The stock market has been on the uptrend for the fifth consecutive week and this movement was driven by investors taking positions for portfolio rebalancing, prompted by pressured sell-offs across various counters and shaped by expectations and outcomes of the newly rebased CPI report and MPC decisions, where the policy committee unanimously decided to pause rate hikes.

Analysts Optimism

On market outlook, the chief operating officer of InvestData Consulting Limited, Ambrose Omordion said, “we expect mixed sentiment, as players digest policy meeting outcomes, even as portfolio reshuffling continues on buying sentiment. As more earnings are expected to hit the market with dividend announcement. Also, sector rotation and portfolio rebalancing continued in the market with investors taking advantage of price correction to buy into value.”

Looking ahead, analysts at Cowry Assets Management Limited said, “we anticipate mixed market sentiment in the coming week as investors await further corporate earnings releases and dividend declarations.

“Additionally, market participants will closely analyse the recently published macroeconomic data on the rebased CPI and the rate hike pause by the CBN to assess their impact on investment portfolios. However, we expect a flow of funds into the equities space as investors seek better investment opportunities, particularly in the near term. Investors are advised to remain vigilant, focusing on stocks with strong fundamentals to make informed investment decisions.”

Last Week’s Trading Activities

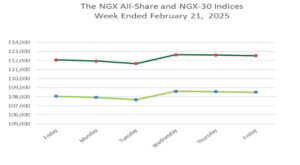

The domestic equities market experienced a bullish performance last week, with the benchmark NGX All-Share Index (ASI) rising by 0.41 per cent week-on-week to close at 108,497.40 points. However, market capitalisation rose by N96 billion or 0.29 per cent W-o-W to close at N67.614 trillion, as a result of the cancellation of 166.95 million units of ordinary shares of Dangote Cement Plc during the week.

Across the sectoral front, market performance was mixed. The NGX Consumer Goods index emerged as the top gainer, surging by 6.55 per cent week-on-week. NGX Insurance index followed with a weekly gain of 1.47 per cent, while NGX Industrial index edged up by 0.05 per cent W-o-W.

Conversely, the NGX Banking Index led the laggards, declining by 3.22 per cent week-on-week. NGX Oil & Gas index followed with a weekly decline of 2.87 per cent and the NGX Commodity index fell by 0.50 per cent for the week.

The market breadth for the week was negative as 28 equities appreciated in price, 58 equities depreciated in price, while 64 equities remained unchanged. Abbey Mortgage Bank led the gainers table by 16.13 per cent to close at N3.60, per share. Smart Products Nigeria followed with a gain of 15.38 per cent to close at 30 kobo, while Dangote Sugar Refinery went up by 15.00 per cent to close to N41.40, per share.

On the other side, Union Dicon Salt led the decliners table by 25.00 per cent to close at N6.00, per share. Ikeja Hotel followed with a loss of 21.43 per cent to close at N11.00, while UPDC declined by 17.99 per cent to close at N3.10, per share.

Overall, a total turnover of 2.001 billion shares worth N49.486 billion in 70,853 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 2.414 billion shares valued at N55.512 billion that exchanged hands prior week in 80,988 deals.

The Financial Services Industry (measured by volume) led the activity chart with 1.199 billion shares valued at N26.325 billion traded in 30,527 deals; contributing 59.91 per cent and 53.20 per cent to the total equity turnover volume and value respectively.

The Agriculture industry followed with 234.002 million shares worth N1.683 billion in 3,191 deals, while the Consumer Goods Industry traded a turnover of 173.829 million shares worth N7.150 billion in 8,903 deals.

Trading in the top equities; Access Holdings, Ellah Lakes and Fidelity Bank (measured by volume) accounted for 618.543 million shares worth N11.207 billion in 7,159 deals, contributing 30.92 per cent and 22.65 per cent to the total equity turnover volume and value respectively.