Nigeria’s private sector continued its expansion in February, with business conditions improving for the third consecutive month, according to the latest Purchasing Managers’ Index (PMI) data released by Stanbic IBTC.

The headline PMI figure rose to 53.7, up from 52.0 in January, marking the strongest improvement in business conditions since January 2024 indicating a robust expansion in output, new orders, and purchasing activity, driven by increased demand and moderating inflationary pressures.

The increase was driven by rising output, new orders, and purchasing activity, as demand showed signs of strengthening. Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration.

According to the Stanbic IBTC PMI report, rates of expansion in output, new orders and purchasing activity all quickened as demand picked up and inflationary pressures showed signs of moderating. “Output was up in agriculture, manufacturing, services and wholesale and retail, although in wholesale and retail the rise was only fractional. New orders also increased at a marked pace, with the latest rise the most pronounced in just over a year.” the report stated

Customers were reportedly more willing to commit to new projects. Signs of strengthening demand coincided with moderating inflationary pressures. Overall input costs increased at the slowest pace in ten months, although the pace of inflation remained elevated amid higher prices for raw materials and a rise in staff

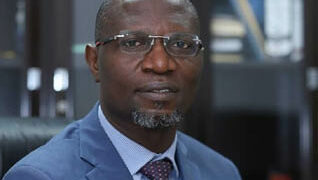

Muyiwa Oni, Head of Equity Research West Africa at Stanbic IBTC Bank commenting on the latest PMI reading said “activity in Nigeria’s private sector improved for the third consecutive month with the latest PMI reading of 53.7 points in February at its highest level since January 2024 (54.5 points).

“A relatively stable exchange rate and moderation in fuel prices are supporting the ease in inflationary pressures, which in turn helped strengthen consumer demand in the month. Thus, new orders increased for the fourth consecutive month, with survey participants noting a greater desire on the part of customers to commit to new projects.

“In line with the increase in new orders, output also increased sharply in February as the output index settled at 56.9 points from 53.7 points in January. That said, input price inflation eased further in February to its weakest level since April 2024. However, about 39.0 per cent of respondents increased their output prices in the month, with less than 1.0 per cent lo wering their charges.

“Nigeria’s real GDP growth improved further in Q4:24, rising by 3.84 per cent y/y, from 3.46 per cent y/y in Q3:24. Growth in Q4:24 was the highest since Q4:21 when this economy grew by 3.98 per cent y/y in real terms. Q4:24 GDP now brings 2024 full-year growth to 3.40 per cent , from 2.74 per cent in 2023, supported by both the oil and the non-oil sectors.

“In terms of contributions to the overall GDP growth in Q4:24, Services continue to dominate with a 79.0 per cent contribution to the country’s GDP growth (same as Q3:24), followed by Agriculture with an 11.9 per cent contribution while Industries contributed the remaining 9.0 per cent of the real GDP growth in the review quarter.

“The non-oil sector of the Nigerian economy is now poised to improve further in 2025 as the lingering FX stability and improved FX liquidity bodes well for the real sector activities, including manufacturing, trade and real estate. This, in addition to the anticipated reduction in borrowing costs should further support the growth of the non-oil sector in 2025.