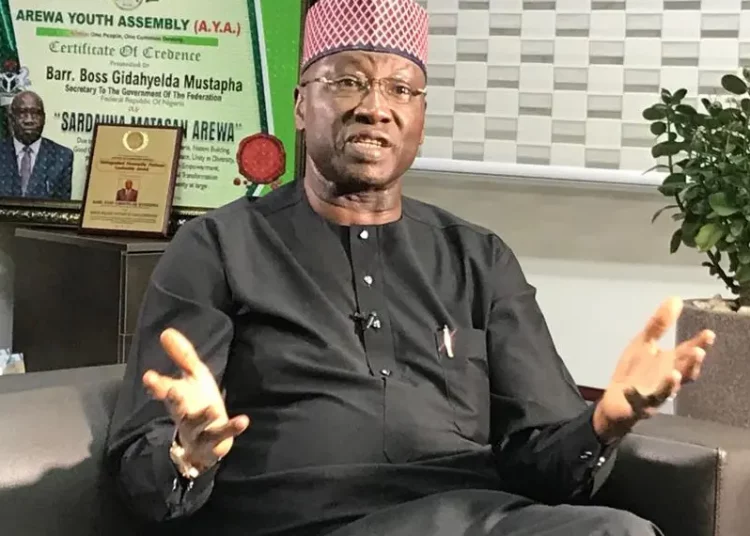

Secretary to the government of the federation, Boss Mustapha has urges Commonwealth members to invest in Nigeria, saying the country is safe and conducive for investors to conduct their businesses.

Mustapha made the call at the 42 annual technical conference of the Commonwealth Association of Tax Administration (CATA) in Abuja.

Mr Mustapha said the current administration has taken steps, including the provision of trade and investment incentives, review of tax policies and registration to improve on tax fairness for ease of doing business in Nigeria.

The SGF said the theme of the conference: “Tax Administration in the Digital Era” is in line with global emerging issues, especially advancement in technology.

Minister of finance, budget and national planning Zainab Shamsuna Ahmed

stated that over the past few years, federal government has committed huge monetary and human resources to champion the cause of developing countries. She urged CATA and similar organisations to blend their voices with Nigerias’ by insisting that skewed international tax rules be straightened for the good of all.

Mrs Ahmed said tax administrative processes must keep pace with changes in the business world. She said since businesses are evolving from physical presence to virtual place, tax administrations must also shift gear unto the virtual realm.

“Countries must cast aside their differences or individual self-interest to jointly develop workable, simple and fair solution. Nigeria is committed to working with other jurisdictions and international bodies to achieve a win-win solution. The ‘Amount A’ proposal being developed by the Inclusive Framework is not achieving consensus because it is founded on win-lose principles. Only rules that promote a win-win situation can achieve the support of all,” she stated.

The finance minister urged delegates and experts to use the opportunity of the conference to speak frankly on the issues highlighted and many others while looking forward to receiving actionable communique that will help Nigeria government in formulating appropriate policies.

FIRS chairman Muhammad Nami said tax authorities are battling with peculiar issues that were triggered by distributive technological innovations. According to Nami, business world over are in a state of flux; while the character of data and its management keeps changing, a situation he said has made it mandatory for tax administrators to align their mandates with the changes arising from technological advancements.

Nami who is also chairman of CATA, said matching the pace of advancement in technology, tax administrators must remain bound by the laws, regulations and codes that safeguard the sourcing, storage, processing and management of data. In diverse ways, Nami said all members of CATA have to deal with the challenges that transformational technology has brought to the commercial space and stay ahead of the conversation.

Nami said harmonisation of tax systems is on the front burner of the fiscal conversations in many jurisdictions, a reform he said must happen for the governments to plug leakages and shore up revenue.

Mr Nami said the 42nd CATA technical conference promises to be a platform that produces a potpourri of ideas and solutions in a fast-changing world that requires sophisticated strategies for problem-solving. Although these issues are emerging, many of our jurisdictions already have several innovative solutions to addressing them. The Conference is the right platform to cross-breed ideas and share experiences we can all learn from”.

In the same vein, the chief executive officer/director-general of Inland Revenue Board of Malaysia, Mr Datuk Mohd Nizom Sairi said in the last decade, countries have embarked on a number of tax policy and tax administration reforms aimed at ensuring that they continue to mobilise tax revenues in an efficient and effective way.

“Part of the reform initiatives have been to create semi-autonomous integrated Revenue Authorities bringing clustered tax-related functions under one roof. But I must hasten to add that though numerous challenges remain we are confident that the revenue agencies will overcome them and afford both their

Governments and its citizens a more efficient service and a sustainable flow of revenue”.

“This conference affords our officials and their Ministry colleagues an opportunity to learn from their colleagues from other Commonwealth tax administrations,” he added.