The Nigeria Deposit Insurance Corporation (NDIC) has called on legal practitioners both in the bar and bench to join in its efforts to fully recover the funds and assets of failed banks to effectively pay out to depositors and creditors of the liquidated banks.

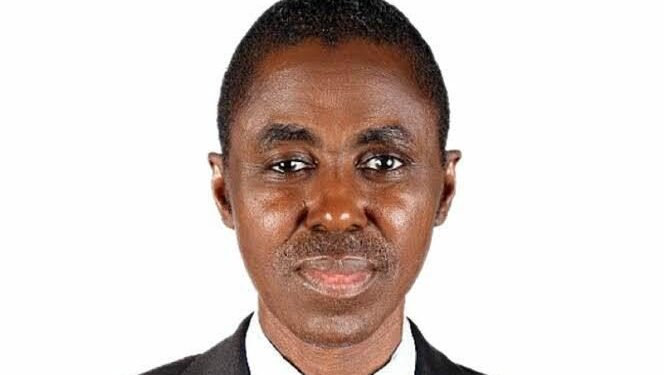

Managing director/CEO of the corporation Bello Hassan made the call yesterday at a sensitisation seminar for external auditors themed “Consolidating Collaborative Efforts in Mastering the Deposit Insurance Scheme and Bank Resolution.”

The aim is to get the support of the lawyers in promoting financial system stability through a deeper understanding of the dynamics of the deposit insurance system in Nigeria.

“While we acknowledge the challenges some of you have encountered during litigation, we urge you to continue your diligent efforts in assisting the Corporation with debt recovery and asset realisation,” the MD said at the sensation workshop yesterday in Abuja.

Hassan told the solicitors that pursuing debt recovery from debtors of closed banks and the realization of assets are crucial to achieving the corporate objectives of NDIC.

Beyond paying the insured sums to depositors from the corporation’s deposit insurance funds, the NDIC as liquidator is also obligated to settle uninsured portions of deposits and all legitimate creditor claims from the realised assets of the insured institution in-liquidation, a responsibility Hassan said he has consistently fulfilled.

He said specific topics that are designed to offer practical approaches to the issues confronting the corporation have been selected to provide valuable insights and solutions.

Second vice president of the Nigerian Bar Association Bolatumi Animashaun said the association is poised to support the NDIC to rid the banking sector of insider abuse and curb official corruption that often result in failure of the banks.

She said NBA will foster greater synergy with NDIC, enabling the external solicitors and the corporation to collectively overcome the challenges.