Benin Republic’s first-ever dollar denominated bond- a $750 million issue- was oversubscribed to the tune of $5 billion on Wednesday as investors lapped up the debt of the small West African nation.

The West African nation’s Finance Minister, Romuald Wadagni,said proceeds from the 14-year bonds which were issued at a rate of 8.375 per cent would be used to finance the country’s 2024 budget.

The bond sale by Benin Republic comes two weeks after Ivory Coast raised $2.6 billion at a rate of between 8.5 and 8.75 per cent in an oversubscribed Eurobond auction.

“Who would have thought that Benin would be able to issue its debut USD external bond at a yield flat to or even below what an equivalent Ivory Coast USD bond was trading at earlier today?” Simon Quijano-Evans, the chief economist of the London-based asset manager, Gemcorp Capital Management, said in a note to clients.

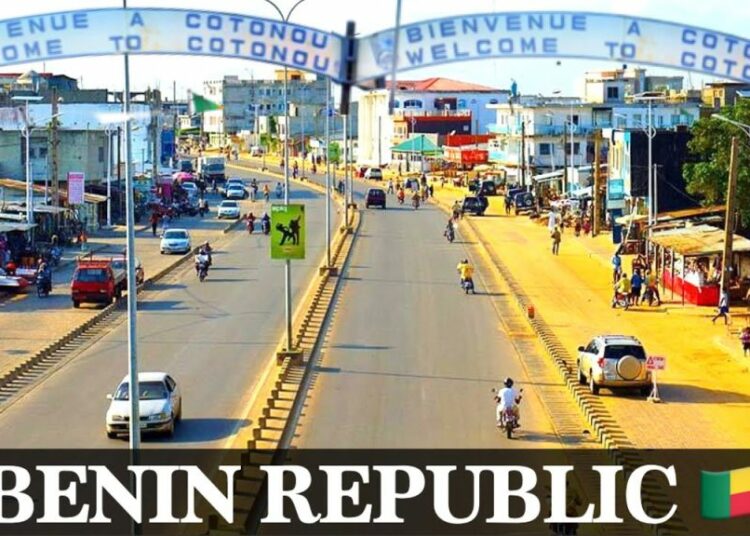

Benin Republic, one of the fastest-growing economies in Sub-Saharan Africa is projected to grow by 6.4 per cent in the 2024-25 period.

The country has displayed an impressive level of macroeconomic stability, as it posted an inflation of 0.40 per cent in December 2023, up from –0.20 per cent recorded in November 2023.

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel