Economic experts have described the economic policies of the federal government in the last year as punitive rather than reformative due to an error of bad sequencing and poor implementation of the reforms.

The experts say while some of the policies are, no doubt, desirable, the manner of implementation leaves much to be desired. One of the flaws was the decision to remove the never-ending and vexatious fuel subsidy in one fell swoop, which many believe should have served as a reform instrument but has ended up making life unbearable for the vast majority of Nigerians.

“The economic policies of the present administration in the last year have, in my view, been punitive policies rather than reform policies,” said a Professor of economics at the University of Benin, Hassan Oaikhenan. He said the decision to deregulate the exchange rate, alongside the astronomic increase in fuel price, served to make life all the more difficult for Nigerians. “The economic policies of the present administration, especially relating to fuel prices and exchange rate, can be likened to the destructive combinations of drinking and driving at the same time or accelerating and holding brakes at the same time.”

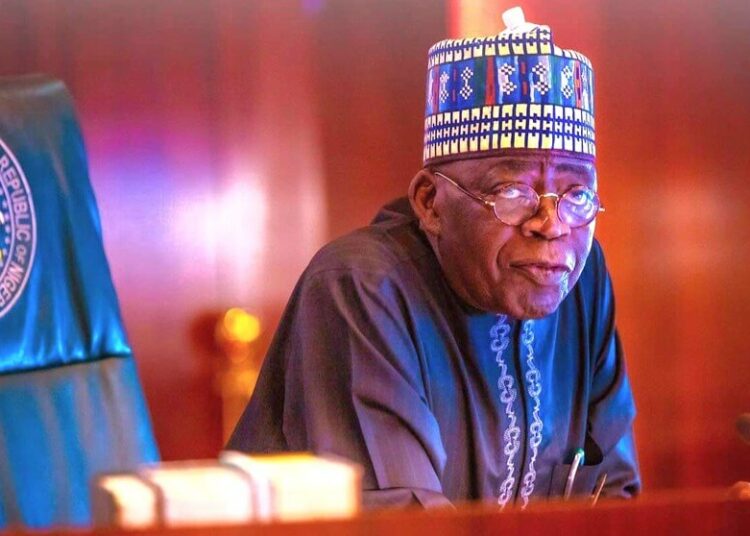

The impact of ingrained legacy macroeconomic challenges President Tinubu inherited from his predecessor who left a comatose economy behind is monumental, a reason many experts say he ought to assembly a crack team of technocrats and hit the ground running with economic recovery and growth tools before engaging in hard policies that have created a nationwide hardship.

Economic policy analyst Dr Justine Amase also said the major problems of the Tinubu reforms were the poor implementation and sequencing, saying there is the need for a thorough impact analysis and extensive expert inputs as well as stakeholder engagements before the rollout of subsequent critical reform measures by the administration.

The general belief is that the government hastily rolled out good but unfriendly reform decisions like gasoline subsidy removal, hawkish monetary policy posture and devaluation of the naira amidst high inflationary pressure without first planning how to manage their fallouts or consequences.

The inflation rate in May 2023 when Tinubu assumed economic leadership was 22.79 percent, and the rate in April 2023 is at a 24-year high of 33.69 percent. This indicates a significant decline in the value of the currency, consumer purchasing power and standards of living within the first year of Tinubunomics.

Experts say for an economy significantly dependent on imports of finished goods and raw materials and machinery production inputs, the status of the exchange rate of the national currency is fundamental to economic growth and welfare. Within the first year of the Tinubu reforms, the exchange rate of the Naira depreciated from N460.7/US$1 in May 2023 when Tinubu took over to N1,480.01/US$ on May 24, 2024. This implies the very high cost of production and finished goods.

The combination of high inflation and persistent depreciation of the Naira has created a major loss of confidence in the Naira as a legal tender and store of value both by domestic users of Naira and foreign investors. This has triggered massive dollar demands for money and wealth to be stored in dollars whose value is stable. This asset’s dollarisation has further brought persistent demand pressures, which weaken the Naira even more.

However, the reforms seem to have brought more confidence to the international community in Nigeria’s future economic prospects. Fitch revised the rating of Nigeria’s market standing to B- showing a stable long-term outlook. In addition, more forex inflows have been attracted, and Nigeria has paid off all backlogs of unmet forex commitments. The Premium between the official and parallel market exchange rates has narrowed and this has improved the confidence of investors. Positive economic growth and recovery momentum have also been sustained. Some improvements in tax revenue have been recorded as the tax-GDP ratio has improved from above 8 percent in 2023 to 9.4 percent in 2024.

As a way out of the economic quicksand into which the APC administration has plunged the country since 2015, Professor Oaikhenan said there is a need for the government to think creatively and put in place an enabling environment that makes production for domestic consumption and for export possible, in place of the strangulating environment that is currently in place. “Indeed, production is the key. There is a need for the current administration to realise that no government ever taxes its citizens to prosperity,” he said in a chat with LEADERSHIP.

Also, Dr Amase said President Tinubu should consolidate the gains of the reforms by redesigning the current development policies into a very practical 20-year economic diversification strategic plan that will prioritise high-impact growth sectors. He said the plan should ensure that fiscal policy elements focus on rapid fiscal revenue growth.

“For this plan to succeed, high priority should be placed on significantly improving and removing major binding constraints to the macroeconomic environment such as the sale of redundant and underperforming public assets; Naira Exchange Rate Stability through exports and foreign direct investment promotion; a single digit inflation and interest rate regime; declaration of an emergency on insecurity and oil theft; provision of critical infrastructure (especially power and transparent)in partnership with private sector investors; effective governance through strengthening of institutions; elimination of multiple taxation; and implementation of effective social transfer policies,” the former commissioner in Benue State said.

He also said the Central Bank of Nigeria needs to pause its current rapid MPR hikes, as their continuation will not only fuel more inflation, it may trigger a recession in the short run.