Ever wondered how some investors consistently outperform the market, seemingly defying the odds? Dive into the realm of value investing, where patience meets prudence, and uncover the secrets to sustainable wealth creation. This article explores the core principles of value investing, delving into fundamental analysis, economic moats, and the timeless wisdom of Benjamin Graham. For those looking to enhance their understanding of value investing principles, consulting with the educational experts at immediate connect can offer meaningful insights and guidance.

Understanding the Core Tenets of Value Investing

Value investing, at its essence, embodies a philosophy that champions patience, prudence, and a keen eye for discerning intrinsic worth. It revolves around the fundamental belief that the market often mispriced assets, presenting opportunities for astute investors to uncover hidden gems. But what are the foundational principles that underpin this approach?

First and foremost is the concept of intrinsic value, the cornerstone upon which value investing stands. Intrinsic value represents the true worth of an asset, independent of its market price fluctuations. It’s akin to the intrinsic qualities of a rare gemstone, unaffected by the ebbs and flows of fashion or trends.

Accompanying intrinsic value is the notion of a margin of safety, a buffer against uncertainty and volatility. Picture a bridge built to withstand forces beyond its design specifications; similarly, value investors seek investments trading at prices significantly below their intrinsic value, providing a safety net should the market falter.

Moreover, value investing espouses a long-term perspective, a departure from the short-sightedness that often plagues financial markets. Instead of chasing quick gains, value investors embrace the patience of a seasoned gardener, nurturing their investments over time to reap bountiful harvests.

The Influence of Benjamin Graham: Pioneering Value Investing Principles

Benjamin Graham, often hailed as the “father of value investing,” left an indelible mark on the world of finance with his pioneering principles. His seminal work, “The Intelligent Investor,” serves as a guiding light for generations of investors seeking to navigate the complexities of the market.

Graham’s value investing framework rests on the bedrock of rationality and discipline. He famously likened the market to a manic-depressive individual named Mr. Market, whose mood swings offer opportunities for savvy investors to capitalize on mispricings.

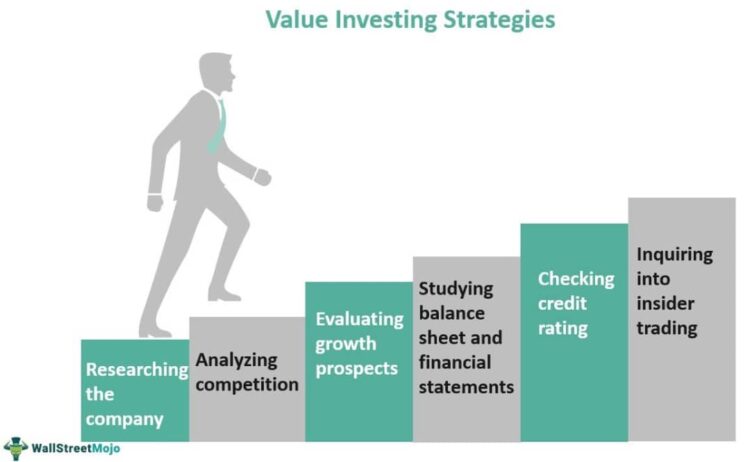

Furthermore, Graham advocated for a meticulous approach to stock selection, focusing on companies with strong fundamentals trading at significant discounts to their intrinsic value. His emphasis on thorough research and analysis laid the groundwork for what we now recognize as fundamental analysis.

Fundamental Analysis: Peering into the Financial Soul of Companies

Fundamental analysis serves as the bedrock of value investing, providing investors with a window into the essence of a company’s financial health and prospects. Much like a skilled physician conducts a thorough examination to diagnose a patient’s condition, value investors meticulously dissect financial statements and operational metrics to gauge the underlying strength of a business.

At the heart of fundamental analysis lies the scrutiny of financial statements, including the balance sheet, income statement, and cash flow statement. These documents serve as the proverbial pulse of a company, revealing its assets, liabilities, revenues, and expenses. By scrutinizing these figures, investors can discern trends, identify areas of strength or weakness, and assess the overall financial stability of a company.

Moreover, fundamental analysis delves beyond the numbers, incorporating qualitative factors such as management quality, competitive positioning, and industry dynamics. Just as a skilled detective gathers evidence to solve a case, value investors comb through annual reports, conference calls, and industry publications to paint a comprehensive picture of a company’s prospects.

By peering into the financial soul of companies through fundamental analysis, investors can uncover hidden gems trading at prices below their intrinsic value. Armed with this knowledge, they can make informed decisions that align with their long-term investment objectives, steering clear of short-term market fluctuations and speculation.

Economic Moats: Building Fortresses Around Value Investments

In the realm of value investing, economic moats serve as the proverbial fortresses that shield companies from competitive forces and market disruptions. Coined by Warren Buffett, these moats represent sustainable competitive advantages that allow companies to fend off rivals and maintain profitability over the long term.

Just as medieval castles were fortified with moats to repel invaders, companies with economic moats boast unique strengths that deter competitors and preserve their market dominance. These moats can take various forms, including brand loyalty, economies of scale, network effects, and regulatory barriers.

Consider the example of a well-established consumer brand with a loyal customer base. This brand loyalty acts as a powerful economic moat, making it difficult for new entrants to challenge its market position. Similarly, companies that enjoy economies of scale benefit from cost advantages that deter competitors from entering the market.

Conclusion

In conclusion, value investing offers a roadmap to navigate the complexities of the market with confidence and conviction. By embracing the core tenets of intrinsic value, margin of safety, and long-term perspective, investors can build robust portfolios fortified against market turbulence. Remember, success in investing is not merely about chasing returns—it’s about seeking more than just financial gain and designing a future tailored towards lasting prosperity.