The International Monetary Fund (IMF) and financial analysts have raised red flags over Nigeria’s rising public debt, as the federal government plans to intensify its external borrowing efforts despite mounting fiscal pressures and a fragile economic outlook.

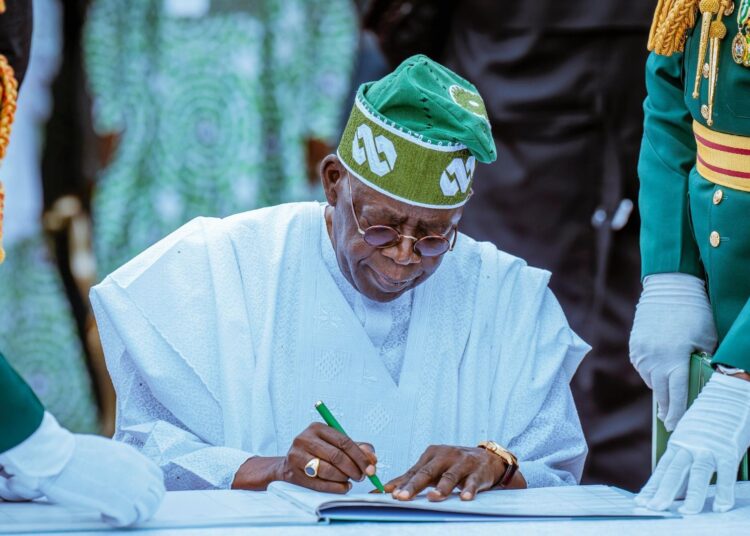

Analysts at Cowry Asset Management in an emailed note had expressed concern over President Bola Tinubu’s recent $21.5 billion loan request to the National Assembly, part of a broader 2025–2026 borrowing plan aimed at closing financing gaps and supporting growth. Alongside the request, the government is also eyeing €2.2 billion ($2.5 billion), 15 billion yen ($104 million), and $2 billion in domestic borrowing, bringing total new loan plans to nearly $26 billion.

Noting that there is growing heavy reliance on debt to fund the 2025 budget, Cowry Research warned that, roughly 60 per cent of the proposed spending would be financed through new borrowings, adding that, ‘This marks a concerning shift from earlier promises to reduce dependence on debt by focusing on foreign direct investments and equity financing.’

The borrowing proposal targets sectors such as infrastructure, health, education, agriculture, and economic reforms, in line with Nigeria’s Medium-Term Expenditure Framework and the Fiscal Responsibility Act. However, Cowry analysts cautioned that a significant portion of the funds is likely to finance recurrent and capital expenditures, with limited impact on generating long-term sustainable revenue.

Data from the Debt Management Office (DMO) showed that the country’s public debt stood at $94.23 billion or N144.67 trillion as of December 2024, down from $108.23 billion a year earlier. However, this drop was largely a result of naira devaluation rather than actual repayment.

External debt servicing hit $4.66 billion in 2024 alone, consisting of $2.8 billion in principal repayments and $1.74 billion in interest payments. Breakdown by lender shows multilateral creditors received the bulk of repayments of $2.62 billion, followed by commercial lenders with $1.47 billion and bilateral lenders with $570.67 million.

Despite the strain, the Tinubu administration has secured $7.2 billion in external loans since assuming office in May 2023, entirely from the World Bank. These include $2.25 billion for economic stabilization, $800 million for social safety nets, and $750 million for the power sector. Another $1.57 billion is expected in September 2024, with a further $632 million due by March 2025.

The IMF, in its latest Fiscal Monitor blog post, flagged growing global debt risks. It revealed that debt is now rising faster in economies accounting for 80per cent of global GDP, warning that if unchecked, public debt could reach 100 per cent of global GDP by 2030.

“Countries must reduce public debt and rebuild fiscal buffers with credible medium-term plans,” the IMF advised, stressing the importance of macroeconomic stability and targeted growth policies, saying, ‘Governments need to build trust, tax fairly, and spend wisely.’

Cowry Research highlighted the mismatch between Nigeria’s rising debt service costs and stagnant revenue growth, made worse by falling global oil prices, which have slipped below the $75 per barrel benchmark.

“This exposes Nigeria to external shocks, given the country’s overdependence on oil revenues for budgetary support. There is an urgent need to strengthen accountability mechanisms, ensure proper fund utilisation, and pursue growth-friendly policies that attract investments, not just loans,” Cowry stated.