors. The value of money is essentially determined by what it can buy in terms of goods and services and as a medium of exchange fluctuates due to various factors, including economic conditions, foreign exchange reserves, and government policies. But what can a Naira buy?

Globally, currencies and exchanges are pegged against the United States Dollar (USD). Overall, a combination of economic, political, historical, and structural factors has contributed to the USD’s status as the global medium of exchange. However, it’s worth noting that other currencies, such as the Euro, Japanese Yen, and Chinese Yuan, also play significant roles in international finance and trade. For Nigeria, however, it is the USD.

What Affects the Value of the Naira?

As at today, the Naira, Nigeria’s currency, currently exchanges for approximately N1,475 to $1 USD and N1,855 to one GBP. The Naira has experienced fluctuations against the USD over the years with factors such as oil prices, economic policies, and external debt influencing its value. Periods of devaluation and efforts to stabilise the currency have characterised its history, reflecting the economic challenges faced by Nigeria. However, this particular period is unprecedented and has thrust many into an inflationary nightmare where the prices of goods and services are at an all time high and continue to climb astronomically.

The Naira’s decline against the USD over the last decade can be attributed to various factors and chief among them is oil dependence. As a country heavily dependent on oil exports, fluctuations in global oil prices directly impact its revenue while declines in oil prices can strain the country’s foreign exchange reserves, affecting the Naira’s value. Another factor is weak economic policies. Inconsistent and inadequate policies can contribute to volatility, years of ineffective economic policies, fiscal mismanagement, and corruption have hindered Nigeria’s economic growth. These issues erode investor confidence and contribute to the currency’s devaluation.

Additionally, our external debt profile and burden from years of accumulation of external debt and reckless spending can strain a country’s finances, leading to pressure on the local currency. Nigeria’s increasing debt levels and balance of trade has been a source of concern with persistent trade imbalances, where imports exceed exports, and has led to a higher demand for foreign currency, putting pressure on the Naira. We are a consumption economy and there is currently no strategy in sight to change that.

Global economic conditions, trends and uncertainties can influence investor sentiment and impact the exchange rate between the Naira and the USD. The COVID-19 pandemic and its aftershocks further sent the world into a spiralling economic meltdown that many countries including Nigeria are yet to recover from. Perhaps one of the most significant factors is the challenge of limited diversification. Nigeria’s economy has been slow to diversify beyond oil, making it vulnerable to external shocks. Diversification efforts could help mitigate the impact of oil price volatility on the Naira.

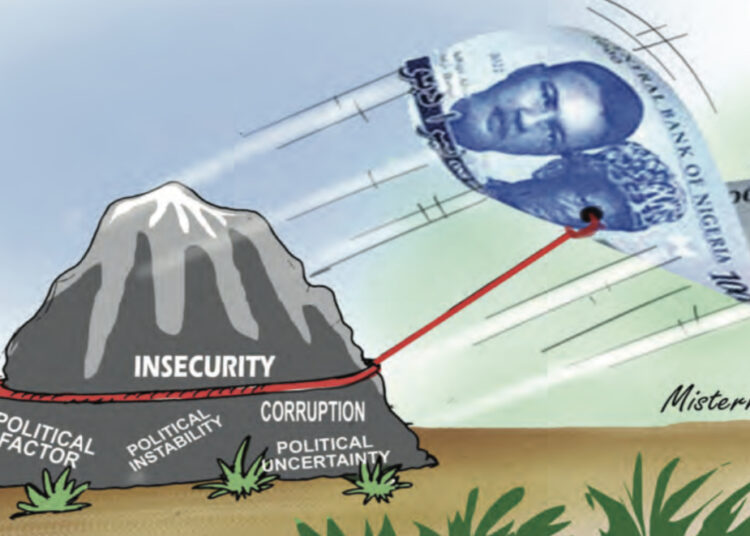

Finally, political factors, including political uncertainty and instability, corruption, insecurity, and internal unrest contribute to a lack of investor confidence, affecting the exchange rate. Political decisions and indecision by government play a crucial role in shaping economic outcomes. Understanding the interplay of these factors provides insights into the challenges that have contributed to the Naira’s depreciation against the USD and the current economic woes in recent years.

What Hopes for the Naira?

Firstly, we urgently need economic stability. The United States has one of the largest and most stable economies globally. Its economic stability, supported by factors like a robust legal system, political stability, and well-developed financial markets, increases confidence in the US dollar as a reliable currency. Nigeria needs to do same to stabilise the economy through efficient monetary and fiscal policies.

Secondly, Nigeria’s international trade also needs an urgent jumpstart by supporting businesses, industries, and exports. The Central Bank of Nigeria needs to go with the flow of other Central banks around the world to hold large reserves of USD as part of our foreign exchange reserves. The US dollar’s status as the world’s primary reserve currency adds to its stability and attractiveness for international transactions.

Thirdly and most importantly, we need to cut the cost of governance. The country is bleeding from every side, and we can no longer afford the huge cost of governance which only favours a few. Our leaders need to take responsibility and tighten their belts even tighter than they demand of the average Nigerian.

For the Poor, Money is Everything.

Money is expensive and is scarce to come by for many. To cope with the current inflationary trend which is at an all time high of 28.9% according to the National Bureau of Statistics, Nigerians need to adjust their budgets to accommodate rising prices by cutting back on non-essential expenses and prioritizing essential items. More than ever, families and individuals will have to find ways to increase their current income through additional work, seeking better-paying job opportunities where they exist and pursue additional income opportunities to offset the impact of inflation.

As unrealistic as it might seem, this is the time for those who can afford it to find ways to save and invest because investing in assets that tend to appreciate over time, such as real estate or stocks, can help hedge against inflation. Additionally, saving money in high-interest savings accounts or other investment vehicles can help preserve the value of savings. For those who can’t afford these luxuries, communities may come together to support each other through informal networks, such as sharing resources or organizing community initiatives to address common challenges arising from inflation.

Most importantly, government needs to provide assistance via social safety nets, social welfare programs and food subsidies, transportation subsidies or other forms of government assistance to alleviate the impact of inflation on the poor. However, this needs to be done in a coordinated and humane manner than does not dehumanize or further impoverish Nigerians.

While labour debates the minimum wage with the government, millions of people living below the poverty line do not have the luxury of time for these bureaucratic exchanges and committees. Every day our political class spend debating on these expensive conversations is an additional day of suffering, pain, hunger, and starvation for the average Nigerian particularly women and children.

Perhaps some day, the Naira can go back to its days of glory where the prize money for a tennis tournament in 1978 was $13,100 or N10,220. For now, we can only wish its premium or nothing.