Nigeria has solidified its place as Africa’s most advanced digital payment economy, recording 7.9 billion real-time transactions in 2024, more than any other country on the continent, driven by the explosive growth of FinTech, mobile banking, and USSD technology.

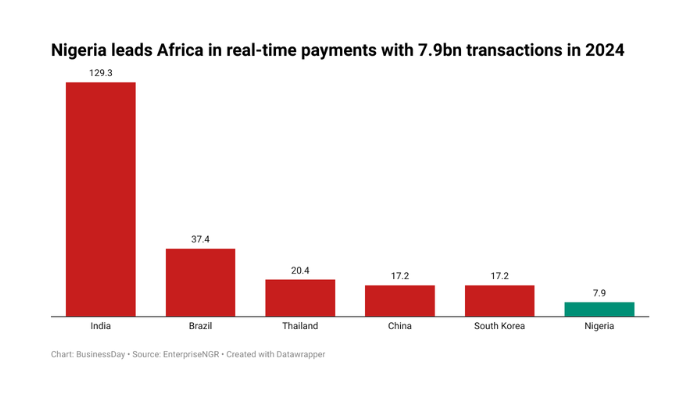

This surge in transaction volume, according to EnterpriseNGR’s new report titled ‘The State of Enterprise 2025: Insights into Nigeria’s Financial and Professional Services Sector,’ represents 2.97 percent of the global total of 266.2 billion real-time transactions. It places Nigeria among an elite group of global digital payments leaders including India, Brazil, Thailand, China, and South Korea.

The report credited Nigeria’s robust financial technology ecosystem for this transformation, highlighting the expanding use of point-of-sale (POS) terminals, mobile apps, internet banking, and USSD codes as the backbone of digital finance in the country.

“These digital channels have redefined how Nigerians access and use financial services, from fund transfers and bill payments to savings and account management. FinTechs and traditional banks are embracing technology-driven models that prioritize speed, convenience, and reach,” the report stated.

In the African context, Nigeria’s 7.9 billion real-time transactions far outpaced its peers. South Africa recorded 284 million, while Egypt and Kenya managed 39 million and 20 million, respectively, underscoring Nigeria’s unrivaled dominance in digital payments on the continent.

EnterpriseNGR pointed to the combination of innovation, youthful tech adoption, and an expanding agent banking network as crucial enablers of this growth. Mobile money platforms and USSD services have become especially vital in reaching unbanked populations in rural and underserved areas.

While the digital shift has enhanced financial access and service delivery, Nigeria still fell short of achieving the Central Bank of Nigeria’s (CBN) ambitious 95 percent financial inclusion target for 2024. As of 2023, the inclusion rate stood at 74 percent, according to EFInA (Enhancing Financial Innovation and Access).

However, EnterpriseNGR acknowledged that the expansion of agent banking and mobile money services helped bridge longstanding infrastructure gaps and brought millions of Nigerians into the formal financial system.

“These innovations are not just improving access, they are boosting operational efficiency, generating new revenue streams for financial institutions, and empowering individuals and small businesses,” the report added.

Despite Nigeria’s impressive growth, the report cautioned that more investment and policy support are needed to sustain momentum and match the scale of global frontrunners like India (129.3 billion real-time transactions), Brazil (37.4 billion), and Thailand (20.4 billion).

To remain competitive, EnterpriseNGR called for improved interoperability across banks, mobile money operators, and FinTechs; deeper infrastructure coverage in underserved areas; and a regulatory environment that balances innovation with consumer protection.